You are carrying out an audit to ISO 9001 at an organisation which offers regulatory consultancy services to manufacturers of cosmetics.

You are interviewing the Technical Director (TD), who manages a team of regulatory experts responsible for providing regulatory services to customers.

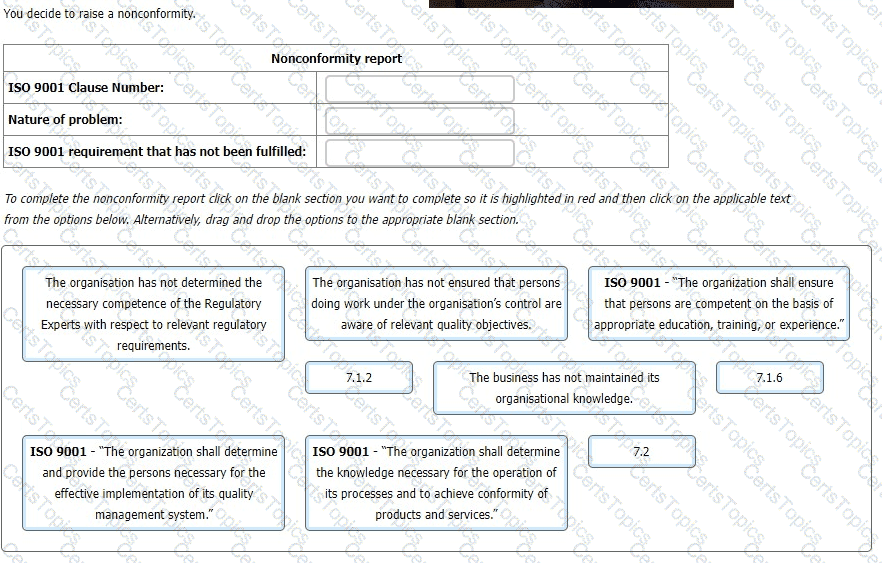

You: "How do you ensure your regulatory team's competence concerning regulatory requirements is maintained?"

TD: "The two Regulatory Experts we employ full-time have years of experience of working in the cosmetics industry."

You: "How is their regulatory competence maintained?"

TD: "They are dedicated individuals with lots of contacts in the sector."

You: "How does the business enable them to maintain their understanding of current regulatory requirements?"

TD: "We leave that up to them."

XYZ Corporation employs 100 people, and during a Stage 1 certification audit, certain issues are identified with the Quality Management System (QMS). Which two options describe the circumstances in which you could raise a nonconformity against Clause 6.2 of ISO 9001:2015?

Scenario 1: AL-TAX is a company located in California which provides financial and accounting services. The company manages the finances of 17 companies and now is seeking to expand their business even more The CEO of AL-TAX, Liam Durham, claims that the company seeks to provide top-notch services to their clients Recently, there were a number of new companies interested in the services provided by AL-TAX.

In order to fulfill the requirements of new clients and further improve quality, Liam discussed with other top management members the idea of implementing a quality management system (QMS) based on ISO 9001. During the discussion, one of the members of the top management claimed that the size of the company was not large enough to implement a QMS. In addition, another member claimed that a QMS is not applicable for the industry in which AL TAX operates. However, as the majority of the members voted for implementing the QMS. Liam initiated the project.

Initially, Liam hired an experienced consultant to help AL-TAX with the implementation of the QMS. They started by planning and developing processes and methods for the establishment of a QMS based on ISO 9001. Furthermore, they ensured that the quality policy is appropriate to the purpose and context of AL TAX and communicated to all employees. In addition, they also tried to follow a process that enables the company to ensure that its processes are adequately resourced and managed, and that improvement opportunities are determined.

During the implementation process, Liam and the consultant focused on determining the factors that could hinder their processes from achieving the planned results and implemented some preventive actions in order to avoid potential nonconformities Six months after the implementation of the QMS. AL-TAX conducted an internal audit. The results of the internal audit revealed that the QMS was not fulfilling all requirements of ISO 9001. A serious issue was that the QMS was not fulfilling the requirements of clause 5.1.2 Customer focus and had also not ensured clear and open communication channels with suppliers.

Throughout the next three years, the company worked on improving its QMS through the PDCA cycle in the respective areas. To assess the effectiveness of the intended actions while causing minimal disruptions, they tested changes that need to be made on a smaller scale. After taking necessary actions, AL-TAX decided to apply for certification against ISO 9001.

Based on the scenario above, answer the following question:

Scenario 1 indicates that AL-TAX did not ensure clear and open communication channels with interested parties. Which quality management principle did the organization not follow in this case?

A small cleaning services organisation is about to start work on a hospital cleaning contract for the local Health Trust. You,

as auditor, are conducting a Stage 2 audit to ISO 9001 and review the contract with the Service Manager. The contract

requires that a cleaning plan is produced.

You: "How was the cleaning plan for the contract developed?"

Service Manager: "We have a basic template that covers the materials, labour requirements and cleaning methods to be

employed. Some of that is specified by the customer."

You: "How does the plan deal with locations like the intensive care wards and the operating theatres, which are included

in the contract?"

Service Manager: "The basic plan covers general wards, but we will do more frequent cleaning in those areas if the

hospital requests it."

You: "Are you aware of the regulatory requirements for cleaning standards in hospitals?"

Service Manager: "No. We depend on the hospital to look after that side of things in the contract."

You decide to raise a non-conformity against section 8.2.2.a.1 of ISO 9001.

You decide to raise another non-conformity against section 8.2.4 of ISO 9001 when finding that the

cleaning plan was amended without the agreement of the Health Trust. A different cleaning chemical was

substituted to that specified in the contract. At the follow-up audit, the corrective action proposed was to

"obtain a concession from the Health Trust for use of the new chemical."

Which one of the following options is the reason why you did not accept this action taken?