Which THREE of the following matters should an entity consider when determining the credit terms granted to a customer?

In accordance with IAS 1 Presentation of Financial Statements, which of the following will be shown in the statement of changes in equity?

Which of the following does the phrase 'events after the reporting period' refer to?

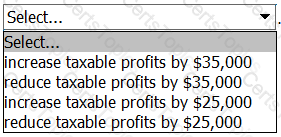

KL has S90.000 of plant and machinery which was acquired on 1 June 20X4. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for 560,000 on 1 June 20X6

Calculate the tax balancing allowance or charge on disposal tor the year ended 31 May 20X7 and state the effect on the taxable profit.

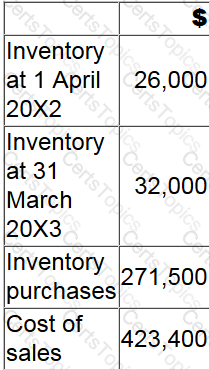

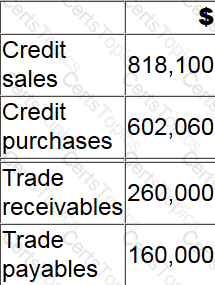

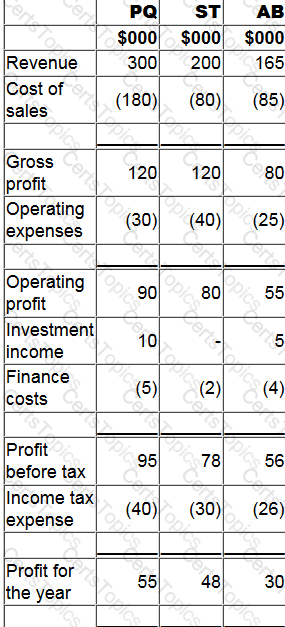

The following data has been extracted from GH's accounting records:

What is GH's average inventory days for the year ended 31 March 20X3?

While conducting their audit, auditor 0 did not encounter issues which significantly limited the scope of their audit, however they did run into problems in that they disagreed with the management on facts in the

statements.

These disagreements were somewhat material, but they did not affect the auditor's overall opinion of the business. Which of the following statements should auditor 0 issue?

Which of the following is a characteristic of a defined contribution post-employment benefit scheme?

Country X levies corporate income tax at a rate of 25% and charges income tax on all profits irrespective of whether they are distributed by way of dividend. Country Y levies corporate income tax at a rate of 20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?

AB sells to ST, a group entity, 10,000 units at $2.50 each. The market value was $6 each.

The effect on AB of the transfer pricing legislation on this transaction would be to: .

Which THREE of the following statements about government grants are INCORRECT?

Entity T operates within several countries, but its country of residence is Country F. In 20X5, Entity T made $8.4 million in Country M. Country M has a flat rate corporation tax of 5.9%.

Country F and Country M operate a double taxation treaty which uses a foreign tax credit system. In Country F, there is a tax of 10% tax on all foreign income.

Taking into account the credit, what is the total tax liability that Entity T owes on its Country M income, in Country F?

Which THREE of the following must an auditor consider in order to form an opinion on the truth and fairness of an entity's financial statements?

Which of the following would be classified as a parent and subsidiary relationship in accordance with IFRS 10 Consolidated Financial Statements?

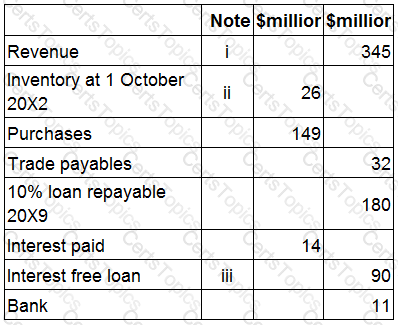

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the cost of sales that would be shown in YY's statement of profit or loss for the year ended 30 September 20X3.

Give your answer to the nearest $ million.

An asset cost $250,000 on 1 January 20X1 and on that date was assessed to have a residual value of $40,000 and a useful economic life of six years. On 1 January 20X4 management assessed that the remaining useful economic life of the asset was five years and that the asset had a residual value of nil.

What is the depreciation charge for this asset in the year ended 31 December 20X4?

Give your answer to the nearest whole number.

A conservative policy for financing working capital is one where short-term finance is used to fund:

The subsidiary company of Group XY has purchased £150,00 worth of goods its parent company. However the goods purchased have yet to arrive at the subsidiary at the end of the financial year 20X4, meaning there is

a disagreement in the current account balances between the parent and subsidiary.

With Group XY looking to produce its CSOFP for the end of the financial year, which of the following statements are true in relation to accounting for this disagreement? Select ALL that apply.

UK purchased an asset, with a useful economic life of 10 years, on 1 January 20X5 for $40,000. The asset was revalued on 31 December 20X6 to 544,000 and the directors believed its total useful economic life remained unchanged On 31 December 20X7 UK sells the asset for $50,000

How much will be recorded as a profit on disposal of the asset in UK's statement of profit or loss for the year ended 31 December 20X7?

Give your answer to the nearest $.

Which of the following is correct?

The primary purpose of a cash budget prepared on a monthly basis is to determine:

To apply the fundamental principles of the Code of Ethics, existing and potential threats to the entity first need to be identified and evaluated.

Which THREE of the following are identified in the Code as threats?

An entity has an inventory holding period of 52 days.

This means that the inventory:

In which of the following concepts is profit an increase in the nominal value of capital over a period?

Which TWO of the following would improve a company's short term cash flow position?

Which of the following methods could be used by a tax authority to reduce tax evasion and avoidance?

RS purchased an asset on 1 May 20X1 for $200,000, exclusive of import duties of $25,000.

The asset was sold on 1 December 20X3 for $450,000, incurring costs to sell of $15,000.

RS is resident in Country Y where indexation is allowable from the date of purchase to the date of sale.

The indexation factor increased by 40% in the period 1 May 20X1 to 1 December 20X3.

Capital gains are taxed at 25%.

What is the capital tax due from RS on disposal of the asset?

Which of the following is the most appropriate definition of the term 'factoring'?

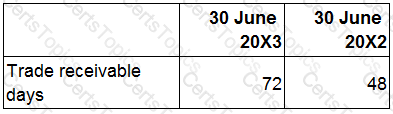

The following information relates to ABC.

Which of the following would be a reason for the movement in the trade receivable days?

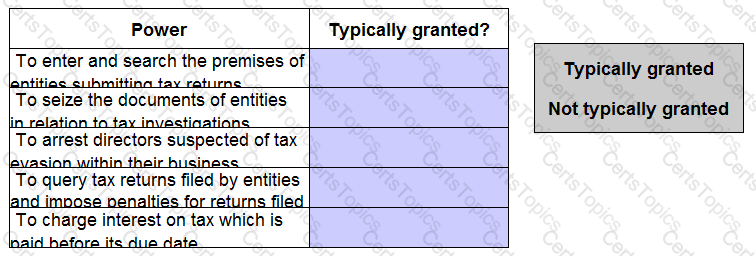

Identify which of the following are powers that a government would typically grant it's tax authority by placing the appropriate response beside each power.

Country X levies a duty on alcoholic drinks. Where the alcohol content is above 40% by volume the duty levied is $5 per 1 litre bottle.

What type of tax is this duty?

Which TWO of the following are features of a bank overdraft?

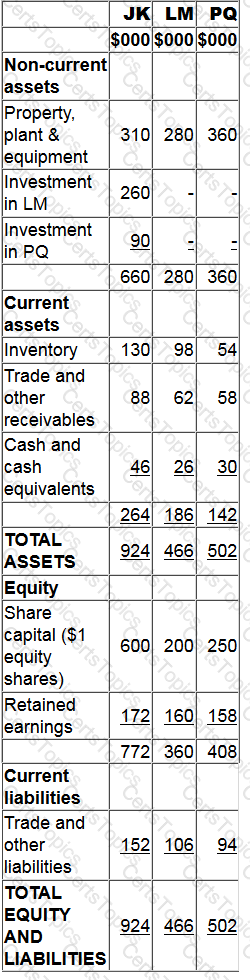

Statements of financial position as at 31 December 20X8 for JK, LM and PQ are as follows:

[1] JK purchased 80% of LM's $1 equity shares on 1 January 20X8 for $260,000 when the retained earnings of JK were $110,000. At that date the non-controlling interest had a fair value of $63,000.

[2] JK purchased 25% of PQ's $1 equity shares on 1 January 20X8 for $90,000 when the retained earnings of PQ were $96,000.

[3] During the year JK sold goods to LM for $32,000 at a mark up of 33.33% on cost. Half of the goods were still in LM's inventory at 31 December 20X8.

[4] LM transferred $32,000 to JK on 30 December 20X8 in settlement of the inter-group trade. JK did not record the cash in its financial records until 2 January 20X9.

Calculate the value of inventory that would be included in JK's consolidated statement of financial position at 31 December 20X8.

Give your answer to the nearest $.

An entity has a working capital cycle of 120 days which has been calculated in part from the following data:

What is the stock holding period on the basis of 365 days in a year?

Give your answer to the nearest whole day.

BCD owns an item of plant which cost $20,000 and at the time of purchase was assessed to have a useful economic life of 8 years and a residual value of $2,000

The carrying amount of the plant at 1 January 20X8 is $11,000. On that date BCD's directors estimate that the plant's remaining useful life is now 6 years The residual value remains unchanged at $2,000

What is the depreciation charge for this plant for the year ended 31 December 20X8?

Give your answer to the nearest $.

For an incorporated business, the taxation of trading income is a form of direct taxation which is based on:

In accordance with the Conceptual Framework for Financial Reporting, which of the following describes the historical cost measurement basis for an asset?

Which THREE of the following are included in the International Accounting Standards Board's "The Conceptual Framework for Financial Reporting"?

What does the exemption method of giving double taxation relief mean?

DE purchased an asset on 1 January 20X1 for $60,000 with a useful economic life of six years and a residual value of $3,000.

DE uses straight line depreciation for this asset.

On 31 December 20X3 the asset has a value in use of $ $28,000 and a fair value of $26,000.

Which of the following values should be used for the asset in DE's statement of financial position as at 31 December 20X3?

An entity's inventory days are 45 days.

An entity ceased to manufacture a product in 20X4. Raw materials used solely in the manufacture of that product are still held in inventory at 31 December 20X4.

Place the appropriate response below to show how inventory days will be affected if this raw material inventory is written off as obsolete.

OP holds an investment property purchased on 1 January 20X3 for $700,000 with a useful economic life of 25 years.

At 31 December 20X5 the fair value of the investment property was $750,000 with a revised useful economic life of 25 years from that date.

OP has been carrying the investment property using the cost model until 31 December 20X5.

The directors wish to change their valuation method to fair value in accordance with IAS 40 Investment Property.

Which of the following is the correct treatment of the revaluation gain and the value of the property in the statement of financial position at 31 December 20X5?

An entity opens a new factory and receives a government grant of $25,000 towards the cost of new plant and equipment. This new plant and equipment originally costs $100,000.

The entity uses the net cost method allowed by IAS 20 Accounting for Government Grants and Disclosure of Government Assistance to record government grants of this nature. All plant and equipment is depreciated at 20% a year on a straight line basis.

Calculate the amount of depreciation to be included for this plant and equipment in the statement of profit of loss for the factory's first year of operation.

Give your answer to the nearest whole $.

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

Which of the following would NOT be a source of taxation rules for a country?

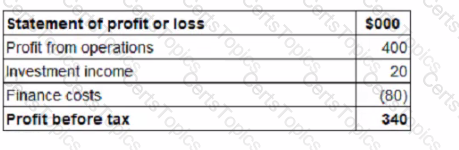

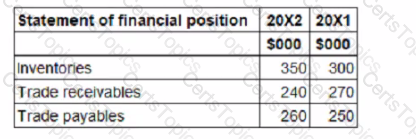

Below are extracts from LLL's financial statements for the year ended 31 December 20X2.

Depreciation of $25,000 was charged on properly, plant and equipment in the year and there were no disposals

What is the cash generated from operations for inclusion in LLL's statement of cash flows for the year ended 31 December 20X2?

On 1 January 20X2 an entity began work on constructing a factory. It purchased the land for $14 million, built the factory buildings for $11 million and installed plant and equipment for $7 million. The project was completed on 31 December 20X3 when the factory was deemed ready to use, however, the factory did not start operations until 1 June 20X4.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.

Which THREE of the following are part of the International Accounting Standards Committee (IASC) Foundation structure?

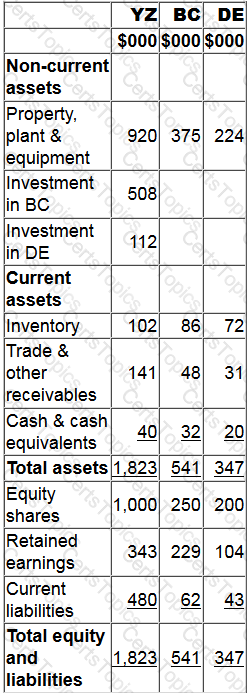

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the amount of the non-controlling interest to be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

Country A permits the following deductions in an entity's annual corporate income tax return in relation to entertaining expenses and gifts;

1 Employee entertaining up to a value of $150 a head

2 Entertaining of overseas customers.

3 Individual gifts not to exceed $10 in value

Which THREE of the following actions would be regarded as tax evasion?

Which TWO of the following are implications of employee income tax being paid to the tax authority through a Pay-As-You-Earn scheme?

An entity bought a capital item for $110,000 on 1 March 20X4 incurring legal fees at the date of purchase of $2,500.

On 1 May 20X4 additional costs classified as capital expenditure by the tax rules of the country of $25,000 were incurred in respect of the asset. On 1 June 20X4 repairs not classified as capital expenditure were incurred at a cost of $15,000.

The asset was sold for $250,000 on 30 November 20X8 and costs to sell were incurred of $4,300.

Calculate the chargeable gain on the disposal.

Give your answer to the nearest $.

Country Q has the following rules in respect of capital tax on the disposal of assets:

*Capital gains are subject to tax at 25%.

*Capital losses can only be carried forward and offset against future capital gains.

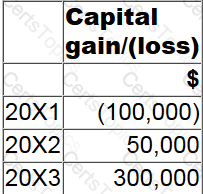

The following data relates to ABC:

How much capital tax will be payable on the capital gain recorded in 20X3?

Give your answer to the nearest $.

Which of the following would be the most immediate impact of overtrading?

In accordance with The Conceptual Framework for Financial Reporting, faithful representation is a fundamental qualitative characteristic.

To be a faithful representation financial information must be as far as possible which THREE of the following?

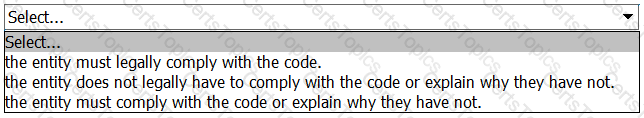

Corporate governance is the means by which an entity is operated and

BC manufactures product X and on 1 February 20X4 started a project to develop a new material for use in its production. The development project is due to be completed by 31 December 20X4 with the new material being used in production from 1 January 20X5. The development project costs have been reliably estimated at $200,000 and it is anticipated that the new material will increase the margin achieved on product X by 20%.

You are a CIMA accountant within BC and are considering how to treat the development costs of $200,000 in the financial statements for the year ended 31 December 20X4.

In accordance with the ethical principle of professional competence and due care, which of the following statements correctly explains how these costs should be accounted for?

