Section C (4 Mark)

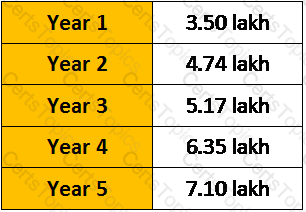

Ms. Sonali Briganza is 22 years old. She is currently earning a salary of Rs.5,00,000/- per annum and saves 20% of her salary every year. If her salary increases by 10% every year and she is able to get a return of 11% p.a. compounded annually throughout her investment horizon what would be the corpus of funds available at her age 58.

Section C (4 Mark)

Mr. Amit Jain has bought a house today which cost him Rs. 50 lacs by taking a loan of 30lacs for 15 years at 11% per annum compounded monthly. He currently has 10 lacs of financial assets and plans to save Rs. 3.25 lacs every year at the beginning of the year for the next 5 years. All his investments are expected to grow at a ROI of 15%per annum compounded quarterly. What will be the net worth of Mr. Amit after 5 years if the value of the house after 5 years is expected to be 75 lacs.

Section B (2 Mark)

Akash has only compulsory third party policy for his car. He jumped a red light and collided with another car and then with the boundary wall of a nearby house. Damage to his car was of Rs. 17,000/-, damage to other car was of Rs. 15,000/- and damage to the boundary wall of house was of Rs. 15,000. The insurance policy of Akash will pay:

Section C (4 Mark)

Mr. Vivek Kalra deposits Rs.11,00,000 today in an investment that would pay after 6 years Rs. 1,00,000 per year for 5 years and Rs. 1,50,000 for the next 5 years. What would be the balance in the account after the last payment is made if the ROI is 18% per annum compounded annually?

Section C (4 Mark)

Ms. Deepika is a famous Bollywood actress having a busy and successful professional business venture in the name of ‘Millennium Production House” with her childhood friend Navin. Initially she received few small assignments. But after a documentary film, which was welcomed by people of Mumbai, she becomes quite successful. She wants to set aside today a capital sum to be liquidated over the next 10 years for the care of her aged mother living alone in MADARUAI with her sisters. The desired income stream for her mother as per her status is Rs. 2,40,000 p.a. beginning after one year and rising 5% p.a. each year thereafter. Deepika belives that the investment earnings on the fund will be 8% p.a.

In the last 8 years, there was no looking back in the business with 22 employees and around Rs. 1.25 crore of annual income, net of all expenses. She leads a very comfortable life as a “modern successful single lady”. She has already constructed a house valuing Rs. 3.75 crore and has a portfolio of assets which include precious metals like gold, silver etc. worth Rs. 1.25 crore, direct and indirect investment in equities (mutual funds) Rs. 2.75 crores, bank deposits and small savings scheme investments Rs. 0.75 crore.

You as a CWM® has been approached by her, for advice on retirement planning. She expects to work for another 10 years and after that wants to pursue her hobbies of traveling and photography and want to be active in social work. She has expressed desire to leave half of her estate in equal proportion to her two nephews and donate other half to charitable trust “Mother Care”.

Section A (1 Mark)

The eligibility Criteria for Personal Loans Salaried Individuals for Maximum Age of Applicant at Loan Maturity in case of personal loan is:

Section A (1 Mark)

All of the following are examples of capital expenditures except:

Section A (1 Mark)

Debt ratio is

Section A (1 Mark)

A bank is considering making a loan to Jitesh Desai. Jitesh is a commissioned sales broker. Some months he earns as much as Rs 1,00,000 and in other months he earns virtually nothing. Which aspect of evaluating a consumer loan would this be concerned with?

Section A (1 Mark)

Mr.Gopal is working in a reputed company and earning Rs. 3,00,000/- p.a. and is now 48 years old. He has invested Rs. 3,00,000/- in an annuity which will pay him after 5 years a certain amount p.m. at the end of every month for 10 years. Rate of interest is 8% p.a. Calculate how much he will receive at the end of every month after 5 years?

Section A (1 Mark)

When markets are in equilibrium, the CML will be upward sloping

Section A (1 Mark)

Mr. Rajesh was the owner of an uninsured property. But unfortunately the property caught fire because of which he suffered severe financial losses. The reason Mr. Rajesh suffered losses as he did not cover:

Section C (4 Mark)

Monika has a investment portfolio of Rs. 100000, a floor of Rs. 75000, and a multiplier of 2. So the initial portfolio mix is 50000 in stocks and 50000 in bonds. If stock market falls by 20%, what should Monika do?

Section C (4 Mark)

Navin Corporation, a manufacturer of do-it-yourself hardware and housewares, reported earnings per share of Rs2.10 in 1993, on which it paid dividends per share of Rs0.69. Earnings are expected to grow 15% a year from 1994 to 1998, during which period the dividend payout ratio is expected to remain unchanged. After 1998, the earnings growth rate is expected to drop to a stable 6%, and the payout ratio is expected to increase to 65% of earnings. The firm has a beta of 1.40 currently, and it is expected to have a beta of 1.10 after 1998. The Risk Free rate is 6.25%.

What is the value of the stock, using the two-stage dividend discount model?

