A venture capitalist is most likely to take which THREE of the following exit routes?

A company's main objective is to achieve an average growth in dividends of 10% a year.

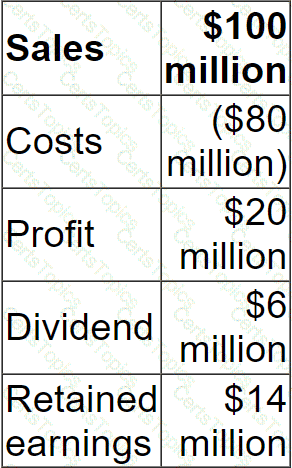

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect

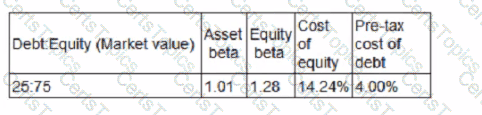

The following information relates to Company ZZA's current capital structure:

Company ZZA is considering a change in the capital structure that will increase gearing to 35:65 (Debt Equity).

The risk-free rate is 4% and the return on the market portfolio is expected to be 12%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.