On 1 May 20X8 DEF enters into a contract to lease plant with a fair value of $200,000. Annual lease payments of $50,000 are to be paid in advance and DEF incurred direct costs to arrange the lease of S2.000 The present value of future lease payments at 1 May 20X8 is $190,000.

What is the amount to be recognised as a right-of-use asset on 1 May 20X8?

From the list below identify the item that appears in the statement of financial position.

The United Kingdom (UK) uses a principle based approach to corporate governance which means:

EF purchased an asset on 1 September 20X4 for $800,000, exclusive of import duties of $30,000. EF is resident in country Y where indexation is allowed on purchase costs when the asset is disposed of.

EF sold the asset on 31 August 20X9 for $1,500,000 incurring transaction charges of $20,000. The indexation factor increased by 40% in the period from 1 September 20X4 to 31 August 20X9.

Capital gains are taxed at 30%.

What is the tax due on disposal of the asset?

When calculating the gam chargeable to tax on the disposal of a building, which of the following would NOT be an allowable deduction?

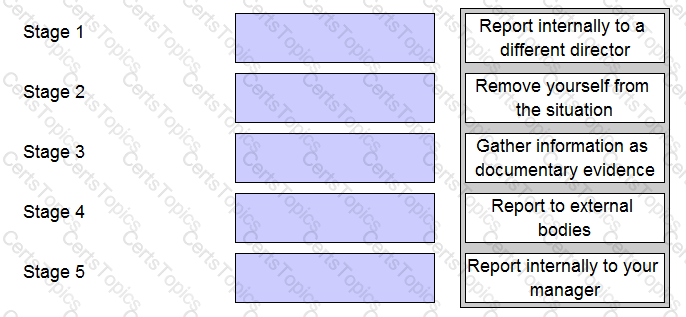

You work in the finance department of an entity. A director has approached you and asked you to falsify sales invoices which would significantly inflate revenue. The CIMA Code of Ethics suggests that you should deal with such an ethical dilemma by following a number of stages.

Place each of the stages identified below into chronological order.

The legislation in Country S provides for an indexation allowance in the calculation of capital tax. STU operates in Country S where the indexation factor for the period 1 January 20X1 to 31 December 20X6 is 20%

STU purchased a building for $64,000 on 1 January 20X1, incurring legal fees of $4,000. STU sold the building for $86,000 on 31 December 20X6 before selling fees of $3,500

What is the chargeable capital gam arising on STU's disposal of the building?

ABC uses an aggressive approach to managing its working capital. XYZ uses a conservative approach to managing its working capital.

Which of the following is ABC more at risk of compared to XYZ?

RST operates in Country X where the tax rules state entertaining costs and accounting depreciation are disallowable for tax purposes.

In year ending 31 May 20X4, XYZ made an accounting profit of $480,000.

Profit included $16,300 of entertaining costs and $15,150 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $24,200 and tax depreciation amounting to $45,200.

Calculate the tax charge for the year ended 31 May 20X4 assuming all profits are taxed at 25%.

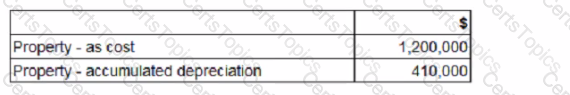

At 31 December 20X4 the directors of MNO decide to revalue its property. Before revaluation adjustments the balances relating to property are as follows:

The property has been revalued at $1,600,000.

How much will be included within MNO's statement of financial position at 31 December 20X4 for revaluation surplus?

Which of the following would NOT be a risk or impact of overtrading?

Which of the following is not a possible tax rate structure?

