Question

What should the auditors consider for judgement-based sampling?

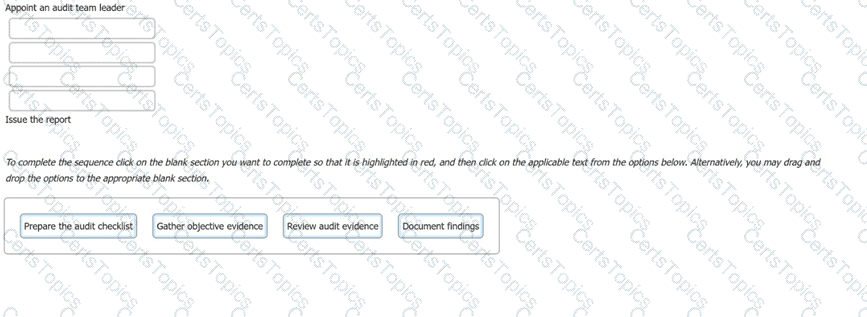

The following options are key actions involved in a first-party audit. Order the stages to show the sequence in which the actions should take place.

Scenario 1

Fintive is a distinguished security provider specializing in online payments and protection solutions. Founded in 1999 by Thomas Fin in San Jose, California, Fintive offers services to companies operating online that seek to improve their information security, prevent fraud, and protect user information such as personally identifiable information (PII).

Fintive bases its decision-making and operational processes on previous cases, gathering customer data, classifying them according to the case, and analyzing them.

Initially, Fintive required a large number of employees to be able to conduct such complex analyses. However, as technology advanced, the company recognized an opportunity to implement a modern tool — a chatbot — to achieve pattern analyses aimed at preventing fraud in real time. This tool would also assist in improving customer service.

The initial idea was communicated to the software development team, who supported the initiative and were assigned to work on the project. They began integrating the chatbot into the existing system and set an objective regarding the chatbot, which was to answer 85% of all chat queries.

After successfully integrating the chatbot, the company released it for customer use. However, the chatbot exhibited several issues. Due to insufficient testing and a lack of sample data provided during the training phase — when it was supposed to learn the query patterns — the chatbot failed to effectively address user queries. Additionally, it sent random files to users when it encountered invalid inputs, such as unusual patterns of dots and special characters.

Consequently, the chatbot could not effectively answer customer queries, overwhelming traditional customer support and preventing them from assisting customers with their requests.

Recognizing the potential risks, Fintive decided to implement a set of new controls. The measures included enabling comprehensive audit logging, configuring automated alert systems to flag unusual activities, performing periodic access reviews, and monitoring system behavior for anomalies. The objective was to identify unauthorized access, errors, or suspicious activities in a timely manner, ensuring that any potential issues could be quickly recognized and investigated before causing significant harm.

Question

Based on the scenario above, to ensure the protection of information privacy, Fintive decided to implement security controls. Is this acceptable?

Scenario 4: SendPay is a financial company that provides its services through a network of agents and financial institutions. One of their main services is transferring money worldwide. SendPay, as a new company, seeks to offer top quality services to its clients. Since the company offers international transactions, it requires from their clients to provide personal information, such as their identity, the reason for the transactions, and other details that might be needed to complete the transaction. Therefore, SendPay has implemented security measures to protect their clients' information, including detecting, investigating, and responding to any information security threats that may emerge. Their commitment to offering secure services was also reflected during the ISMS implementation where the company invested a lot of time and resources.

Last year, SendPay unveiled their digital platform that allows money transactions through electronic devices, such as smartphones or laptops, without requiring an additional fee. Through this platform, SendPay's clients can send and receive money from anywhere and at any time. The digital platform helped SendPay to simplify the company's operations and further expand its business. At the time, SendPay was outsourcing its software operations, hence the project was completed by the software development team of the outsourced company. The same team was also responsible for maintaining the technology infrastructure of SendPay.

Recently, the company applied for ISO/IEC 27001 certification after having an ISMS in place for almost a year. They contracted a certification body that fit their criteria. Soon after, the certification body appointed a team of four auditors to audit SendPay's ISMS.

During the audit, among others, the following situations were observed:

1.The outsourced software company had terminated the contract with SendPay without prior notice. As a result, SendPay was unable to immediately bring the services back in-house and its operations were disrupted for five days. The auditors requested from SendPay's representatives to provide evidence that they have a plan to follow in cases of contract terminations. The representatives did not provide any documentary evidence but during an interview, they told the auditors that the top management of SendPay had identified two other software development companies that could provide services immediately if similar situations happen again.

2.There was no evidence available regarding the monitoring of the activities that were outsourced to the software development company. Once again, the representatives of SendPay told the auditors that they regularly communicate with the software development company and that they are appropriately informed for any possible change that might occur.

3.There was no nonconformity found during the firewall testing. The auditors tested the firewall configuration in order to determine the level of security provided by

these services. They used a packet analyzer to test the firewall policies which enabled them to check the packets sent or received in real-time.

Based on this scenario, answer the following question:

Based on scenario 4, the auditors requested documentary evidence regarding the monitoring process of outsourced operations. What does this indicate?