CIMA Related Exams

P2 Exam

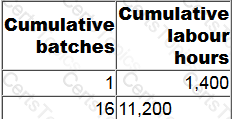

A company has just completed the production of the first 16 batches of a product. A learning curve has been observed throughout. The following table gives further details.

To the nearest whole percentage, what rate of learning is implied?

Which of the following statements is correct in respect of the key feature of dual pricing?