KL has S90.000 of plant and machinery which was acquired on 1 June 20X4. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for 560,000 on 1 June 20X6

Calculate the tax balancing allowance or charge on disposal tor the year ended 31 May 20X7 and state the effect on the taxable profit.

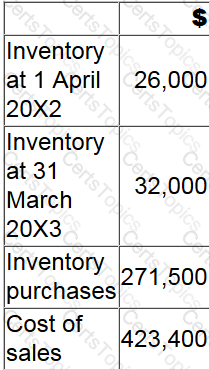

The following data has been extracted from GH's accounting records:

What is GH's average inventory days for the year ended 31 March 20X3?

While conducting their audit, auditor 0 did not encounter issues which significantly limited the scope of their audit, however they did run into problems in that they disagreed with the management on facts in the

statements.

These disagreements were somewhat material, but they did not affect the auditor's overall opinion of the business. Which of the following statements should auditor 0 issue?

Which of the following is a characteristic of a defined contribution post-employment benefit scheme?