Section C (4 Mark)

Read the senario and answer to the question.

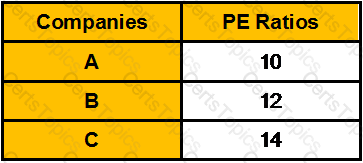

Mrs. Deepika’s brother is impressed with Manav Fashion Ltd. an online clothing firm that focuses on the 18–22 age bracket. Their prices are much lower than their competitors, and the quality is high. Reading about the firm on its web site and in various financial newspapers, her brother has learned that the company plans to expand its clothing lines. The prevailing price of its share is 70 per share. Manav Fashion Ltd. has had recent annual earnings of Rs. 5 per share. Only three other companies have very similar business to Manav Fashion Ltd. and have stock that is traded and there PE ratios are as follows:

Her brother asked Mrs. Deepika to guide him in investing the Manav Fashion Ltd. Getting the query from her brother Mrs. Deepika asks your advice on this matter. As a Chartered Wealth Manager what will be your advice?

Section B (2 Mark)

Manav invests Rs. 500/- every 6 months towards a fund to pay for his children education. If the investment pays ROI @ 9 % per annum, compounded Semi Annually, then what will be the corpus after 10 years ?

Section B (2 Mark)

The Motor Vehicle Insurance Policy has inbuilt cover for death/disability of driver/owner caused by accident during the use of the insured motor vehicle up to Rs. __________ in case of car/commercial vehicle and Rs. _________ in case of two wheelers.

Section C (4 Mark)

J&M had a return on equity of 31.5% in 1993, and paid out 37% of its earnings as dividends. The stock had a beta of 1.25. (The treasury bill rate is 6%.) The extraordinary growth is expected to last for ten years, after which the growth rate is expected to drop to 6% and the return on equity to 15% (the beta will move to 1).

Assuming the return on equity and dividend payout ratio continue at current levels for the high growth period, estimate the P/BV ratio for J&M.