A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

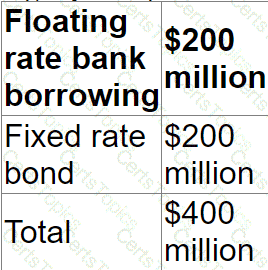

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

• Company A has 100 million shares in issue, with market price currently at $8.00 per share.

• Company T has 90 million shares in issue, with market price currently at $5.00 each share.

• Synergies valued at $60 million are expected to arise from the acquisition.

• The terms of the offer will be 2 shares in A for 3 shares in B.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

$ ? .

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

ART manufactures traditional scooters. It has an equity beta of 1.4 and is financed entirely by equity. It plans to continue to be all-equity financed in future.

It is considering producing a range of electric scooters

GGG is a comparable quoted electric scooter manufacturer GGG has an equity beta of 2 4 reflecting its high level of gearing (the ratio of debt to equity is VI using market values).

The risk-free rate is 5%, and the market premium is 6%. The rate of corporation tax is 20%

What is the recommended discount rate that ART should use to assess the project to manufacture electric scooters?