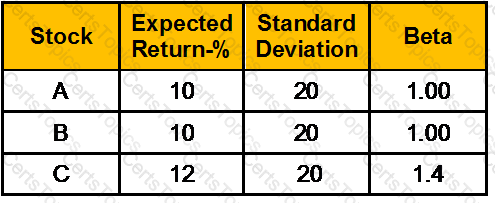

Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

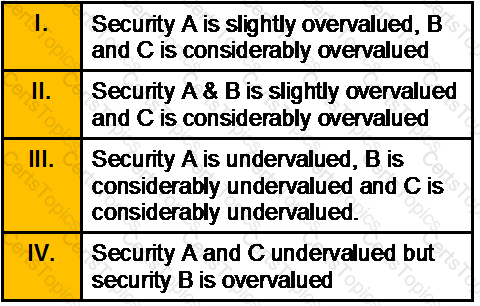

Which of the following statements is/are correct?

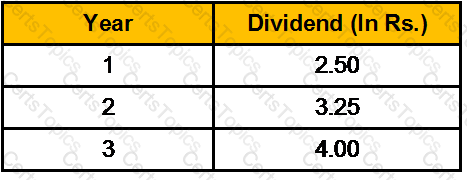

The management of Pearls India Shopping Ltd has recently announced that expected dividends for the next three years will be as follows:

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Samantha celebrated her 21st birthday today, her father gave her Rs. 6,25,000/- which is deposited in a account that pays a ROI of 12.25% p.a. compounded monthly. If she wants to withdraw Rs. 7,50,000 on her 31st. Birthday and balance on her 41stBirthday. How much can she withdraw on her 41st. birthday.?

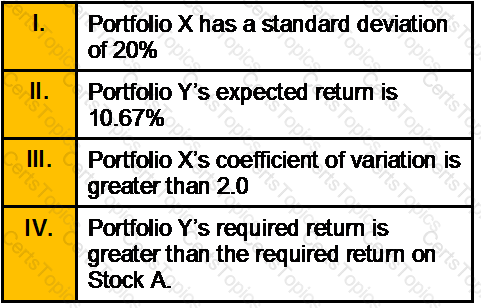

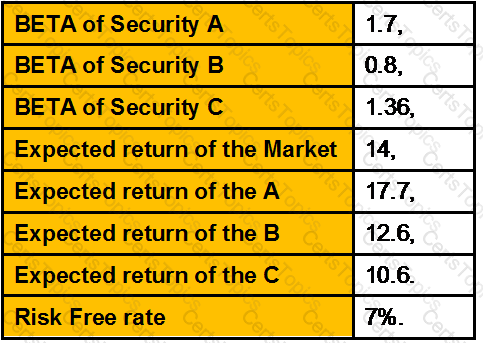

Consider the following information:

Which of the following statements is/are true?