Company P is a large unlisted food-processing company.

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

• A rights issue.

• A bond issue.

• A combination of both at the current debt to equity ratio.

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

A company's directors plan to increase gearing to come in line with the industry average of 40%. They need to know what the effect will be on the company's WACC.

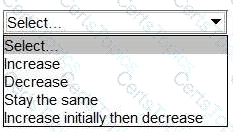

According to traditional theory of gearing the WACC is most likely to:

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?