Section B (2 Mark)

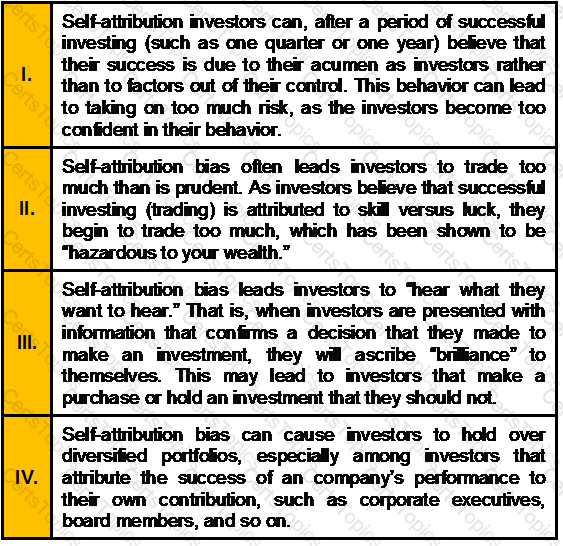

When returns to an investor’s portfolio increase, to what does he believe the change in performance is mainly due (if the investor exhibits self attribution bias)?

Section C (4 Mark)

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio’s required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D. What would be the portfolio’s required rate of return following this change?

Section A (1 Mark)

Marketing relationships are:

Section B (2 Mark)

Amount of liability of payment of gratuity is calculated at the rate of

Section A (1 Mark)

Minimum number of employees in an establishment for it to come under the purview of the Payment of Gratuity act is ______

Section B (2 Mark)

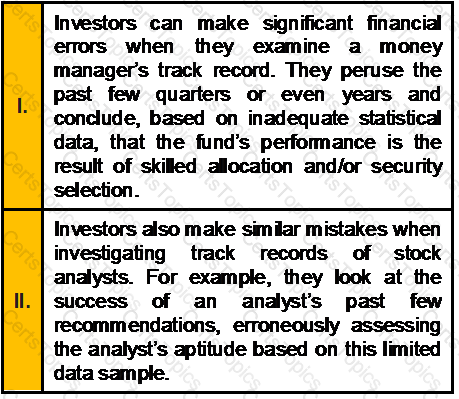

Which of the Following are the Negative Effects of Sample-Size neglect for investors

Section A (1 Mark)

Family Offices provide _____________

Section A (1 Mark)

A(n) _________________________ guarantees the swap parties a specific rate of return on their credit asset. Bank A may agree to pay the total return on the loan to Bank B plus any appreciation in the market value of the loan. In return Bank A will often get LIBOR plus a fixed spread plus any depreciation in the value of the loan.

Section B (2 Mark)

You are estimating the value of a small office building. Suppose the estimated NOI for the first year of operations is Rs100,000. a. If you expect that NOI will remain constant at Rs100,000 over the next 50 years and that the office building will have no value at the end of 50 years, what is the present value of the building assuming a 12.2% discount rate?

Section A (1 Mark)

An administrator is appointed if there is no nominated:

Section A (1 Mark)

___________CRM automates and improves customer-facing and customer supporting business processes

Section C (4 Mark)

The current dividend on an equity share of Bharat Limited is Rs.8.00 on earnings per share of Rs. 30.00. Assume that the dividend per share will grow at the rate of 20 percent per year for the next 5 years. Thereafter, the growth rate is expected to fall and stabilize at 12 percent. Investors require a return of 15 percent from Bharat’s equity shares. What is the intrinsic value of Bharat’s equity share?

Section B (2 Mark)

Total income of an individual including long-term capital gain of Rs. 50,000 is Rs. 1,10,000, the tax on total income shall be:

Section C (4 Mark)

Read the senario and answer to the question.

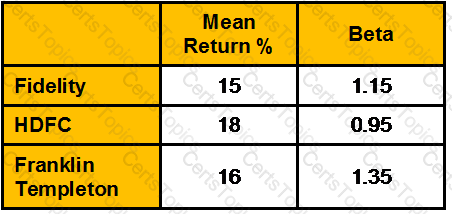

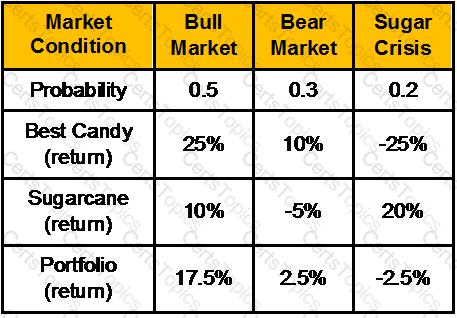

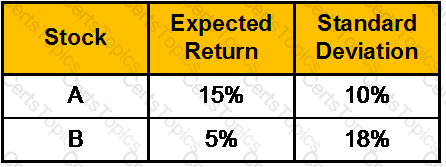

If Mahesh has the option of 3 funds whose details are as below, find Jensen’s index for fund A, Treynor index for fund B and Sharpe index for the market

Section B (2 Mark)

You purchase one ILM 70 call option for a premium of Rs6. Ignoring transaction costs, the break-even price of the position is

Section C (4 Mark)

Data on following mutual funds given below:

Risk free return is 8%. Calculate Treynor measure.

Section A (1 Mark)

The stage in venture Capital financing where the business plan is completed and presented to a venture capital firm is called________________.

Section C (4 Mark)

KB, a household product manufacturer, reported earnings per share of Rs3.20 in 1993, and paid dividends per share of Rs1.70 in that year. The firm reported depreciation of Rs315 million in 1993, and capital expenditures of Rs475 million. (There were 160 million shares outstanding, trading at Rs51 per share.) This ratio of capital expenditures to depreciation is expected to be maintained in the long term. The working capital needs are negligible. KB had debt outstanding of Rs1.6 billion, and intends to maintain its current financing mix (of debt and equity) to finance future investment needs. The firm is in steady state and earnings are expected to grow 7% a year. The stock had a beta of 1.05. (The Risk Free Rate is 6.25%.)

Estimate the value per share, using the FCFE Model.

Section A (1 Mark)

Stock broker’s human capital is _________ to stock market as compared to a school teacher

Section C (4 Mark)

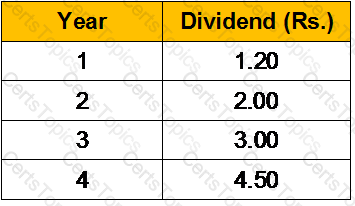

The required rate of return on an investment is 12%, you estimate that a firm X’s dividend will grow as follows:

For the subsequent years you expect the dividend to grow at the more modest rate of 7% annually. What is the maximum price that you should pay for this stock?

Section B (2 Mark)

Ramesh has invested Rs 3,000/- in Reliance Growth Fund two years ago and its worth is now 4,000/-. Ram has received dividend Rs.300 at the end of two years. Calculate Compounded annual growth rate (CAGR) of Ram’s investment.

Section A (1 Mark)

The difference between a wagering contract and insurance contract is ___________.

Section C (4 Mark)

Pinnacle India Ltd, reported a net profit of Rs1.085 billion on sales of Rs7.425 billion in 1993. The sales/book value ratio in 1993 was approximately 1.2, and the dividend payout ratio was 20%. The book value per share was Rs19 in 1993. The firm is expected to maintain high growth for ten years, after which the growth is expected to drop to 6%, and the dividend payout ratio is expected to increase to 65%. The beta of the stock is 1.05. (The treasury bill rate is 7%.)

Estimate the price/sales ratio for the company.

Section A (1 Mark)

Fiscal termites are factors that threaten the integrity of tax systems, and most of which relate to the internationalization of tax. These are:

Section A (1 Mark)

In “CAMPARI” Model, R stands for:

Section A (1 Mark)

A cognitive heuristic in which decisions are made based on how representative a given individual case appears to be independent of other information about its actual likelihood. We tend to think that trends we observe are likely to continue. Which of the following is most likely consistent with this bias?

Section A (1 Mark)

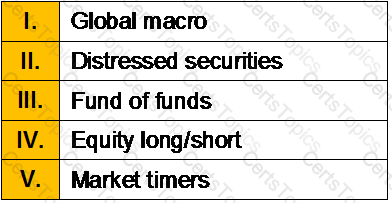

Which one of the following definitions of hedge fund strategies is not correct?

Section A (1 Mark)

In a life insurance contract, offer refers to

Section C (4 Mark)

Rate of 15% p.a compounded annually will be equal to ---------------- % per month.

Section C (4 Mark)

A rate of interest of 10% semi-annual compounded quarterly would be equal to -------------------- % per annum compounded annually.

Section A (1 Mark)

____________means that people resist inequitable outcomes; i.e., they are willing to give up some material payoff to move in the direction of more equitable outcomes.

Section C (4 Mark)

Read the senario and answer to the question.

Sajan sold 350 shares of a company at Rs. 300 each on 1st March 2010. He purchased 50 shares on 1st May 1979 for Rs. 20 each. The fair market value was Rs. 40 each as on 1st April 1981. Again on 7 August 1998, he was allotted 50 bonus shares. The fair market value was Rs. 115 each as on 7th August 1998. He purchased additional 250 shares on 1st April 2009 for Rs. 150 each. Calculate the capital gains on shares sold.

(CII – 1981-82 : 100; 1998-99 : 351; 2008-2009 ; 582; 2009-10; 632)

Section A (1 Mark)

Which of the following act is done by the most dissatisfied customers?

Section A (1 Mark)

__________ is the most important investment decision because it determines the risk-return characteristics of the portfolio.

Section B (2 Mark)

The risk-free return is 9 percent and the expected return on a market portfolio is 12 percent. If the required return on a stock is 14 percent, what is its beta?

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the income from house property for Vinay. Municipal rental value 75000, Fair Rental value is 80000, Standard rent is 1,10,000. Municipal taxes paid for full house are Rs. 10,000 during the year. Interest paid by Vinay on borrowed money during the year is Rs. 101070.

Section A (1 Mark)

If the proposer does not disclose fully all the material facts at the time of Proposal the principle violated

Section B (2 Mark)

An employee benefit plan can generally help in accomplishing all of the following items except:

Section A (1 Mark)

The trust which is empty at creation during life and tranfers the property into the trust at death is called ____________

Section B (2 Mark)

If an investor determines that next year’s earnings estimate is Rs2.00 per share and the company subsequently falters, the investor may not readjust the Rs2.00 figure enough to reflect the change because he or she is “anchored” to the Rs2.00 figure. This is not limited to downside adjustments—the same phenomenon occurs when companies have upside surprises

Which of the following Biases have been exhibited by the investor?

Section A (1 Mark)

Quicker attention and resolution of complaints lead to ________

Section B (2 Mark)

What is the future value of Rs. 5000 at the end of 5 years at 8% compounded annually?

Section A (1 Mark)

In US Over one-half the money spent by state and local governments goes to just three services. Which of the following is not one of these services?

Section A (1 Mark)

According to Prospect Theory, investors are more concerned with changes in wealth than in returns. Prospect Theory suggests that investors:

Section C (4 Mark)

OHM Corporation, an environmental service provider, had revenues of Rs209 million in 1992 and reported losses of Rs3.1 million. It had earnings before interest and taxes of Rs12.5 million in 1992, and had debt outstanding of Rs109 million (in market value terms). There are 15.9 million shares outstanding, trading at Rs11 per share. The pre-tax interest rate on debt owed by the firm is 8.5%, and the stock has a beta of 1.15. The firm's EBIT is expected to increase 10% a year from 1993 to 1996, after which the growth rate is expected to drop to 4% in the long term. Capital expenditures will be offset by depreciation, and working capital needs are negligible. (The corporate tax rate is 40%, and the Risk free rate is 7%.)

