Section A (1 Mark)

Hedge funds often seek to take advantage of market inefficiencies such as:

Section A (1 Mark)

Ideally, clients would like to invest with the portfolio manager who has

Section B (2 Mark)

Which of the following is/are the Potential Challenges for wealth management players in India?

Section C (4 Mark)

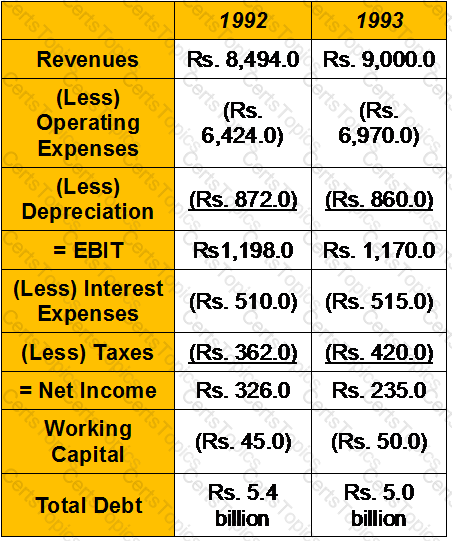

OMG Petro Ltd produces and markets crude oil. The following are selected numbers from the financial statements for 1992 and 1993 (in millions).

The firm had capital expenditures of Rs950 million in 1992 and Rs1 billion in 1993. The working capital in 1991 was Rs190 million, and the total debt outstanding in 1991 was Rs5.75 billion. There were 305 million shares outstanding, trading at Rs21 per share.

Estimate the cash flows to equity in 1992 and 1993(in Rs Millions)