CIMA Related Exams

P2 Exam

Which of the following statements is correct in respect of the key feature of dual pricing?

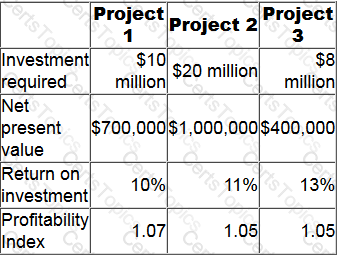

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

SkillWeave Industries are focused on managing the risk of selling their cars to the region due to economic turmoil, and have now begun using funds from sales in the region to fund supplier purchases from that region to

reduce the risk from the volatile currency. However, SkillWeave want to go a step further and make the risk even less sizeable.

Which of the following is a method by which SkillWeave can operate in the market and transfer the risk of exchange rate exposure to another party?