Section C (4 Mark)

Read the senario and answer to the question.

During identification of new business opportunities, one of Harish’s friends Shekhar has offered him a business proposal. In this proposal a partnership firm consisting of two partners, Harish and Shekhar, shall take the franchise of a company which is a reputed brand in the field of pathology lab in which their investment and profit sharing ratio shall be equal.

Franchise rights shall be valid for 5 years and the project requires an upfront investment of Rs. 25 lakh for required infrastructure. The franchisee agreement has an option that the company can take over the franchisee after 5 years by charging depreciation @15% p.a. on straight line basis.

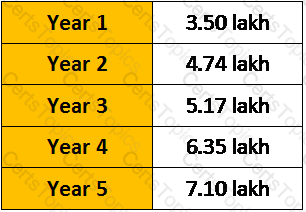

The projected profits from the firm are as follows:

Harish wants to know what IRR he will earn on his investment from this project ? (Please ignore taxes and assuming no additional investment is made during this five year period)

Section A (1 Mark)

In the start-up stage of the industry life cycle

Section C (4 Mark)

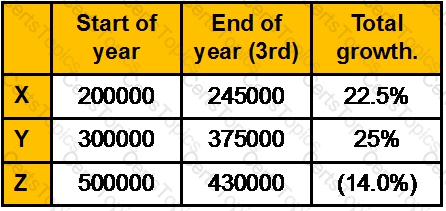

You own 3 scripts with their market value at

Calculate the CAGR of portfolio.

Section A (1 Mark)

Limited growth prospects are indicated by