Estimate the value of the firm.

Section A (1 Mark)

An aggressive asset allocation would contain larger proportions of __________ than a conservative allocation.

Section A (1 Mark)

Mr. X’s minor daughter earned Rs. 50000 from his special talent. This income will be clubbed with

Section B (2 Mark)

A typical personal accident policy would normally have provisions to pay

Section A (1 Mark)

Which of the following statements about Real Estate Investment Trusts is/are true?

Section A (1 Mark)

The subscription paid into PPF account enjoys the tax benefit under

Section A (1 Mark)

___________ is a measure of the ratio between the net income produced by an assets (usually real estate) and its capital cost.

Section C (4 Mark)

Read the senario and answer to the question.

Keshav purchased a Health Insurance. The policy has a calendar-year deductible of Rs. 500 and 80:20 as coinsurance. Keshav was hospitalized with a covered illness on January 23rd 2009. This hospitalization was his first claim under the said policy for the calendar year. His covered medical expenses were Rs. 20,500. How much of this amount will the insurer pay and how much will Keshav be required to pay to the Hospital?

Section B (2 Mark)

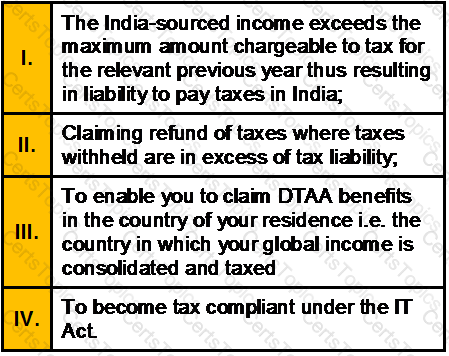

You may need to file your Returns in India under the following circumstances:

Section A (1 Mark)

A covered call position is equivalent to a

Section B (2 Mark)

If an investor strongly believes that the stock market is going to have a sharp decline shortly, he or she could maximize profit by

Section C (4 Mark)

Read the senario and answer to the question.

Calculate income from House property for Mr. Keshav for assessment year 2010-11.

Section A (1 Mark)

Which of the following is an element of an organization’s internal-environment?

Section A (1 Mark)

A put option on a stock is said to be out of the money if

Section A (1 Mark)

“Early accumulation” life stage is normally during ______

Section B (2 Mark)

Mr. Jain is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6 months and Rs. 800 for 2 months thereafter. EACH CASH FLOW starts from the beginning of the month. Please calculate the Present Value of this cash stream if rate of interest is 9 % per annum compounded monthly?

Section A (1 Mark)

A market timing approach that increases the proportion of funds in stocks when the stock market is expected to be rising, and increases cash when the stock market is expected to be falling is a:

Section B (2 Mark)

An approved superannuation fund must have a minimum of _______ trustees

Section A (1 Mark)

When the sponsored entities creates CMOs they often use different _____________ which each promise a different coupon rate and which have different maturity and risk characteristics.

Section A (1 Mark)

A good wealth management plan must include an analysis of all of the following EXCEPT

Section A (1 Mark)

_____________ is the transfer of the balance of an existing home loan that you availed at a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a lower rate of interest.

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Saxena is planning to visit USA for the very first time in his carrier to promote software of his company and is expected to stay long. He wants to plan his journey in such a manner so that he can get maximum tax benefits in the FY 2007–08 from the residential status point of view. What is the latest date when he can afford to leave India & earn status of an NRI to get maximum tax benefits in assessment year 2008–09?

Section C (4 Mark)

Read the senario and answer to the question.

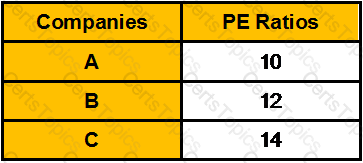

Mrs. Deepika’s brother is impressed with Manav Fashion Ltd. an online clothing firm that focuses on the 18–22 age bracket. Their prices are much lower than their competitors, and the quality is high. Reading about the firm on its web site and in various financial newspapers, her brother has learned that the company plans to expand its clothing lines. The prevailing price of its share is 70 per share. Manav Fashion Ltd. has had recent annual earnings of Rs. 5 per share. Only three other companies have very similar business to Manav Fashion Ltd. and have stock that is traded and there PE ratios are as follows:

Her brother asked Mrs. Deepika to guide him in investing the Manav Fashion Ltd. Getting the query from her brother Mrs. Deepika asks your advice on this matter. As a Chartered Wealth Manager what will be your advice?

Section B (2 Mark)

Manav invests Rs. 500/- every 6 months towards a fund to pay for his children education. If the investment pays ROI @ 9 % per annum, compounded Semi Annually, then what will be the corpus after 10 years ?

Section B (2 Mark)

The Motor Vehicle Insurance Policy has inbuilt cover for death/disability of driver/owner caused by accident during the use of the insured motor vehicle up to Rs. __________ in case of car/commercial vehicle and Rs. _________ in case of two wheelers.

Section C (4 Mark)

J&M had a return on equity of 31.5% in 1993, and paid out 37% of its earnings as dividends. The stock had a beta of 1.25. (The treasury bill rate is 6%.) The extraordinary growth is expected to last for ten years, after which the growth rate is expected to drop to 6% and the return on equity to 15% (the beta will move to 1).

Assuming the return on equity and dividend payout ratio continue at current levels for the high growth period, estimate the P/BV ratio for J&M.

