Which of the following taxes are allowed as deduction while computing the business income?

Calculate premium payable for term insurance policy of Rs. 10 lacs, for a group of 278 people of 39 years of age. The Mortality Table shows that in this age group 2,681 people die every year in a group of 12,50,000.

Girish is 25 years old and plans to retire at 60. His life expectancy is 75 years. Mr. Binoy his CWM® estimates that his client will require Rs. 45,000 in the first month after retirement. Inflation rate is 5% p.a. and the rate of return is 7% p.a. How much she should save every year in order to achieve her post retirement needs?

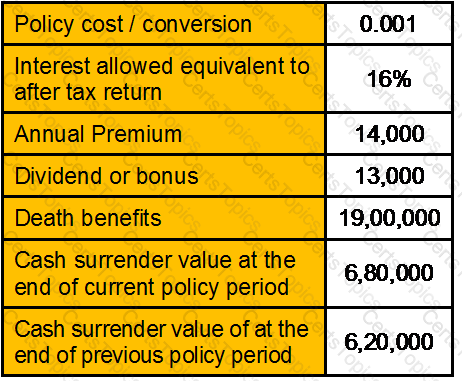

Derive policy cost per thousand with following data: