The Board of Directors of a small listed company engaged in exploration are currently considering the future dividend policy of the company. Exploration is considered a high-risk business and consequently the company has a low level of debt finance.

Forecasts indicate a period of profit fluctuation in the next few years as the company is planning to embark on a major capital investment project. Debt finance is unlikely to be available due to the project's high business risk.

Which THREE of the following are practical considerations when determining the company's dividend/retention policy?

Integrated reporting is designed to make visible the capitals on which the organisation depends, and how the organisation uses those capitals to create value in the short, medium and long term

Which THREE of the following capitals are specifically identified in the Integrated Reporting

A is a listed company. Its shares trade on a stock market exhibiting semi-strong form efficiency.

Which of the following is most likely to increase the wealth of A's shareholders?

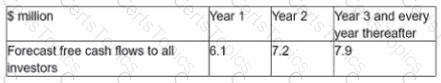

The financial assistant of a geared company has prepared the following calculation of the company's equity value:

Useful information;

• Tax rate - 20%

• Cost of equity = 12%

• Weighted average cost of capital (WACC)« 10%

" Debt finance of the company comprises a $6 million 7% undated bond trading at par Valuation workings.

Which of the following errors has been made by the financial assistant?