Section B (2 Mark)

Matrix Ltd has a current ratio of 1.6, and a quick ratio equal to 1.2. The company has Rs 20,00,000 in sales and its current liabilities are Rs 10, 00,000. What is the company’s inventory turnover ratio?

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $ 83560 in SGD and he is a Singapore citizen

• £ 73150p.a (only employment) and he is a UK citizen

Section B (2 Mark)

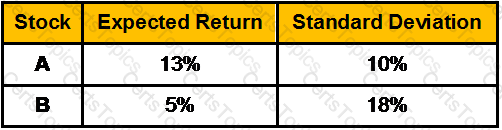

The expected returns and standard deviations of stock A and B are:

Manish buys Rs.20000 stock A and sells short Rs.10000 of stock B, using all the proceeds to buy more of stock A. The correlation between the two securities is 0.25. What are the expected return and the standard deviation of Manish’s portfolio?

Section C (4 Mark)

Mr. XYZ is bearish about Nifty and expects it to fall. He sells a Call option with a strike price of Rs. 2600 at a premium of Rs. 154, when the current Nifty is at 2694. If the Nifty stays at 2600 or below, the Call option will not be exercised by the buyer of the Call and Mr. XYZ can retain the entire premium of Rs.154.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2900

• If Nifty closes at 2400