Country X levies corporate income tax at a rate of 25% and charges income tax on all profits irrespective of whether they are distributed by way of dividend. Country Y levies corporate income tax at a rate of 20%.

A, who is resident in Country X, pays a divided to B, who is resident in Country Y. B is required to pay corporate income tax on the dividend received from A, but a deduction can be made for the tax suffered on this dividend restricted to a rate of 20%.

Which method of relief for foreign tax does this describe?

AB sells to ST, a group entity, 10,000 units at $2.50 each. The market value was $6 each.

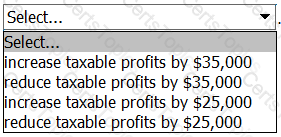

The effect on AB of the transfer pricing legislation on this transaction would be to: .

Which THREE of the following statements about government grants are INCORRECT?

Entity T operates within several countries, but its country of residence is Country F. In 20X5, Entity T made $8.4 million in Country M. Country M has a flat rate corporation tax of 5.9%.

Country F and Country M operate a double taxation treaty which uses a foreign tax credit system. In Country F, there is a tax of 10% tax on all foreign income.

Taking into account the credit, what is the total tax liability that Entity T owes on its Country M income, in Country F?