Section C (4 Mark)

Suppose Nifty is at 4500 in May. An investor, Mr. A, executes a Long Strangle by buying a Rs. 4300 Nifty Put for a premium of Rs. 23 and a Rs 4700 Nifty Call for Rs 43.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 4232

• If Nifty closes at 5241

Section B (2 Mark)

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-.As a CWM® calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

Section B (2 Mark)

All of the following are assumptions made by technical analysts except:

Section B (2 Mark)

Which one of the following statements is/are correct?

Section A (1 Mark)

If a certain stock has a beta greater than 1.0, it means that

Section C (4 Mark)

Mr. A bought XYZ Ltd. For Rs. 3850 and simultaneously sells a call option at an strike price of Rs. 4000. Which means Mr. A does not think that the price of XYZ Ltd. will rise above Rs. 4000. However, incase it rises above Rs. 4000, Mr. A does not mind getting exercised at that price and exiting the stock at Rs. 4000 (Target Sell Price = 3.90% return on the stock purchase price). Mr. A receives a premium of Rs. 80 for selling the call. Thus net outflow to Mr. A is (Rs. 3850 – Rs. 80) = Rs. 3770. He reduces the cost of buying the stock by this strategy.

What would be the Net Payoff of the Strategy?

• If XYZ closes at 3350

• If XYZ closes at 4800

Section B (2 Mark)

A project should be considered if the Profitability Index is

Section B (2 Mark)

In a wealth management Platform which of the following is/are the functions of Middle/Back Office – Advisor

Section C (4 Mark)

Read the senario and answer to the question.

Sajan and Jennifer want to accumulate funds for their vacation expenses as per their determined goal. They want to invest a fixed amount immediately from the Bonus amount he has received, and then in the beginning of every financial year till April, 2020 in a separate scheme of an Equity Mutual Fund. He would withdraw the required amount annually as adjusted for inflation from the Scheme from April, 2021 till April, 2036 for undertaking vacation trips. What approximate amount should be invested every year to achieve this goal?

Section A (1 Mark)

Mortgage loans:

Section B (2 Mark)

Non-Resident (NR) is __________on Indian Income and ___________on Foreign Income.

Section A (1 Mark)

In “Teenage Years” life stage, one learns about ___________

Section B (2 Mark)

In order to determine the residential status of an NRI returning to India for permanent settlement, for the year of return, besides the stay not exceeding 181 days an additional condition is applicable that of stay not totalling to____________ days or more in relevant year if his stay in earlier ___________ years totaled to 365 days or more.

Section C (4 Mark)

A stock ABC Ltd. is trading at Rs. 450. Mr. XYZ is bullish on the stock. But does not want to invest Rs. 450. He does a Long Combo. He sells a Put option with a strike price Rs. 400 at a premium of Rs. 1.00 and buys a Call Option with a strike price of Rs. 500 at a premium of Rs. 2.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 625

• If ABC Ltd closes at 328

Section A (1 Mark)

__________ is a tangible company asset that can (and should) be inventoried and managed.

Section B (2 Mark)

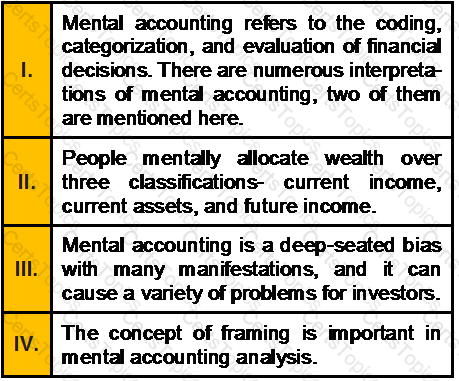

Which of the following statements is/are correct with respect to Mental Accounting?

Section A (1 Mark)

Hedge funds often seek to take advantage of market inefficiencies such as:

Section A (1 Mark)

Ideally, clients would like to invest with the portfolio manager who has

Section B (2 Mark)

Which of the following is/are the Potential Challenges for wealth management players in India?

Section C (4 Mark)

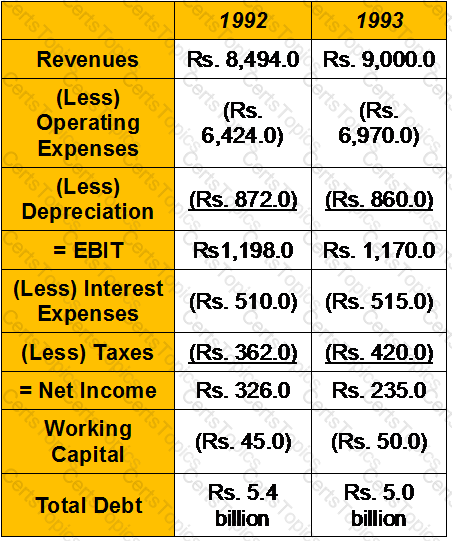

OMG Petro Ltd produces and markets crude oil. The following are selected numbers from the financial statements for 1992 and 1993 (in millions).

The firm had capital expenditures of Rs950 million in 1992 and Rs1 billion in 1993. The working capital in 1991 was Rs190 million, and the total debt outstanding in 1991 was Rs5.75 billion. There were 305 million shares outstanding, trading at Rs21 per share.

