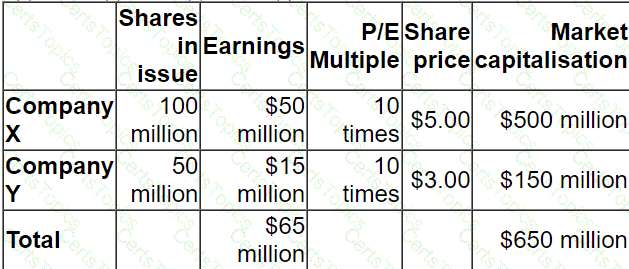

Company X plans to acquire Company Y.

Pre-acquisition information:

Post-acquisition information:

Total combined earnings are expected to increase by 10%

Total combined P/E multiple will remain at 10 times

Which of the following share-for-share exchanges will result in an increase of 10% in Company X's share price post-acquisition?

A company's Board of Directors is assessing the likely impact of financing new projects by using either debt or equity finance.

The impact of using debt or equity finance on some key variables is uncertain.

Which THREE of the following statements are true?

The value of a call option will increase because of: