CIMA Related Exams

F1 Exam

An asset cost $250,000 on 1 January 20X1 and on that date was assessed to have a residual value of $40,000 and a useful economic life of six years. On 1 January 20X4 management assessed that the remaining useful economic life of the asset was five years and that the asset had a residual value of nil.

What is the depreciation charge for this asset in the year ended 31 December 20X4?

Give your answer to the nearest whole number.

On 1 January 20X2 an entity began work on constructing a factory. It purchased the land for $14 million, built the factory buildings for $11 million and installed plant and equipment for $7 million. The project was completed on 31 December 20X3 when the factory was deemed ready to use, however, the factory did not start operations until 1 June 20X4.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

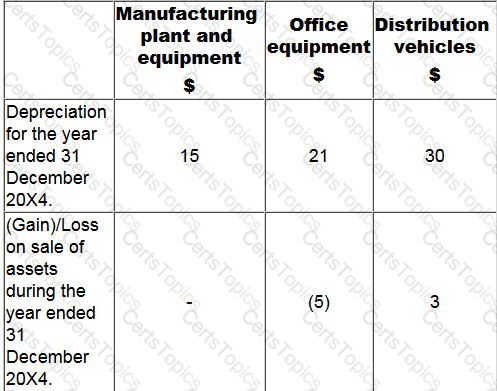

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?