Estimate the cash flows to equity in 1992 and 1993(in Rs Millions)

Section B (2 Mark)

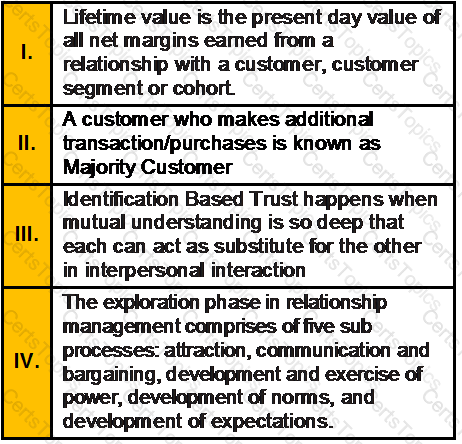

Which of the following statements is/are correct?

Section B (2 Mark)

Payback period is

Section A (1 Mark)

Which of the following might be used as a factor in an APT factor model?

Section A (1 Mark)

During “Teen age years” life stage, typical asset allocation should be

Section C (4 Mark)

Read the senario and answer to the question.

During identification of new business opportunities, one of Harish’s friends Shekhar has offered him a business proposal. In this proposal a partnership firm consisting of two partners, Harish and Shekhar, shall take the franchise of a company which is a reputed brand in the field of pathology lab in which their investment and profit sharing ratio shall be equal.

Franchise rights shall be valid for 5 years and the project requires an upfront investment of Rs. 25 lakh for required infrastructure. The franchisee agreement has an option that the company can take over the franchisee after 5 years by charging depreciation @15% p.a. on straight line basis.

The projected profits from the firm are as follows:

Harish wants to know what IRR he will earn on his investment from this project ? (Please ignore taxes and assuming no additional investment is made during this five year period)

Section A (1 Mark)

In the start-up stage of the industry life cycle

Section C (4 Mark)

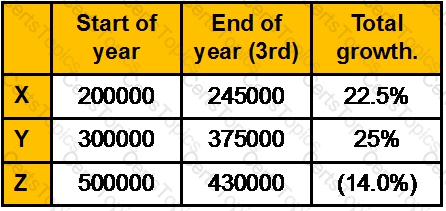

You own 3 scripts with their market value at

Calculate the CAGR of portfolio.

Section A (1 Mark)

Limited growth prospects are indicated by

Section B (2 Mark)

A fixed-rate mortgage for Rs210 000 with monthly payments is amortized over 20 years. The interest rate is 4.85% compounded semi-annually for a 7-year term. How much of the mortgage principal has been repaid by the end of the 7-year term?

Section A (1 Mark)

The most profitable credit card customers for a bank are those that:

Section A (1 Mark)

Which of the following is true regarding the resistance level?

Section A (1 Mark)

____________ may be responsible for the prevalence of active versus passive investments management.

Section B (2 Mark)

Suppose the price of a share of CAS stock is Rs500. An April call option on CAS stock has a premium of Rs5 and an exercise price of Rs500. Ignoring commissions, the holder of the call option will earn a profit if the price of the share

Section A (1 Mark)

The principle in real estate valuation which acknowledges limitation on growth in market value, not ably in the case of improvements is known as:

Section C (4 Mark)

Which of the following statements are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Which one of the following statements most accurately describes the risk exposure of the Shankers’ portfolio?

Section B (2 Mark)

Matrix Ltd has a current ratio of 1.6, and a quick ratio equal to 1.2. The company has Rs 20,00,000 in sales and its current liabilities are Rs 10, 00,000. What is the company’s inventory turnover ratio?

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $ 83560 in SGD and he is a Singapore citizen

• £ 73150p.a (only employment) and he is a UK citizen

Section B (2 Mark)

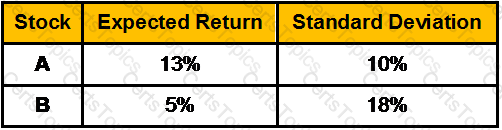

The expected returns and standard deviations of stock A and B are:

Manish buys Rs.20000 stock A and sells short Rs.10000 of stock B, using all the proceeds to buy more of stock A. The correlation between the two securities is 0.25. What are the expected return and the standard deviation of Manish’s portfolio?

Section C (4 Mark)

Mr. XYZ is bearish about Nifty and expects it to fall. He sells a Call option with a strike price of Rs. 2600 at a premium of Rs. 154, when the current Nifty is at 2694. If the Nifty stays at 2600 or below, the Call option will not be exercised by the buyer of the Call and Mr. XYZ can retain the entire premium of Rs.154.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2900

• If Nifty closes at 2400

Section B (2 Mark)

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

Section B (2 Mark)

Property A provides an annual income of Rs. 160,000 and a similar property B has sold based on 8 % capitalization rates. Calculate the value at which property A can be priced.

Section B (2 Mark)

Consider a one-year maturity call option and a one-year put option on the same stock, both with striking price Rs45. If the risk-free rate is 4%, the stock price is Rs48, and the put sells for Rs1.50, what should be the price of the call?

Section A (1 Mark)

For any given stock, which of the following must be true?

Section A (1 Mark)

Garima deposits Rs. 2,000/- every month in an account and is getting interest @ 12 % per annum compounded monthly. How much will be her nest egg after 10 years ?

Section B (2 Mark)

As per Article 11 double Taxation Avoidance Agreement with US Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State.However, such interest may also be taxed in the Contracting State in which it arises, and according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed:

(a) ____per cent of the gross amount of the interest if such interest is paid on a loan granted by a bank carrying on a bona fide banking business or by a similar financial institution (including an insurance company); and

(b) _____ per cent of the gross amount of the interest in all other cases.

