An investment centre manager is considering the purchase of a new machine. If purchased, the new machine would replace an existing one that is used to manufacture one of the investment centre's existing products.

The new machine would incur $800 per month additional running costs; this includes $300 per month of additional depreciation.

The new machine would save on direct labor time. This means that the fixed production overhead absorbed by the product on the basis of direct labor hours would reduce by $100 per month.

What is the total cost of the above that is relevant to the decision to purchase the machine?

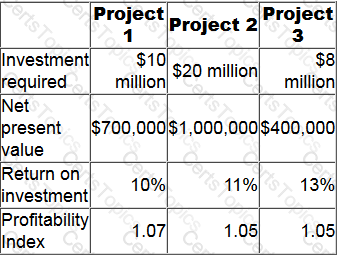

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

The money cost of capital is 12%. The expected rate of inflation is 4%. What is the real cost of capital?

Give your answer to 2 decimal places.

Which of the following correctly defines the expected value of a project?

An organization wants to increase the use value that customers place on one of its products - a laptop computer.

Which of the following actions, taken to increase the value to the customer, would increase the product's use value?

Select ALL that apply.

Which of the following statements is correct in respect of the key feature of dual pricing?

In order to support decision making, management accounting information categorizes costs in a variety of ways.

Responsibility accounting primarily distinguishes between costs on the basis that they are either:

A company has invested $500,000 in developing a new product and requires a return of 12% on this investment.

The company has researched the market and has set the selling price for the new product at $300 per unit. At this price, sales volume for next year is forecast to be 500 units. The forecast unit cost is $210.

What is the target cost gap per unit for the coming year?

Give your answer to the nearest whole $.

Which TWO of the following statements are correct?

Endure Co. makes 1,000 units ofX and 2,000 units of Y.

Costs for X: Material $4, labour $8, direct overhead $2, fixed cost $4.

Costs for Y: Material $9, labour $9, direct overhead $4, fixed cost $6.

Selling price for X and Y are S19 and $25 respectively. Another company can sell ready made product X and product Y's to Endure Co, this company sells X at $12 and Y at $21. Advise Endure Co. on what would be the

most cost effective way to source products X and Y.

Which TWO of the following are examples of management information made possible by the availability of big data?

K Supermarket spends $80,000 per year on checking and processing receipts of inventory. Annual warehouse costs are a further $70,000 per year. These costs are currently treated as fixed overheads in the company's costing system.

As an experiment, the company is preparing a direct profitability analysis of a small range of products, including fresh grapes.

K Supermarket receives a total of 3,600 deliveries every year. 20% of these deliveries are of perishable goods such as grapes. It takes twice as long to process a delivery of perishable goods compared to a normal delivery because perishable goods have to be checked more carefully.

Half of the warehouse costs are for the chilled store that is used to store perishable goods. At any time, the chilled store has 800 kilos of perishable goods in stock.

K Supermarket receives 150 deliveries of grapes every year. Each delivery is for 100 kilos of grapes. The grapes spend an average of two days in the chilled store before they are sold.

Calculate the total cost per kilo of checking, processing and storing grapes that should be taken into account in determining the profitability of grapes.

Give your answer to the nearest whole cent.

SQ has the opportunity to invest in project X. The net present value for project X is $12,600. Cash inflows occur in years 1, 2 and 3. The company's cost of capital is 14%.

Calculate the annualized equivalent annuity of project X.

Give your answer to the nearest whole $.

.

In order to remain competitive an organization wishes to achieve cost savings for one of its existing products.

Which of the following correctly describes methods which the organization can use to achieve these cost savings?

Select ALL that apply.

Which TWO of the following expressions are correct?

LL produces an item, the Z, for which the demand curve is estimated to be:

P = 10 - 0.0001Q

where, P is the unit price in $ and Q is the annual sales volume in units;

Marginal revenue (MR) = 10 - 0.0002Q

The variable cost of producing the Z is $2 per unit. The annual fixed costs of production are $110,000.

