An analyst has valued a company using the free cash flow valuation model.

The analyst used the following data in determining the value:

• Estimated free cashflow in 1 year's time = $100,000

• Estimated growth in free cashflow after the first year = 5% each year indefinitely

• Appropriate cost of equity = 10%

The result produced by the analyst was as follows:

Value of equity = $100,000 (1+0.05)/0.10 = $1,050,000

The analyst made a number of errors in determining the value.

By how much has the analyst undervalued the company?

Company AEE has a 10 year 6% corporate bond in issue which has a nominal value of $400 million, which is currently trading at 95%. The bond is secured on the company's property

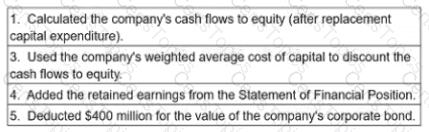

The Board of Directors has calculated the equity value of Company AEE as follows;

Which THREE of the following are errors in the valuation?

Which THREE of the following would be of most interest to lenders deciding whether to provide long-term debt to a company?

The competition authorities are investigating the takeover of Company Z by a larger company, Company Y.

Both companies are food retailers.

The takeover terms involve using a part cash, part share exchange means of payment.

Company Z is resisting the bid, arguing that it undervalues its business, while lobbying extensively among politicians to sway public opinion against the bidder.

Which of the following actions by Company Y is most likely to persuade the competition authorities to approve the acquisition?