Which of the following would NOT be a source of taxation rules for a country?

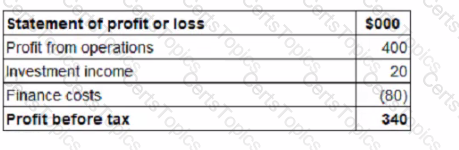

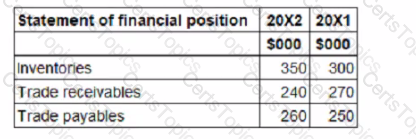

Below are extracts from LLL's financial statements for the year ended 31 December 20X2.

Depreciation of $25,000 was charged on properly, plant and equipment in the year and there were no disposals

What is the cash generated from operations for inclusion in LLL's statement of cash flows for the year ended 31 December 20X2?

On 1 January 20X2 an entity began work on constructing a factory. It purchased the land for $14 million, built the factory buildings for $11 million and installed plant and equipment for $7 million. The project was completed on 31 December 20X3 when the factory was deemed ready to use, however, the factory did not start operations until 1 June 20X4.

To fund the project the entity borrowed $25 million on 1 January 20X2, with interest at 10% per year.

The loan was repaid in full on 31 December 20X4.

Calculate the total amount to be added to the cost of property, plant and equipment in respect of the above development.

Give your answer to the nearest $ million.

Which THREE of the following are part of the International Accounting Standards Committee (IASC) Foundation structure?