Under traditional theory, an increase in a company's WACC would cause the value of the company to:

Which THREE of the following methods of business valuation would give a valuation of the equity of an entity, rather than the value of the whole entity?

WX, an advertising agency, has just completed the all-cash acquisition of a competitor, YZ. This was seen by the market as a positive strategic move byWX.

Which THREE of the following will WX's shareholders expect the company's directors to prioritise following the acquisition?

A private company was formed five years ago and is currently owned and managed by its five founders. The founders, who each own the same number of shares have generally co-operated effectively but there have also been a number of areas where they have disagreed

The company has grown significantly over this period by re-investing its earnings into new investments which have produced excellent returns

The founders are now considering an Initial Public Offering by listing 70% of the shares on the local stock exchange

Which THREE of the following statements about the advantages of a listing are valid?

Company A plans to acquire Company B, an unlisted company which has been in business for 3 years.

It has incurred losses in its first 3 years but is expected to become highly profitable in the near future.

No listed companies in the country operate the same business field as Company B, a unique new high-risk business process.

The future success of the process and hence the future growth rate in earnings and dividends is difficult to determine.

Company A is assessing the validity of using the dividend growth method to value Company B.

Which THREE of the following are weaknesses of using the dividend growth model to value an unlisted company such as Company HHG?

Which THREE of the following non-financial objectives would be most appropriate for a listed company in the food retailing industry?

A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

For which THREE of the following risk categories does IFRS 7 require sensitivity analysis?

A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

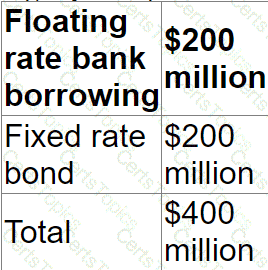

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

• Company A has 100 million shares in issue, with market price currently at $8.00 per share.

• Company T has 90 million shares in issue, with market price currently at $5.00 each share.

• Synergies valued at $60 million are expected to arise from the acquisition.

• The terms of the offer will be 2 shares in A for 3 shares in B.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

$ ? .

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

ART manufactures traditional scooters. It has an equity beta of 1.4 and is financed entirely by equity. It plans to continue to be all-equity financed in future.

It is considering producing a range of electric scooters

GGG is a comparable quoted electric scooter manufacturer GGG has an equity beta of 2 4 reflecting its high level of gearing (the ratio of debt to equity is VI using market values).

The risk-free rate is 5%, and the market premium is 6%. The rate of corporation tax is 20%

What is the recommended discount rate that ART should use to assess the project to manufacture electric scooters?

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $10 0 million.

The rate of corporate tax is 20%.

The average P/E multiple of listed companies in the same industry is 10 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 11 times to 12 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 16 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?

Company A is identical in all operating and risk characteristics to Company B, but their capital structures differ.

Company B is all-equity financed. Its cost of equity is 17%.

Company A has a gearing ratio (debt:equity) of 1:2. Its pre-tax cost of debt is 7%.

Company A and Company B both pay corporate income tax at 30%.

What is the cost of equity for Company A?

A company is reporting under IFRS 7 Financial Instruments: Disclosures for the first time and the directors are concerned about whether this will lead to the disclosure of information that could affect the company's share price.

The company is based in a country that uses the A$ but 40% of revenue relates to export sales to the USA and priced in US$.

When the company reports under IFRS 7 for the first time, the share price is most likely to:

A company is planning a share repurchase programme with the following details:

• Repurchased shares will be immediately cancelled.

• The shares will be purchased at a premium to the market share price.

The current market share price is greater than the nominal value of the shares.

Which of the following statements about the impact of the share repurchase programme on the company's financial statements is correct?

The ex div share price of a company's shares is $2.20.

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

A company has a financial objective of maintaining a gearing ratio of between 30% and 40%, where gearing is defined as debt/equity at market values.

The company has been affected by a recent economic downturn leading to a shortage of liquidity and a fall in the share price during 20X1.

On 31 December 20X1 the company was funded by:

• Share capital of 4 million $1 shares trading at $4.0 per share.

• Debt of $7 million floating rate borrowings.

The directors plan to raise $2 million additional borrowings in order to improve liquidity.

They expect this to reassure investors about the company's liquidity position and result in a rise in the share price to $4.2 per share.

Is the planned increase in borrowings expected to help the company meet its gearing objective?

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?

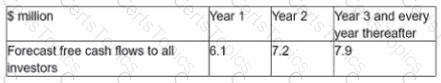

An analyst has valued a company using the free cash flow valuation model.

The analyst used the following data in determining the value:

• Estimated free cashflow in 1 year's time = $100,000

• Estimated growth in free cashflow after the first year = 5% each year indefinitely

• Appropriate cost of equity = 10%

The result produced by the analyst was as follows:

Value of equity = $100,000 (1+0.05)/0.10 = $1,050,000

The analyst made a number of errors in determining the value.

By how much has the analyst undervalued the company?

Company AEE has a 10 year 6% corporate bond in issue which has a nominal value of $400 million, which is currently trading at 95%. The bond is secured on the company's property

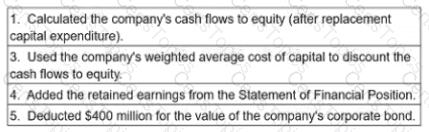

The Board of Directors has calculated the equity value of Company AEE as follows;

Which THREE of the following are errors in the valuation?

Which THREE of the following would be of most interest to lenders deciding whether to provide long-term debt to a company?

The competition authorities are investigating the takeover of Company Z by a larger company, Company Y.

Both companies are food retailers.

The takeover terms involve using a part cash, part share exchange means of payment.

Company Z is resisting the bid, arguing that it undervalues its business, while lobbying extensively among politicians to sway public opinion against the bidder.

Which of the following actions by Company Y is most likely to persuade the competition authorities to approve the acquisition?

A company has accumulated a significant amount of excess cash which is not required for investment for the foreseeable future.

It is currently on deposit, earning negligible returns.

The Board of Directors is considering returning this excess cash to shareholders using a share repurchase programme.

The majority of shareholders are individuals with small shareholdings.

Which THREE of the following are advantages of the company undertaking a share repurchase programme?

A company is currently all-equity financed with a cost of equity of 9%.

It plans to raise debt with a pre-tax cost of 3% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 25%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

A product costs USD10 when purchased in the USA. The same product costs USD12 when it is purchased in the UK and the price in GBP is convened to USD.

Which of the following statement concerning purchasing power parity is correct?

A company's current earnings before interest and taxation are $5 million.

These are expected to remain constant for the forseeable future.

The company has 10 million shares in issue which currently trade at $3.60.

It also has a $10 million long term floating rate loan.

The current interest rate on this loan is 5%.

The company pays tax at 20%.

The company expects interest rates to increase next year to 6% and it's Price/Earnings (P/E) ratio to move to 9.5 times by the end of next year.

What percentage reduction in the share price will occur by the end of next year if the interest rate increase and the P/E movement both occur?

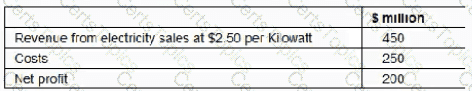

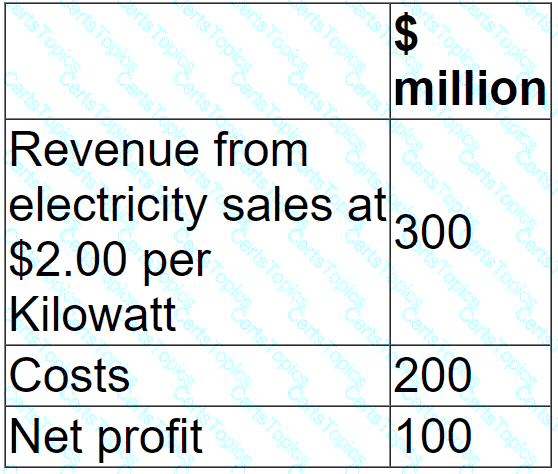

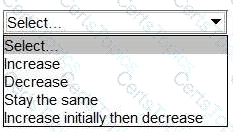

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

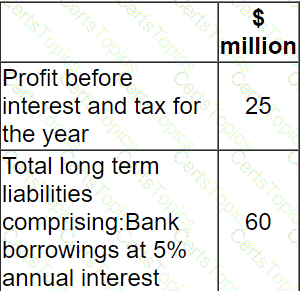

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

Company A plans to diversify by a cash acquisition of Company B an unlisted company in another country (Country B) which operates in a different industrial sector

Company A already manufactures its product in Country B and has a loan denominated in Country B's currency

Company A regularly suffers foreign exchange losses due to volatility in the exchange rate between the two countries' currencies in recent years.

Which THREE of the following appear to be be valid justifications of this diversification decision?

A company has just received a hostile bid. Which of the following response strategies could be considered?

A company based in Country D, whose currency is the D$, has an objective of maintaining an operating profit margin of at least 10% each year.

Relevant data:

• The company makes sales to Country E whose currency is the E$. It also makes sales to Country F whose currency is the F$.

• All purchases are from Country G whose currency is the G$.

• The settlement of all transactions is in the currency of the customer or supplier.

Which of the following changes would be most likely to help the company achieve its objective?

A listed company in the retail sector has accumulated excess cash.

In recent years, it has experienced uncertainly with forecasting the required level of cash for capital expenditure due to unpredictable economic cycles.

Its excess cash is on deposit earning negligible returns.

The Board of Directors is considering the company's dividend policy, and the need to retain cash in the company.

Which THREE of the following are advantages of retaining excess cash in the company?

A company is considering a divestment via either a management buyout (MBO) or sale to a private equity purchaser. Which of the following is an argument in favour of the MBO from the viewpoint of the original company?

A company has borrowings of S5 million on which it pays interest at 8%. It has an operating profit margin of 20%.

The company plans to increase borrowings by S2 million Interest on additional borrowings would be 10% and the operating profit margin would remain unchanged

A debt covenant attached to the new borrowings requires interest cover to be at least 4 times throughout the period of the borrowing

Interest cover is defined in the loan documentation as being based on operating profit

What is the minimum sales value required each year to avoid a breach of the interest cover covenant'

A company has stable earnings of S2 million and its shares are currently trading on a price earnings multiple {PIE) of 10 times. It has10 million shares in issue.

The company is raising S4 million debt finance to fund an expansion of its existing business which is forecast to increase annual earnings straight away by 25% and then remain at that level for the foreseeable future. The corporation tax rate is 20%. It is expected that the P/E will reduce to 8 times over the next year.

What is the most likely change in shareholder wealth resulting from this plan?

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $4.0 million.

The rate of corporate tax is 25%.

The average P/E multiple of listed companies in the same industry is 8 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 9 times to 10 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 15 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?

A company gas a large cash balance but its directors have been unable to identify any positive NPV projects to invest in. Which THREE of the following are advantages of a share repurchase, compared with a one-off large dividend?

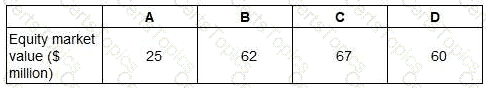

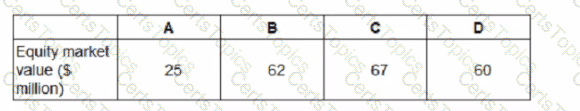

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $590 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

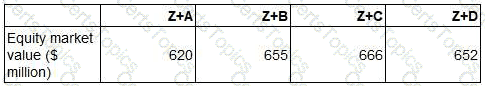

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

Which THREE of the following long term changes are most likely to increase the credit rating of a company?

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

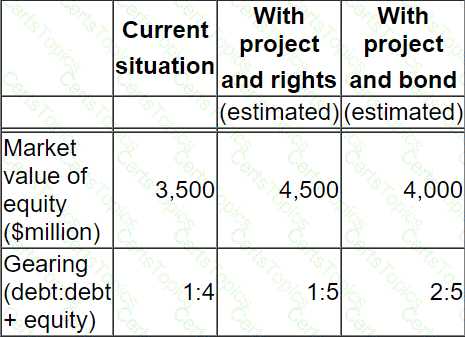

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

CAPM:

E(R)=Rf+β(Rm−Rf)E(R) = R_f + \beta (R_m - R_f)E(R)=Rf+β(Rm−Rf)

Given:

E(R)=11%,Rf=2%,Rm=8%E(R) = 11\% , R_f = 2\%, R_m = 8\%E(R)=11%,Rf=2%,Rm=8%

0.11=0.02+β(0.08−0.02)⇒0.11−0.02=0.06β⇒0.09=0.06β⇒β=1.50.11 = 0.02 + \beta(0.08 - 0.02) \Rightarrow 0.11 - 0.02 = 0.06\beta \Rightarrow 0.09 = 0.06\beta \Rightarrow \beta = 1.50.11=0.02+β(0.08−0.02)⇒0.11−0.02=0.06β⇒0.09=0.06β⇒β=1.5

Beta > 1 ⇒ higher risk than the market.

PPA owns $500,000 of shares in Company ABB. Company ABB has a daily volatility of 2% of its share price

Calculate the 12-day value at risk that shows the most PPA can expect to lose during a 12-day period (PPA wishes to be 90% certain that the actual loss in any month will be less than your predicted figure)

Give your answer to the nearest thousand dollars.

A company has a 4% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 4 times

• Retained earnings for the year must not fall below S5 00 million

The Company has 100 million shares in issue. The most recent dividend per share was $0 10 The Company intends increasing dividends by 8% next year.

Financial projections tor next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

A company has:

• A price/earnings (P/E) ratio of 10.

• Earnings of $10 million.

• A market equity value of $100 million.

The directors forecast that the company's P/E ratio will fall to 8 and earnings fall to $9 million.

Which of the following calculations gives the best estimate of new company equity value in $ million following such a change?

A)

B)

C)

D)

Option A

Option B

Option C

Option D

A venture capitalist is most likely to take which THREE of the following exit routes?

A company's main objective is to achieve an average growth in dividends of 10% a year.

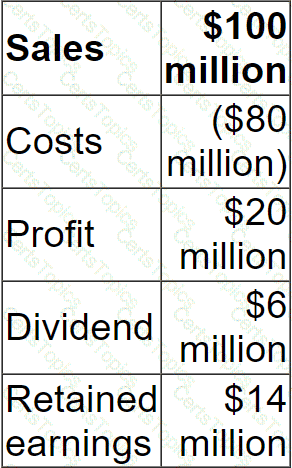

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect

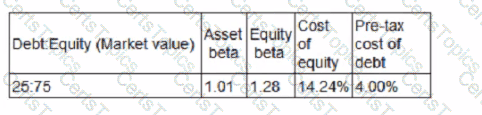

The following information relates to Company ZZA's current capital structure:

Company ZZA is considering a change in the capital structure that will increase gearing to 35:65 (Debt Equity).

The risk-free rate is 4% and the return on the market portfolio is expected to be 12%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

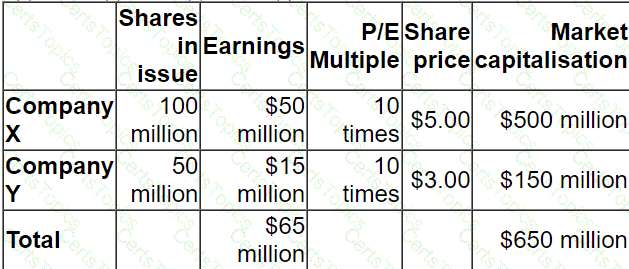

Company X plans to acquire Company Y.

Pre-acquisition information:

Post-acquisition information:

Total combined earnings are expected to increase by 10%

Total combined P/E multiple will remain at 10 times

Which of the following share-for-share exchanges will result in an increase of 10% in Company X's share price post-acquisition?

A company's Board of Directors is assessing the likely impact of financing new projects by using either debt or equity finance.

The impact of using debt or equity finance on some key variables is uncertain.

Which THREE of the following statements are true?

The value of a call option will increase because of:

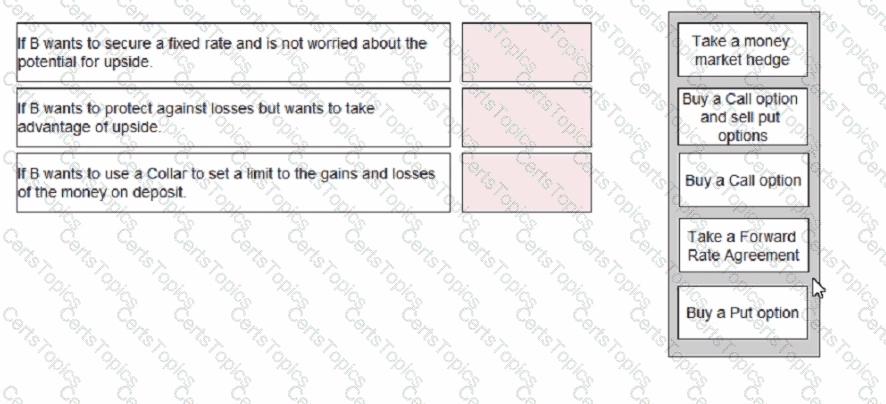

B has a S3 million loan outstanding on which the interested rate is reset every 6 months for the following 6 month and the interested is payable at the end of that 6 month period. The next 6 monthly reset period starts in 3 months and the treasurer of B thinks interested rates are likely to raise between and then.

Current 6-month rates are 6.4% and the treasurer can get a rate of 6.9% for a 6-month forward rate agreement (FRA) starting in 3 months time. By transacting an TRA the treasurer can lock in a rate today of 6.9%.

If interested rates are 7.5% in 3 months’ time, what will the net amount payable be?

Give your answer to the nearest thousand dollars.

A company needs to raise $40 million to finance a project. It has decided on a right issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $10.00 per share.

A major energy company, GDE, generates and distributes electricity in country A. The government of country A is concerned about rising inflation and has imposed price controls on GDE, limiting the price it can charge per unit of electricity sold to both domestic and commercial customers. It is likely that price controls will continue for the foreseeable future.

The introduction of price controls is likely to reduce the profit for the current year from $3 billion to $1 billion.

The company has:

• Distributable reserves of $2 billion.

• Surplus cash at the start of the year of $1 billion.

• Plans to pay a total dividend of $1.5 billion in respect of the current year, representing a small annual increase as in previous years. However, no dividends have yet been announced.

Which THREE of the following responses would be MOST appropriate for GDE following the imposition of price controls?

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $4 million.

• The corporate income tax rate is 20%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 5% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.

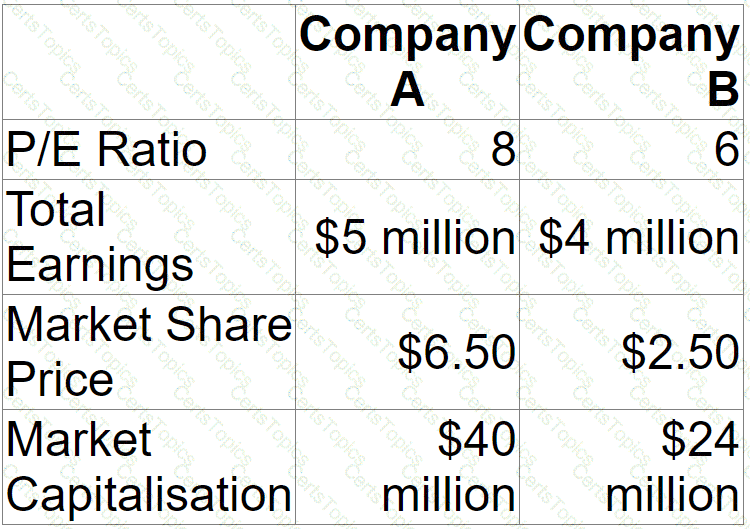

Company A is planning to acquire Company B.

Company A's managers think they can improve the performance of Company B to the extent that its own P/E ratio should be applied to Company B's earnings.

Relevant Data:

What is the expected synergy if the acquisition goes ahead?

Give your answer to the nearest $ million.

$ ? million

Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, located m country B that has the BS as its currency AAB has asked BBA to pay BS40 million surplus funds to AAB to assist with a planned new capital investment in country A The exchange rate today is AS1 = BS3

Tax regimes

• Company BBA pays withholding tax of 25% on all cash remitted to the parent company

• Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?

PPP's home currency is the PS. An overseas customer is due to make a payment of A$5,000,000 to PPP in 3 months. The present spot rate is 1PS = 5A$. P can obtain an interest rate of 4% per year on P$ deposits and 6% per year on AS deposits.

Forecast the value of the customer's payment to PPP, in PS, when the payment is made in 3 months' time.

Give your answer to the nearest thousand P$.

The Senior Management Team of ABC, an owner-managed, capital intensive start-up engineering business, is considering the options for its dividend policy. It has so far been a successful business and is expanding quickly Once in place, the Senior Management Team anticipates that its current investment plans will yield returns for many years to come The first agenda item at every meeting currently concerns arranging and funding new equipment and premises.

Which of the following dividend policies is likely to be the most suitable?

Which TWO of the following statements about debt instruments are correct?

A UK company enters into a 5 year borrowing with bank P at a floating rate of GBP Libor plus 3%

It simultaneously enters into an interest rate swap with bank Q at 4.5% fixed against GBP Libor plus 1.5%

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place.

Company A is located in Country A, where the currency is the A$.

It is listed on the local stock market which was set up 10 years ago.

It plans a takeover of Company B, which is located in Country B where the currency is the B$, and where the stock market has been operating for over 100 years.

Company A is considering how to finance the acquisition, and how the shareholders of Company B might respond to a share exchange or cash (paid in B$).

Which of the following is likely to explain why the shareholders of Company B would prefer a share exchange as opposed to a cash offer?

An all equity financed company reported earnings for the year ending 31 December 20X1 of $8 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 4%.

