Section B (2 Mark)

Suppose the price of a share of CAS stock is Rs500. An April call option on CAS stock has a premium of Rs5 and an exercise price of Rs500. Ignoring commissions, the holder of the call option will earn a profit if the price of the share

Section A (1 Mark)

The principle in real estate valuation which acknowledges limitation on growth in market value, not ably in the case of improvements is known as:

Section C (4 Mark)

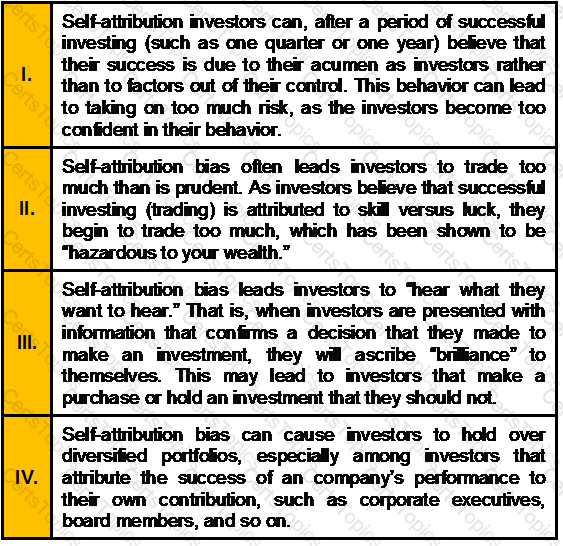

Which of the following statements are correct?

Section C (4 Mark)

Read the senario and answer to the question.

Which one of the following statements most accurately describes the risk exposure of the Shankers’ portfolio?