The ex div share price of a company's shares is $2.20.

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

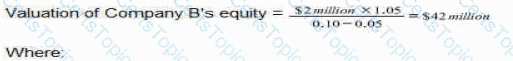

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

A company has a financial objective of maintaining a gearing ratio of between 30% and 40%, where gearing is defined as debt/equity at market values.

The company has been affected by a recent economic downturn leading to a shortage of liquidity and a fall in the share price during 20X1.

On 31 December 20X1 the company was funded by:

• Share capital of 4 million $1 shares trading at $4.0 per share.

• Debt of $7 million floating rate borrowings.

The directors plan to raise $2 million additional borrowings in order to improve liquidity.

They expect this to reassure investors about the company's liquidity position and result in a rise in the share price to $4.2 per share.

Is the planned increase in borrowings expected to help the company meet its gearing objective?

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?