The company pays corporate income tax at 20%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

LPM Company is based in Country C. whose currency is the CS

It has entered Into a contract to buy a machine in three months' time. The supplier is overseas and the payment is to be made in a different currency from the CS

The treasurer at LPM Company is considering using a money market hedge to manage the transaction risk associated with a payment.

The assumptions of interest rate parity apply

Which THREE of the following statements concerning the use of a money market hedge for this supplier payment are correct?

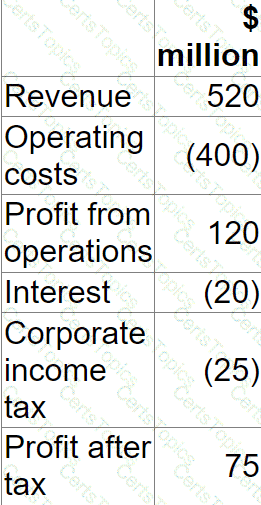

The table below shows the forecast for a company's next financial year:

The forecast incorporates the following assumptions:

• 25% of operating costs are variable

• Debt finance comprises a $400 million fixed rate loan at 5%

• Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

• Pay a total dividend of $20 million

• Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.

Which THREE of the following statements are correct?

Which of the following is NOT an advantage of a share repurchase?

An unlisted company wishes to obtain an estimated value for its shares in anticipation of a private sale of a large parcel of shares.

Relevant data for the unlisted company:

• It has a residual dividend policy.

• It has earnings that are highly sensitive to underlying economic conditions.

• It is a small business in a large industry where there are listed companies but there are none with a similar capital structure.

The company intends to base valuations on the cost of equity of a proxy company after adjusting for any differences in capital structure where appropriate.

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

When valuing an unlisted company, a P/E ratio for a similar listed company may be used but adjustments to the P/E ratio may be necessary.

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?

A profit-seeking company intends to acquire another company for a variety of reasons, primarily to enhance shareholder wealth.

Which THREE of the following offer the greatest potential for enhancing shareholder wealth?

A company proposes to value itself based on the net present value of estimated future cash flows.

Relevant data:

• The cash flow for the next three years is expected to be £100 million each year

• The cash flow after year 3 will grow at 2% to perpetuity

• The cost of capital is 12%

The value of the company to the nearest $ million is:

Formed in 2010, the International Integrated Reporting Council The primary purpose of the IIRC's framework is to help enable an organisation to communicate which of the following'?

A listed company has recently announced a profit warning.

The company's share price fell 20% on the day of the announcement but had been fairly static in the weeks leading up to the announcement.

Which form of efficient market is most likely to be indicated by this share price movement?

Company X is an established, unquoted company which provides IT advisory services.

The company's results and cashflows are growing steadily and it has few direct competitors due to the very specialised nature of it's business. Dividends are predictable and paid annually.

Company P is looking to buy 30% of company X's equity shares.

Which TWO of the following methods are likely to be considered most suitable valuation methods for valuing company P's investment in Company X?

The Board of Directors of a small listed company engaged in exploration are currently considering the future dividend policy of the company. Exploration is considered a high-risk business and consequently the company has a low level of debt finance.

Forecasts indicate a period of profit fluctuation in the next few years as the company is planning to embark on a major capital investment project. Debt finance is unlikely to be available due to the project's high business risk.

Which THREE of the following are practical considerations when determining the company's dividend/retention policy?

Integrated reporting is designed to make visible the capitals on which the organisation depends, and how the organisation uses those capitals to create value in the short, medium and long term

Which THREE of the following capitals are specifically identified in the Integrated Reporting

A is a listed company. Its shares trade on a stock market exhibiting semi-strong form efficiency.

Which of the following is most likely to increase the wealth of A's shareholders?

The financial assistant of a geared company has prepared the following calculation of the company's equity value:

Useful information;

• Tax rate - 20%

• Cost of equity = 12%

• Weighted average cost of capital (WACC)« 10%

" Debt finance of the company comprises a $6 million 7% undated bond trading at par Valuation workings.

Which of the following errors has been made by the financial assistant?

An unlisted company:

Is owned by the original founder and member of their families.

Is growing more rapidly than other companies in the same industry.

Pays a fixed annual divided

Which of the following methods would be the most appropriate to value this company’s equity?

A company is located in a single country. The company manufactures electrical goods for export and for sale in its home country. When exporting, it invoices in its customers' currency. What currency risks is the company exposed to?

ZZZ is a listed company based in Brinland. a European country. It is the largest owner and operator of residential care homes for elderly people in Brinland

Most of the residential care homes in Brinland are run by small private operators, and the standards of cafe are extremely variable However. 22Z has developed a good reputation because its client service is considered to be extremely good even though its prices are higher than those of most of its competitors.