Section C (4 Mark)

Suppose Nifty is at 4450 on 27th April. An investor, Mr. A enters a long straddle by buying a May Rs 4500 Nifty Put for Rs. 85 and a May Rs. 4500 Nifty Call for Rs. 122.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3729

• If Nifty closes at 5214

Section B (2 Mark)

Total income for assessment year 2007-08 of an individual including long-term capital gain of Rs. 60,000 is Rs. 1,40,000. The tax on total income shall be:

Section B (2 Mark)

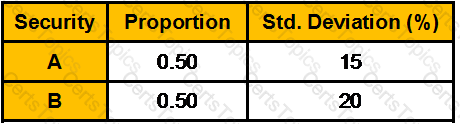

You are required to calculate standard deviation of the following portfolio

CovAB = 220.

Section A (1 Mark)

Following is not a head of income

Section C (4 Mark)

Read the senario and answer to the question.

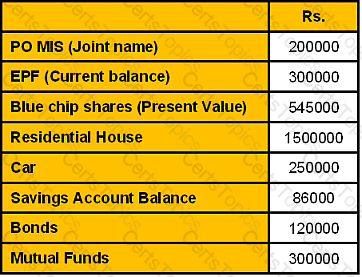

Calculate the Net Worth of Mr. Adhikari as on 31/03/2009.

Section A (1 Mark)

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

Section A (1 Mark)

Loans to individuals and families to finance the purchase of new homes are known as:

Section B (2 Mark)

In the calculation of rates of return on common stock, dividends are _______ and capital gains are _____.

Section B (2 Mark)

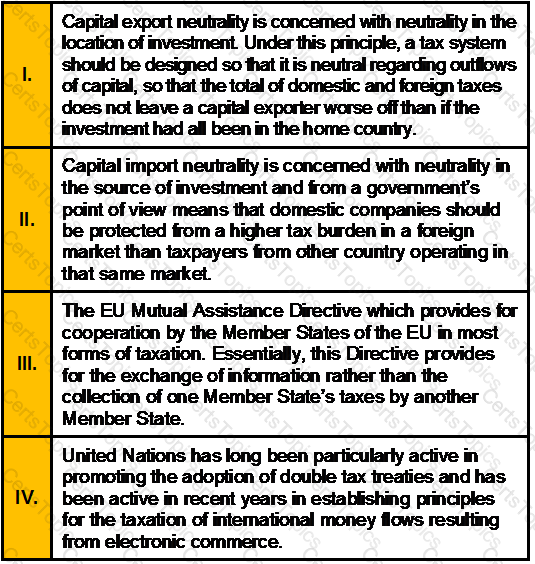

Which of the following statements with respect to International Taxation Structure is/are correct?

Section B (2 Mark)

PPF is a

Section C (4 Mark)

Mr. XYZ buys a Nifty Call with a Strike price Rs. 4100 at a premium of Rs. 170.45 and he sells a Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

What would be the Net Payoff of the Strategy?

• if Nifty closes at 4200

• if Nifty closes at 5447

Section A (1 Mark)

----------- shifts the weights of securities in the portfolio to take advantage of areas that are expected to do relatively better than other areas.

Section B (2 Mark)

IFB Stock currently sells for Rs38. A one-year call option with strike price of Rs45 sells for Rs9, and the risk free interest rate is 4%. What is the price of a one-year put with strike price of Rs45?

Section A (1 Mark)

Which of the following is not a characteristic of defined benefit plan?

Section A (1 Mark)

Which of following is not an exclusion under a health policy?

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Technical Fees in UK is charged at:

Section A (1 Mark)

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that can be used to assess how effectively the firm is managing its assets in consideration of current and projected operating levels.

Section B (2 Mark)

Which one of the following statements is/are correct?

Section A (1 Mark)

A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 on one of the factors and a beta of 0 on any other factor.

Section C (4 Mark)

Today is 14th February 2008 Mr. Mehta is 29 years old and is salaried. His wife, Nisha is a housewife. He has started depositing Rs. 5,000 at the beginning of each year in an education fund for his new born child.

He is earning a monthly income of Rs. 53000. His expenses are Rs. 27000 p.m. He takes the help of a wealth manager to plan his investments. He has taken housing loan and outstanding amount is Rs. 1000000 and outstanding amount on car loan is Rs. 300000.He is paying an EMI of Rs. 9547 on housing loan and an EMI of Rs. 2600 on car loan at the end of each year.

His other investments are as follows:

Mr. Mehta has joined the services after completing his education five years back. But during the previous year he works for 230 days.

Assumptions

Section A (1 Mark)

A dividend paid by a company which is a resident of India to a resident of the United Kingdom may also be taxed in India but the Indian tax so charged shall not exceed __________per cent of the gross amount of the dividend.

Section A (1 Mark)

The Base Year for BSE Realty index is____________

Section A (1 Mark)

The covariance of the market returns with the stocks returns is 0.007. The standard deviation of the market is 7% and standard deviation of stock’s return is 10%. What is the correlation coefficient between stocks and market returns?

Section A (1 Mark)

Which of the following is an advantage of a credit scoring model?

Section A (1 Mark)

Teena Dutta wants to buy a used car and wants a loan that she will pay off over the next three years with monthly payments. What type of loan does Teena want?

Section B (2 Mark)

Which one of the above statements is/are incorrect?

Section A (1 Mark)

A(n)_______________ is a credit-rating agency that keeps records of borrowers' loan payment histories.

Section B (2 Mark)

A Family consists of karta, his wife four sons and their wires and children and its income is Rs. 1000000 if by family arrangement income yield property is settled on karta his wife and sons & daughter in law than tax liability would be

Section A (1 Mark)

An agreement entered into between the owner of the vacate land and the builder/ developer is known ____________.

