A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments

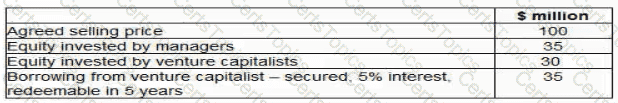

The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 3Q°/o a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?