AAFM Related Exams

CWM_LEVEL_2 Exam

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Saxena is planning to visit USA for the very first time in his carrier to promote software of his company and is expected to stay long. He wants to plan his journey in such a manner so that he can get maximum tax benefits in the FY 2007–08 from the residential status point of view. What is the latest date when he can afford to leave India & earn status of an NRI to get maximum tax benefits in assessment year 2008–09?

Section C (4 Mark)

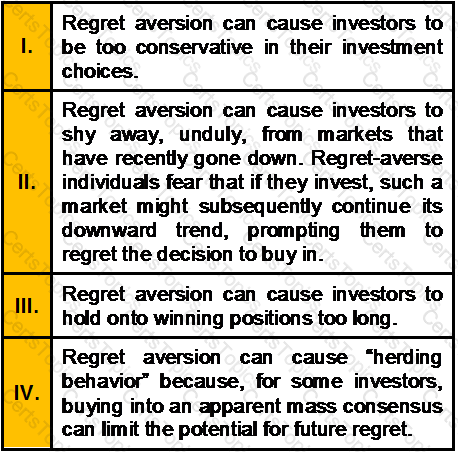

Which of the following statements is/are correct?

Section B (2 Mark)

Mr. Jain is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6 months and Rs. 800 for 2 months thereafter. EACH CASH FLOW starts from the beginning of the month. Please calculate the Present Value of this cash stream if rate of interest is 9 % per annum compounded monthly?