ZZZ has expanded rapidly in the last few years, partly by acquisition and partly by organic growth consequently, the company's share price now stands at a record high, and the dividend declared at the end of the most recent accounting period was 10% higher than the previous year's dividend.

The Brinland government has recently set up a regulatory body to monitor the residential care homes industry. The regulatory body is considering introducing a variety of regulations to improve the customer experience in the industry. Following a period of consultation and investigation, the regulatory body is expected to announce a range of new regulations in the near future.

The directors of ZZZ are concerned that the new regulations may adversely affect their company

Which THREE of the following new regulations are likely to have the greatest negative impact on ZZTs performance?

A listed company in a high growth industry, where innovation is a key driver of success has always operated a residual dividend policy, resulting in volatility in dividends due to periodic significant investments in research and development.

The company has recently come under pressure from some investors to change its dividend policy so that shareholders receive a consistent growing dividend. In addition, they suggested that the company should use more debt finance.

If the suggested change is made to the financial policies, which THREE of the following statements are true?

A listed company has suffered a period of falling revenues and profit margins. It has been obliged to issue a profit warning to the market and its share price has fallen sharply. The company relies heavily on debt finance and is discussing with its banks possible refinancing options to assist with a restructuring programme.

Which THREE of the following are likely to be of MOST interest to the company's banks when they review the refinancing requests?

Which of the following statements is true of a spin-off (or demerger)?

Company ADE is an unlisted company; it needs to raise a significant amount of finance to fund future expansion. The directors are considering listing the company on the local stock exchange The following discussions have taken place between some of the directors:

Director A - We consider a public issue of bonds in the capital markets, we don't need to list to issue the bonds which will save time and money.

Director B - We should list on the Alternative Investment Market (AIM) and not the main market to avoid any regulatory requirements

Director C - We should remain unlisted; we can access an unlimited amount of equity finance through a rights issue

Director D - Listing will increase Company ADE's ability to raise new equity and debt finance in the future.

Director E - If we list, Company ADE will be a more likely target for a takeover than if we remain unlisted.

Which TWO of the directors' statements are correct?

A company has announced a rights issue of 1 new share for every 4 existing shares.

Relevant data:

• The current market price per share is $10.00.

• Rights are to be issued at a 20% discount to the current price.

• The rate of return on the new funds raised is expected to be 10%.

• The rate of return on existing funds is 5%.

What is the yield-adjusted theoretical ex-rights price?

Give your answer to two decimal places.

$ ?

A company raised fixed rate bank finance together with an interest rate swap for the same term and same principal value to pay floating receive fixed rate interest on an annual basis.

Which THREE of the following statements are correct?

A large, listed company in the food and household goods industry needs to raise $50 million for a period of up to 6 months.

It has an excellent credit rating and there is almost no risk of the company defaulting on the borrowings. The company already has a commercial paper programme in place and has a good relationship with its bank.

Which of the following is likely to be the most cost effective method of borrowing the money?

Company AAB is located in Country A with the A$ as its functional currency It plans to grow by acquisition and has identified Company BBA as a potential takeover candidate Company BBA is located in Country B with the BS as its functional currency.

The directors of Company AAB are concerned about foreign currency risk if the acquisition goes ahead

Which of the following will be most effective in reducing Company AAB's exposure to translation risk if the acquisition is successful1?

ADC is planning to acquire DEF in order to benefit from the expertise of DEF's owner ‘managers Both are Listed companies. ADC is trying to decide whether to offer cash or shares in consideration for DEF's shares.

Which THREE of the following are advantages to ABC of offering shares to acquire CEF?

Company AD is planning to acquire Company DC. It is evaluating two methods of structuring the terms of the bid, which will be ether a debt-funded cash offer or a share exchange

The following Information is relevant

• The two companies are of similar size and in related industries

• AB's gearing ratio measured as debt to debt plus equity, is currently 30% based on market values. This Is the company's optimum capital structure set to reflect the risk appetite of shareholders.

• The combined company is expected to generate savings and synergies

Which THREE of the following are advantages to AB's shareholders of a debt-funded cash offer compared with a share exchange?

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

A company's Board of Directors wishes to determine a range of values for its equity.

The following information is available:

Estimated net asset values (total asset less total liabilities including borrowings):

• Net book value = $20 million

• Net realisable value = $25 million

• Free cash flows to equity = $3.5 million each year indefinitely, post-tax.

