Pegasystems Related Exams

PEGAPCDC85V1 Exam

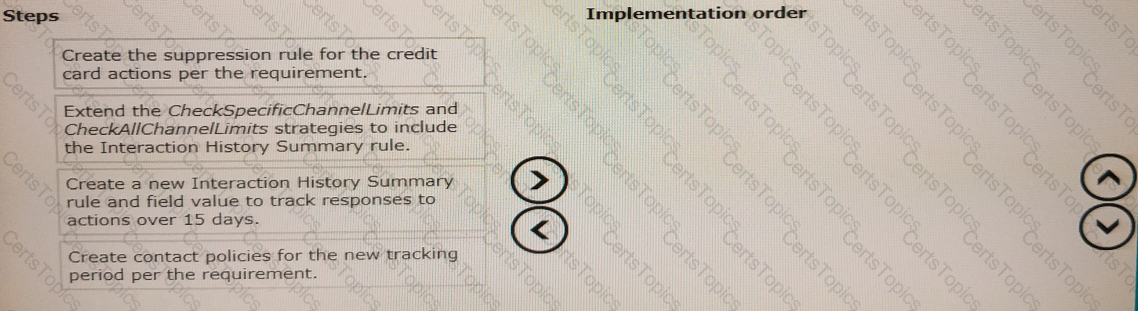

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days.

Put the steps in the correct order to implement this task.

You are the decisioning consultant on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

Myco, a telecom company, uses Pega Customer Decision Hub™ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a decisioning consultant, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?