CIMA Related Exams

F2 Exam

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of 5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

MNO has calculated its return on capital employed ratio for 20X4 and 20X5 as 41% and 56% respectively.

Taking each statement in isolation, which would explain the movement in the ratio between the 2 years?

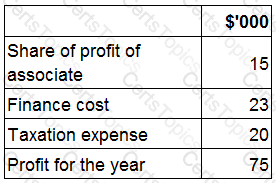

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?