• Cost of equity = 10%

• Weighted Average Cost of Capital = 7%

Advise the Board on reasonable minimum and maximum values for the equity.

B, a European based modern art dealer, frequently imports and sells single high value items created in the United States. The price is fixed at the date of sale but the items are commissioned and made to order with a lead time of three to nine months depending on the individual specification

B holds payment for his customers from the point of purchase and passes funds when the items are shipped However, despite putting the money on short term deposit, there have been times when B's profits have been almost entirely eroded by adverse movements m interest rates Advise B by matching the appropriate instrument to B's requirements.

Company J plans to acquire Company K, an unlisted company whose equity is to be valued using a P/E ratio approach.

A listed company has been identified which is very similar to Company K and which can be used as a proxy.

However, the growth prospects of Company K are higher than those of the proxy.

The Directors of Company J are aware that certain adjustments will be necessary to the proxy company's P/E ratio in order to obtain a more reliable valuation.

The following adjustments have been agreed:

• 20% due to Company K being unlisted.

• 15% to allow for the growth rate difference.

The total adjustment to the proxy p/e ratio is:

A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at a ratio of 20 ordinary shares per $100 nominal value bond.

Each share:

• has a current market value of $5.60

• is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

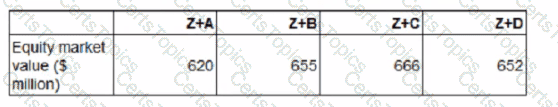

Company Z has identified four potential acquisition targets: companies A, B. C and D.

Company Z has a current equity market value of S590 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Company ABD and Company BCD operate in the same industry and each has a significant market share.

The directors of Company ABD have heard rumours in the market that Company BCD is planning to bid to takeover Company ABD. They do not believe the takeover would be in the best interests of the shareholders and are therefore keen to prevent the bid from going ahead.

Which THREE of the following defense strategies could be used by the directors of Company ABD at this point in time?

X exports goods to customers in a number of small countries Asia. At present, X invoices customers in X's home currency.

The Sales Director has proposed that X should begin to invoice in the customers currency, and the Treasurers considering the implications of the proposal.

Which TWO of the following statement are correct?

A company is planning to issue a 5 year $100 million bond at a fixed rate of 6%.

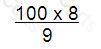

It is also considering whether or not to enter into a 10 year $100 million swap to receive 5% fixed and pay Libor + 1% once a year.

The company predicts that Libor will be 4% over the life of the 5 years.

What is the impact of the swap on the company's annual interest cost assuming that the Libor prediction is correct?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

Company P is a large unlisted food-processing company.

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

• A rights issue.

• A bond issue.

• A combination of both at the current debt to equity ratio.

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

A company's directors plan to increase gearing to come in line with the industry average of 40%. They need to know what the effect will be on the company's WACC.

According to traditional theory of gearing the WACC is most likely to:

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

A listed company is planning to raise $21.6 million to finance a new project with a positive net present value of $5 million. The finance is to be raised via a rights issue at a 10% discount to the current share price. There are currently 100 million shares in issue, trading at $2.00 each.

Taking the new project into account, what would the theoretical ex-rights price be?

Give your answer to two decimal places.

$ ?

A new company was set up two years ago using the personal financial resources of the founders.

These funds were used to acquire suitable premises.

The company has entered into a long-term lease on the premises which are not yet fully fitted out.

The founders are considering requesting loan finance from the company's bank to fund the purchase of custom-made advanced technology equipment.

No other companies are using this type of equipment.

The company expects to continue to be profitable for the forseeable future.

It re-invests some of its surplus cash in on-going essential research and development.

Which THREE of the following features are likely to be considered negatives by the bank when assessing the company's credit-worthiness?

The directors of a unlisted manufacturing company have prepared a valuation of their company using the price-earning method.

Their calculation is:

Value if the company‘s equity = $6 million x 10 =$60 million where.

$6 million is the company’s reported profit before interested and tax in the most recent accounting period and

10 is the average price-earnings ratio for all listed companies

Which THREE of the following are weakness of this valuation?

A company is planning a new share issue.

The funds raised will be used to repay debt on which it is currently paying a high interest rate.

Operating profit and dividends are expected to remain unchanged in the near future.

If the share issue is implemented, which THREE of the following are most likely to increase?

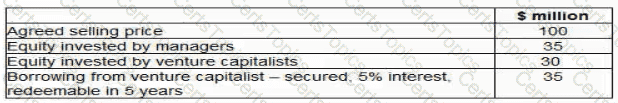

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments

The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 3Q°/o a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?