Company J plans to acquire Company K, an unlisted company whose equity is to be valued using a P/E ratio approach.

A listed company has been identified which is very similar to Company K and which can be used as a proxy.

However, the growth prospects of Company K are higher than those of the proxy.

The Directors of Company J are aware that certain adjustments will be necessary to the proxy company's P/E ratio in order to obtain a more reliable valuation.

The following adjustments have been agreed:

• 20% due to Company K being unlisted.

• 15% to allow for the growth rate difference.

The total adjustment to the proxy p/e ratio is:

A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at a ratio of 20 ordinary shares per $100 nominal value bond.

Each share:

• has a current market value of $5.60

• is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

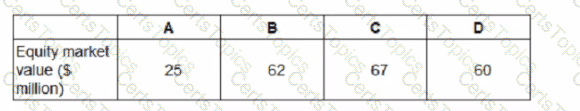

Company Z has identified four potential acquisition targets: companies A, B. C and D.

Company Z has a current equity market value of S590 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

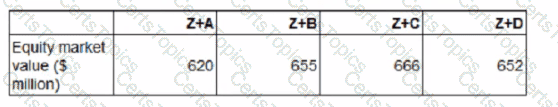

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

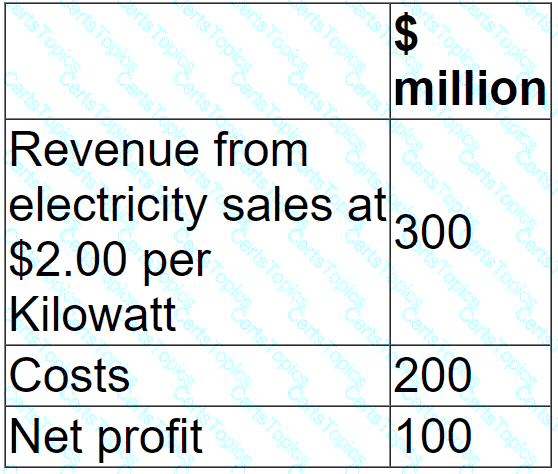

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to: