CIMA Related Exams

CS3 Exam

Hello

I have attached a news article

Arrfield does not set the price for aviation fuel sold at our airports, but we do receive a percentage of the revenues earned by the fuel companies.

I need your help to prepare for a Board meeting to discuss this matter Please write a paper covering the following

* Firstly, explain the impact that the criticisms voiced by the environmental campaigners will have on the frequent PESTEL analysis that Arrfield's Board conducts.

[sub-task (a) = 34%

* Secondly, evaluate the commercial logic of Arrfield's strategy of basing charges for non-aeronautical services (such as fuel sales and retail activities) on percentages of the revenues generated by the companies that operate at its airports

[sub-task (b) = 33%)

* Thirdly, recommend with reasons whether Arrfield should attempt to justify strategic decisions to its shareholders when the commercial logic of those decisions is not immediately obvious

[sub-task (c) = 33%}

Thanks

Romuald Marek

Chief Finance Officer

A month later, you receive the following email:

Reference Material:

From: Hesham El-Sayed. Independent Non-executive

Director

To: Romuald Marek. Chief Finance Officer

Subject: Collapse of fuel supplier

Hi Romuald

I am writing to give you some advance notice of an internal audit investigation that has been commissioned by the Audit Committee

Just over a year ago. Planejoos, a newly formed company, approached the management team at Airfield's Capital City International (CCI) airport and offered to take over refueling operations at Starport Planejoos offered a higher percentage of revenue than the existing supplier was paying CCI's management team agreed and appointed Planejoos rather than renew the existing supplier's contract.

CCI was unable to conduct the usual background and credit checks on Planejoos for two reasons. Firstly, Planejoos was a new company and so did not have an extensive credit history that could be checked Secondly CCI was under time pressure to reach a decision on whether to renew the existing supplier's contract or allow it to expire

CCI's management team claimed that it had acted quickly in order to benefit from the additional revenue that could be earned from dealing with Planejoos The management team was acting on the basis that it had an ethical duty to maximise the wealth of Airfield's shareholders and that maximising revenues from fuel sales through this agreement with Planejoos was consistent with that ethical duty.

Unfortunately, as a new company. Planejoos struggled to obtain trade credit and the high demand for fuel put the company's cash flows under extreme pressure Receipts from sales lagged behind payments for inventory Planejoos has now collapsed, leaving a large trade receivable that CCI will have to write off as uncollectable CCI had permitted this receivable to accumulate rather

than pressing for payment and so putting Planejoos under further pressure.

Fortunately, the previous fuel supplier was prepared to return to CCI.

Kind regards

Wodd’s Chairman enters your office:

"I am glad I caught you, I am looking for some advice, but I do not wish to involve your boss at this stage, or any of the other executive directors.

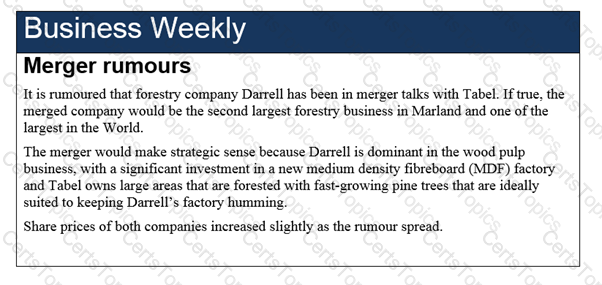

I have been approached by Darrell’s Chairman concerning the possibility of a merger between our two companies. I was a little surprised because it has apparently, according to a press article, been in talks with at least one of our competitors and I suspect that it is keen to merge with any large company that can offer some synergy. I understand that Tabel, another major forestry company, has already rejected its proposal.

I happen to know that Darrell has invested a little too heavily in its new MDF factory. It is state of the art, but it has to operate at close to full capacity in order to be economic and Darrell just hasn’t got sufficient forestry resources to keep the factory operating at full volume without destroying its own forests.

We are attractive to merge with because we own large forests that can sustain Darrell’s needs. We don’t manufacture MDF ourselves, but we have lots of experience of supplying this market with raw material. We would divert lots of this output to Darrell’s factory. Darrell believes that it would be possible to dominate the MDF industry if it merged with a company such as ourselves. The fact that we were quite liquid at the end of last year also helps, because I understand that Darrell is having a few cash flow problems.

Its Chairman proposes a full merger. This will be achieved by the creation of a new parent company which will acquire existing equity in both companies through an exchange of shares. He and I will head a special nomination committee to select the most suitable Board for the new company and then I will step down from the Board while he continues as Chairman of the new company.

Needless to say, this is all highly confidential.

Do you think that it sounds as if there are potential and achievable synergies between Wodd and Darrell?

Would you regard it as a gross ethical breach to keep this conversation just between the two of us for the time being, without warning your boss, until I have had the chance to negotiate further with my counterpart at Darrell?"

Reference Material: