Rhona has a daughter Zena five years old. She wants to plan for Zena’s education and has found out that she would be requiring 2,75,000 at her age 18 and another 4,50,000 on her age 25. She also wants to have Rs. 10,00,000 for Zena’s Marriage which she expects at the age of 28. She wants to deposit the entire amount for these expenses today in an account that pays a ROI of 15% per annum compounded annually. What would this amount be?

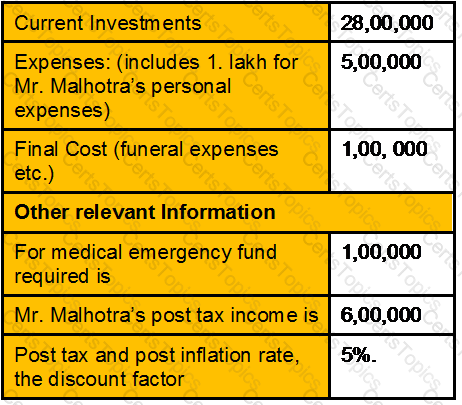

Mr. Malhotra and Mrs.Malhotra aged 50 and 45 years respectively, both have a life expectancy of 35 years.

You have following information

Calculate the adequate insurance required based on need based approach.

Mr. Ravi aged 28 years is a marketing professional who earns a salary of Rs. 50000 p.m. He is very concerned about his retirement expenses. For the same he has started saving Rs. 6000 p.m. regularly in a bank fixed deposit paying an interest of 9.5% p.a. since the age of 23.

At the age of 38, he is thinking of buying a house on his retirement which is 25 years away.

He has estimated that the price of the house at his retirement will be Rs. 4000000. Calculate the amount of retirement corpus accumulated by him and the extra savings he has to make at the age of 38 in order to purchase the house? (Inflation rate = 3% p.a.)

Mr. Sachdeva is working as a regional head in a Pharmaceutical Company in New Delhi. He has a annual income of Rs. 10,00,000. His current expenses are Rs. 5,00,000 and he will be retiring in next ten years . The inflation rate for the foreseeable future is expected to be 5%. He assumes that his post retirement expenses will be 70% of his last year expenses of his service and they will increase at inflation rate and paid at the beginning of each year.

On his retirement he plans to leave his current rented apartment and shift into a another apartment located in NCR . The current price of the bungalow is Rs. 24 lakh which is estimated to increase in line with inflation rate. A ten year government security paper fetches 10% interest rate, which will remain constant for the forthcoming period. He is in good health and expects to live for twenty years after retirement.

As a CWM you are required to calculate the amount Mr. Sachdeva needs to save at the end of ten years on an annual basis so that he can pay his post retirement expenses as well as to buy the apartment.