Section A (1 Mark)

An arbitrage opportunity exists if an investor can construct a __________ investment portfolio that will yield a sure profit.

Section A (1 Mark)

Notice of loss should be given to the insurer within ________days of the event of loss.

Section C (4 Mark)

Which of the following statements is/are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Assuming his son gets average marks in class 10th when he was just 15 years old, his father decided to send him abroad for further studies at age 21.calculate the amount that Mr. Mehta requires to invest in excess of the amount accumulated in previous question during next six years to accumulate a fund of Rs. 500000?

Section B (2 Mark)

What are the two strategies that have the broadest mandate across financial, commodity, and futures markets?

Section A (1 Mark)

For calculating the benefit under Entertainment allowance, Salary means,

Section A (1 Mark)

Investments that are difficult to convert to cash are said to have _________

Section A (1 Mark)

You buy a investment plan by investing Rs. 6000/- per month for first 12years and Rs. 11000/- per month for next 12 years. If the rate of interest is 15% per annum compounded monthly . How much amount would you have after 24 years?

Section C (4 Mark)

Read the senario and answer to the question.

Assume the following additional facts:

The Shankers have purchased a homeowner’s policy (comprehensive) covering 100% of the replacement cost of their residence. This policy has a Rs. 500 deductible. Also, they have purchased a disability income policy with a 30-day elimination period and an any-occupation definition of disability.

What actions should the Shankers consider in order to improve the quality of the insurance program described above?

Section C (4 Mark)

Read the senario and answer to the question.

For the purpose of World Tour Nimita has an option to use her investments in PPF A/c. She would contribute maximum permissible amount on the 1st working day of April every year till its due maturity as well as in all years of the extension of account for a 5-year term after its due maturity. She wants to use half of the PPF account proceeds for the proposed world tour. You estimate the adequacy of such amount, the same is _____________.

Section B (2 Mark)

You borrowed Rs8500, with the understanding that you are to make monthly payments over 36 months. Interest is charged at 7% compounded monthly. If you were to increase your payments by Rs20 per month, how much less time would it take you to pay back the loan?

Section B (2 Mark)

Which of the following statements with respect to US Taxation Structure is/are correct?

Section B (2 Mark)

An employee joined in the year 2000 in a sugar mill. After working all the years as a seasonal employee up to the year 2011. He retires with the following monthly salary

How much gratuity is payable to him?

Section B (2 Mark)

Under the Payment of Gratuity Act, 1972, where the employee employed in a seasonal establishment is deemed to be in continuous service for such period if he actually worked for not less than __________% of the number of days on which the such establishment was in operation during such period.

Section A (1 Mark)

Which among the following is not an advantage of setting up a trust?

Section B (2 Mark)

After making an investment, assume that an investor overhears a news report that has negative implications regarding the potential outcome of the investment he has just executed. How likely is he to then seek information, if he exhibits self attribution bias, that could confirm that you’ve made a bad decision?

Section B (2 Mark)

For calculation of liability of payment of gratuity to an employee on leaving service, the wage to be taken into account is

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhaitia will continue to invest Rs. 10,000 in his PPF a/c at the beginning of each year till his retirement. Then calculate how much he has to save extra at the end of per month in a scheme to achieve his retirement corpus with a yield of 10%?

Section B (2 Mark)

If the commodity’s futures price declines

Section C (4 Mark)

The expected return and standard deviations of stock A & B are:

Amit buys Rs.20,000 of Stock A and sells short Rs.10,000 of Stock B using all the Proceeds to buy more or Stock A. The correlation Between the two securities is .35. What are the expected return & standard deviation of Amit’s portfolio?

Section C (4 Mark)

Read the senario and answer to the question.

Jogen commuted his 40% of pension in April, 2008 with Rs. 2,15,000.What would be the taxable amount on commuted pension received by Jogen, if he would retire from a private organization?

Section B (2 Mark)

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be

Section C (4 Mark)

Nifty is at 3200. Mr. XYZ expects large volatility in the Nifty irrespective of which direction the movement is, upwards or downwards. Mr. XYZ buys 2 ATM Nifty Call Options with a strike price of Rs. 3200 at a premium of Rs. 97.90 each, sells 1 ITM Nifty Call Option with a strike price of Rs. 3100 at a premium of Rs. 141.55 and sells 1 OTM Nifty Call Option with a strike price of Rs. 3300 at a premium of Rs. 64.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2929

• If Nifty closes at 4325

Section A (1 Mark)

A bank is considering making a loan to Sandeep Hunjan. Sandeep owns his own home and has lived there for the past four years. What aspect of evaluating a consumer loan application is this fact most concerned with?

Section B (2 Mark)

Money kept in current account normally earns

Section A (1 Mark)

__________ organization try to segment their customers based on what product the customer purchased.

Section B (2 Mark)

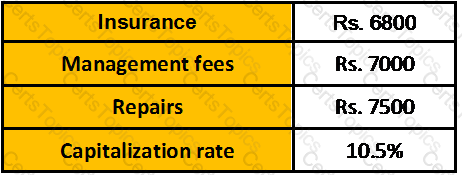

Mahesh wants to sell a property for Rs. 30 lakhs. He is earning rent from tenant Rs. 3,60,000. He is spending following amounts annually on that property.

Based on the above information what should be the value of the property would be:

Section A (1 Mark)

You buy a investment plan by investing Rs. 5000/- per month for first 12years what is the maximum amount you can withdraw from this account for 12 years every month if you want to have Rs. 500000 at the end of 24 years .The rate of interest is 15% per annum compounded monthly.

Section A (1 Mark)

Which one of the following statements is false?