Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

LPM Company is based in Country C. whose currency is the CS

It has entered Into a contract to buy a machine in three months' time. The supplier is overseas and the payment is to be made in a different currency from the CS

The treasurer at LPM Company is considering using a money market hedge to manage the transaction risk associated with a payment.

The assumptions of interest rate parity apply

Which THREE of the following statements concerning the use of a money market hedge for this supplier payment are correct?

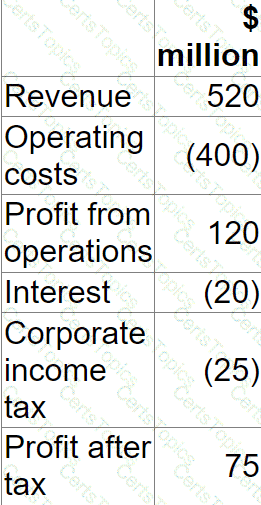

The table below shows the forecast for a company's next financial year:

The forecast incorporates the following assumptions:

• 25% of operating costs are variable

• Debt finance comprises a $400 million fixed rate loan at 5%

• Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

• Pay a total dividend of $20 million

• Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.

Which THREE of the following statements are correct?