PRMIA Related Exams

8008 Exam

As part of designing a reverse stress test, at what point should a bank's business plan be considered unviable (ie the point where it can be considered to have failed)?

Under the actuarial (or CreditRisk+) based modeling of defaults, what is the probability of 4 defaults in a retail portfolio where the number of expected defaults is 2?

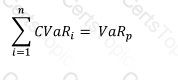

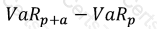

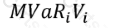

Which of the formulae below describes incremental VaR where a new position 'm' is added to the portfolio? (where p is the portfolio, and V_i is the value of the i-th asset in the portfolio. All other notation and symbols have their usual meaning.)

A)

B)

C)

D)