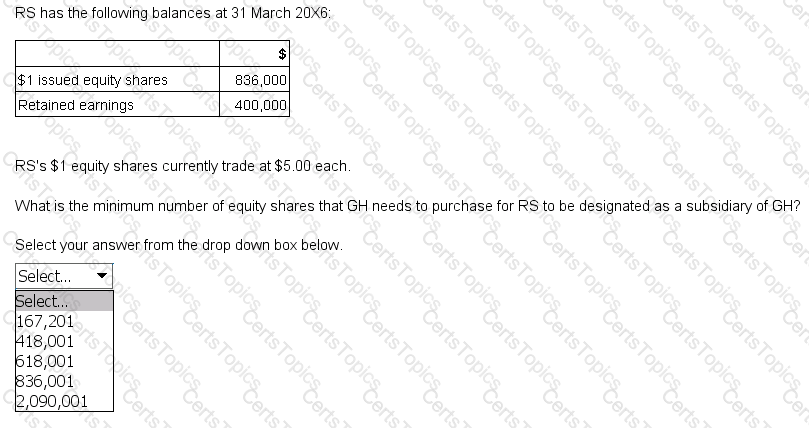

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?

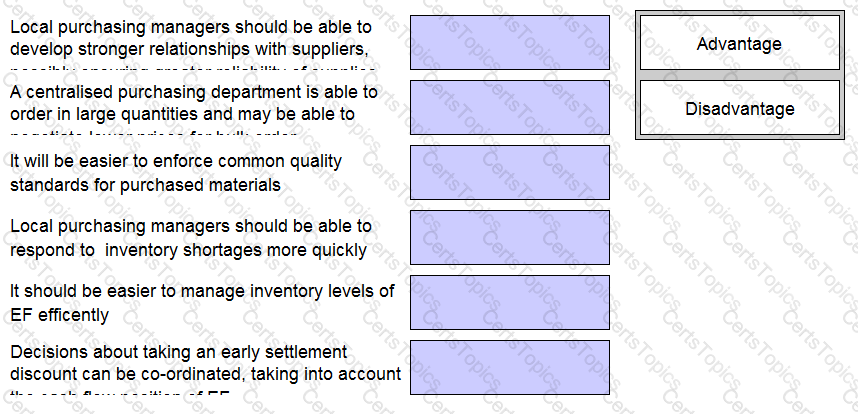

EF is a large manufacturing entity with several of its manufacturing sites in different locations. Currently all of the sites have a local procurement department. EF's board are looking to implement a centralized purchasing system.

Match the tokens according to whether you believe each statement is either an advantage or disadvantage of implementing a centralized purchasing system for EF.

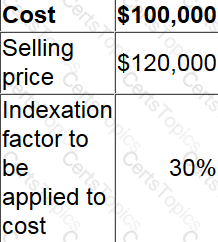

Country ZZ allows the cost of a capital asset to be adjusted for an indexation allowance which takes into consideration the effect of inflation, although the indexation allowance cannot convert a chargeable gain into a chargeable loss.

The following data relates to the sale of an asset ABC has the following working capital ratios at 31 December 20X2:

Dunng the year ended 31 December 20X4 credit purchases wefe $1,700,000 and at 31 December 20X4 the outstanding trade payables balance was $340,000

Calculate the working capital cycle for ABC.

Give your answer to the nearest whole number of days and assume there are 365 days in a year. March 20X4:

Calculate the chargeable gain or loss in respect of the sale of this asset.

Give your answer to the nearest $.

Why are excise duties an attractive method of raising tax for governments?

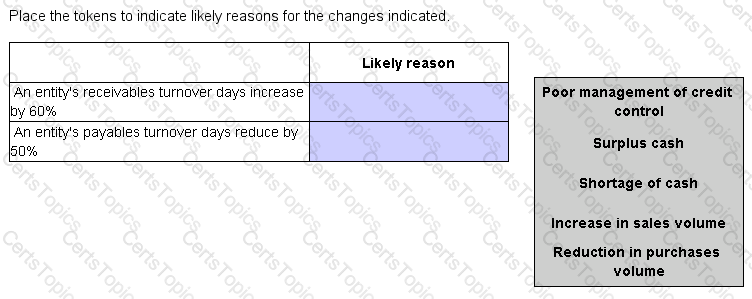

Select TWO that apply.