What is the profit maximizing output level?

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?

Which of the following statements about learning curves is correct?

IOP's product is manufactured using a production process that is known to have a defect rate of 10%.

IOP's quality control department has developed a test that has a 98% probability of classifying a non-defective item correctly and a 2% probability of classifying a non-defective item as defective.

The same test has a 95% probability of classifying a defective item correctly and a 5% probability of classifying a defective item as non-defective.

Calculate the proportion of IOP's output that will be classified as non-defective by the quality control department's test.

Give your answer to one decimal place.

A very large organization is financed by both debt and equity. It evaluates all projects on the basis of their net present value (NPV) using an organization wide weighted average cost of capital as the discount rate.

For a small project, which TWO of the following would affect the project's cash flows AND the discount rate?

An organization is comprised of two divisions. One of the divisions manufactures a product that it sells both to an imperfect external market and to the other division.

The organization wishes to establish the most suitable basis for the transfer price for this product and is considering either a negotiated transfer price or a market-based transfer price.

Which of the following statements is correct?

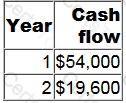

A project requires an initial investment of $50,000. It will generate positive cash flows for two years as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

Company TTM has the opportunity to invest $60,000 in a project. The project is anticipated to produce annual returns of $12,500 each year for 8 years. The cost of capital is 12%.

What is the net present value of the project? Give your answer to the nearest whole number.

A company operates a divisional structure. The manager of division D receives a bonus based on the division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be 19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?

A long established organization has recognised the need to make urgent changes to the way it operates in order to remain competitive. The organization wishes to dramatically improve its performance through a fundamental rethinking and radical redesign of its existing activities.

Which of the following techniques should be used to achieve this?

SkillWeave Industries are focused on managing the risk of selling their cars to the region due to economic turmoil, and have now begun using funds from sales in the region to fund supplier purchases from that region to

reduce the risk from the volatile currency. However, SkillWeave want to go a step further and make the risk even less sizeable.

Which of the following is a method by which SkillWeave can operate in the market and transfer the risk of exchange rate exposure to another party?

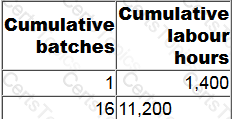

A company has just completed the production of the first 16 batches of a product. A learning curve has been observed throughout. The following table gives further details.

To the nearest whole percentage, what rate of learning is implied?

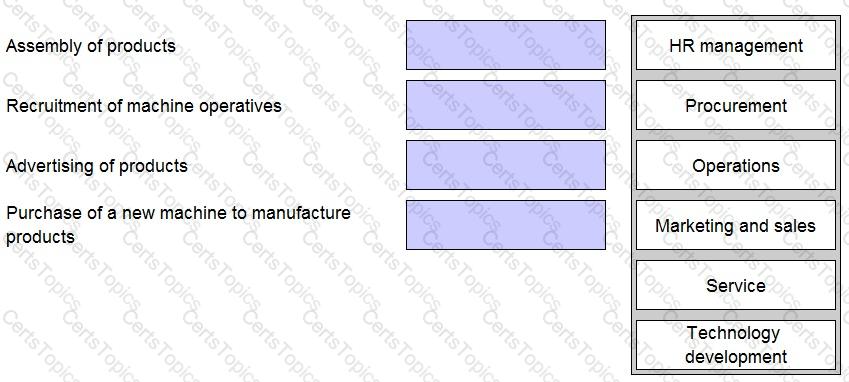

Using Porter's value chain, place the tokens to correctly categories the following activities of a manufacturing company.

A company has just received the latest in a series of annual payments; this payment was $620. The annual payments are expected to continue for three more years with each payment being increased by the expected rate of inflation. The real cost of capital is 8% per year and the expected rate of inflation is 6% per year.

What is the present value of the future payments the company expects to receive?

Give your answer to the nearest $.

Which of the following is a correct description of the key features of net present value?