CIMA Related Exams

BA2 Exam

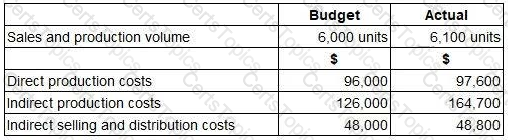

A company uses standard absorption costing. Budgeted and actual data for the latest period are as follows.

What was the production overhead absorption rate per unit?

During the first financial period of this year a company posted profit of £340,000. However, their overheads were over absorbed by £20,000 in this period. As a result they tried to update their absorption rate for the current

period and as such they ended up under absorbing their overheads by £12,000.

They have also reported a sales volume increase of 550 when comparing this period to last.

You have been given the following information on unit cost/prices:

Selling price = £95 per unit

Variable production cost per unit = £15

Variable selling cost per unit = £18

Fixed overhead per unit = £8

They have asked you to reconcile their profit between periods.

Based on the information you have been given, what is their profit for the current period?

Which THREE of the following are parts of the master budget? (Choose three.)