Which of the following is not a possible tax rate structure?

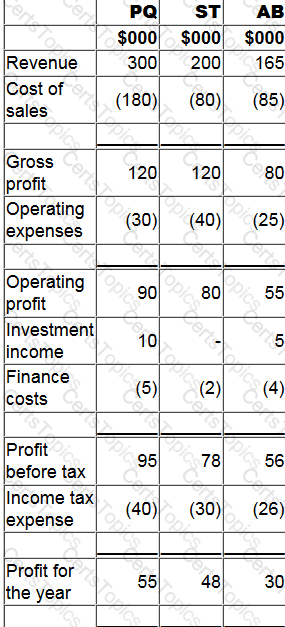

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?

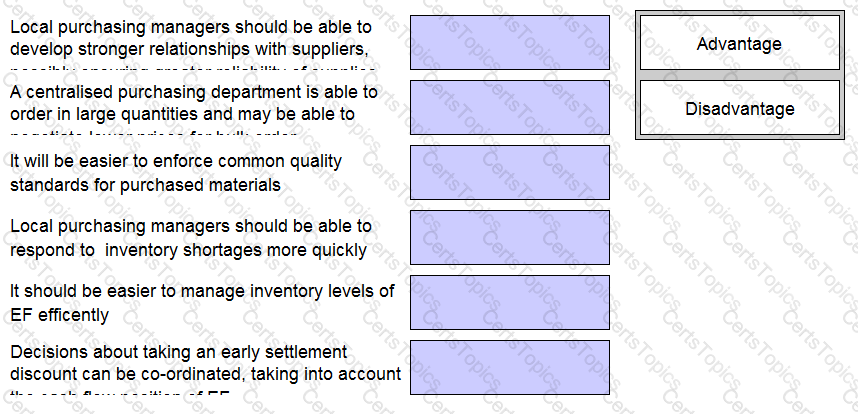

EF is a large manufacturing entity with several of its manufacturing sites in different locations. Currently all of the sites have a local procurement department. EF's board are looking to implement a centralized purchasing system.

Match the tokens according to whether you believe each statement is either an advantage or disadvantage of implementing a centralized purchasing system for EF.