EF purchased an asset on 1 September 20X4 for $800,000, exclusive of import duties of $30,000. EF is resident in country Y where indexation is allowed on purchase costs when the asset is disposed of.

EF sold the asset on 31 August 20X9 for $1,500,000 incurring transaction charges of $20,000. The indexation factor increased by 40% in the period from 1 September 20X4 to 31 August 20X9.

Capital gains are taxed at 30%.

What is the tax due on disposal of the asset?

When calculating the gam chargeable to tax on the disposal of a building, which of the following would NOT be an allowable deduction?

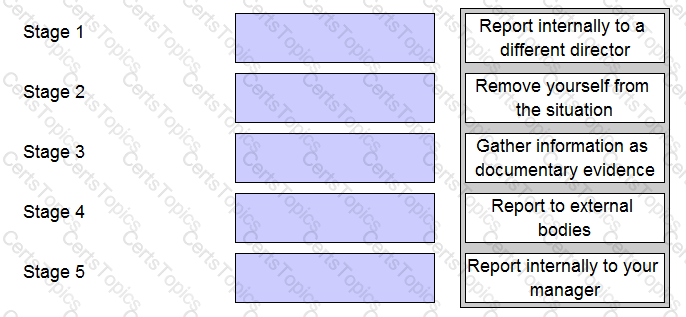

You work in the finance department of an entity. A director has approached you and asked you to falsify sales invoices which would significantly inflate revenue. The CIMA Code of Ethics suggests that you should deal with such an ethical dilemma by following a number of stages.

Place each of the stages identified below into chronological order.

The legislation in Country S provides for an indexation allowance in the calculation of capital tax. STU operates in Country S where the indexation factor for the period 1 January 20X1 to 31 December 20X6 is 20%

STU purchased a building for $64,000 on 1 January 20X1, incurring legal fees of $4,000. STU sold the building for $86,000 on 31 December 20X6 before selling fees of $3,500

What is the chargeable capital gam arising on STU's disposal of the building?