If the loss given default is denoted by L, and the recovery rate by R, then which of the following represents the relationship between loss given default and the recovery rate?

The largest 10 losses over a 250 day observation period are as follows. Calculate the expected shortfall at a 98% confidence level:

20m

19m

19m

17m

16m

13m

11m

10m

9m

9m

For a corporate bond, which of the following statements is true:

I. The credit spread is equal to the default rate times the recovery rate

II. The spread widens when the ratings of the corporate experience an upgrade

III. Both recovery rates and probabilities of default are related to the business cycle and move in opposite directions to each other

IV. Corporate bond spreads are affected by both the risk of default and the liquidity of the particular issue

Which of the following statements is true in relation to a normal mixture distribution:

I. Normal mixtures represent one possible solution to the problem of volatility clustering

II. A normal mixture VaR will always be greater than that under the assumption of normally distributed returns

III. Normal mixtures can be applied to situations where a number of different market scenarios with different probabilities can be expected

Which of the following event types is hacking damage classified under Basel II operational risk classifications?

Which of the following are true:

I. Delta hedges need to be rebalanced frequently as deltas fluctuate with fluctuating prices.

II. Portfolio managers are right to focus on primary risks over secondary risks.

III. Increasing the hedge rebalance frequency reduces residual risks but increases transaction costs.

IV. Vega risk can be hedged using options.

Which of the following statements are true:

I. Common scenarios for stress tests include the 1997 Asian crisis, the Russian default in 1998 and other well known economic stress situations.

II. Stress tests provide the assurance that an institution's worst case losses will be covered.

III. Performing stress tests is highly recommended but is not mandated under Basel II.

IV. Historical events can be modeled quite accurately as they have defined start and end dates.

If the annual variance for a portfolio is 0.0256, what is the daily volatility assuming there are 250 days in a year.

As part of designing a reverse stress test, at what point should a bank's business plan be considered unviable (ie the point where it can be considered to have failed)?

If A and B be two debt securities, which of the following is true?

A bank holds a portfolio of corporate bonds. Corporate bond spreads widen, resulting in a loss of value for the portfolio. This loss arises due to:

The Altman credit risk score considers:

If two bonds with identical credit ratings, coupon and maturity but from different issuers trade at different spreads to treasury rates, which of the following is a possible explanation:

I. The bonds differ in liquidity

II. Events have happened that have changed investor perceptions but these are not yet reflected in the ratings

III. The bonds carry different market risk

IV. The bonds differ in their convexity

A risk management function is best organized as:

Which of the following introduces model error when basing VaR on a normal distribution with a static mean and standard deviation?

According to the Basel II framework, subordinated term debt that was originally issued 4 years ago with a maturity of 6 years is considered a part of:

What ensures that firms are not able to selectively default on some obligations without being considered in default on the others?

If the systematic VaR for an equity portfolio is $100 and the specific VaR is $80, then which of the following is true in relation to the total VaR:

The backtesting of VaR estimates under the Basel accord requires comparing the ex-ante VaR to:

An asset has a volatility of 10% per year. An investment manager chooses to hedge it with another asset that has a volatility of 9% per year and a correlation of 0.9. Calculate the hedge ratio.

Which of the following is NOT true in respect of bilateral close out netting:

Which of the following statements are true:

I. Shocks to risk factors should be relative rather than absolute if we wish to avoid a change in the sign of the risk factor.

II. Interest rate shocks are generally modeled as absolute shocks.

III. Shocks to volatility are generally modeled as absolute shocks.

IV. Shocks to market spreads are generally modeled as relative shocks.

If the annual default hazard rate for a borrower is 10%, what is the probability that there is no default at the end of 5 years?

Which of the following are measures of liquidity risk

I. Liquidity Coverage Ratio

II. Net Stable Funding Ratio

III. Book Value to Share Price

IV. Earnings Per Share

Pick underlying risk factors for a position in an equity index option:

I. Spot value for the index

II. Risk free interest rate

III. Volatility of the underlying

IV. Strike price for the option

If the default hazard rate for a company is 10%, and the spread on its bonds over the risk free rate is 800 bps, what is the expected recovery rate?

An assumption regarding the absence of ratings momentum is referred to as:

The CDS rate on a defaultable bond is approximated by which of the following expressions:

Company A issues bonds with a face value of $100m, sold at issuance at $98. Bank B holds $10m in face of these bonds acquired at a price of $70. What is Bank B's exposure to the debt issued by Company A?

A corporate bond maturing in 1 year yields 8.5% per year, while a similar treasury bond yields 4%. What is the probability of default for the corporate bond assuming the recovery rate is zero?

The standard error of a Monte Carlo simulation is:

Which of the following is not a credit event under ISDA definitions?

When building a operational loss distribution by combining a loss frequency distribution and a loss severity distribution, it is assumed that:

I. The severity of losses is conditional upon the number of loss events

II. The frequency of losses is independent from the severity of the losses

III. Both the frequency and severity of loss events are dependent upon the state of internal controls in the bank

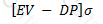

If EV be the expected value of a firm's assets in a year, and DP be the 'default point' per the KMV approach to credit risk, and σ be the standard deviation of future asset returns, then the distance-to-default is given by:

A)

B)

C)

D)

A statement in the annual report of a bank states that the 10-day VaR at the 95% level of confidence at the end of the year is $253m. Which of the following is true:

I. The maximum loss that the bank is exposed to over a 10-day period is $253m.

II. There is a 5% probability that the bank's losses will not exceed $253m

III. The maximum loss in value that is expected to be equaled or exceeded only 5% of the time is $253m

IV. The bank's regulatory capital assets are equal to $253m

If the 1-day VaR of a portfolio is $25m, what is the 10-day VaR for the portfolio?

The standalone economic capital estimates for the three business units of a bank are $100, $200 and $150 respectively. What is the combined economic capital for the bank, assuming the risks of the three business units are perfectly correlated?

Which of the following statements is true:

I. If the sum of its parameters is less than one, GARCH is a mean reverting model of volatility, while EWMA is never mean reverting

II. Standardized returns under both EWMA and GARCH show less non-normality than non standardized returns

III. Steady state variance under GARCH is affected only by the persistence coefficient

IV. Good risk measures are always sub-additive

The principle underlying the contingent claims approach to measuring credit risk equates the cost of eliminating credit risk for a firm to be equal to:

Stress testing is useful for which of the following purposes:

I. For providing the risk manager with an intuitive check on his risk estimates

II. Providing a means of communicating risk implications using plausible scenarios that can be easily explained to a non-technical audience

III. Guarding against major errors in the form of model risk

IV. Complying with the requirements of Basel II.

Which of the following is the most accurate description of EPE (Expected Positive Exposure):

Under the actuarial (or CreditRisk+) based modeling of defaults, what is the probability of 4 defaults in a retail portfolio where the number of expected defaults is 2?

Which of the following is not a limitation of the univariate Gaussian model to capture the codependence structure between risk factros used for VaR calculations?

Which of the following correctly describes survivorship bias:

Under the KMV Moody's approach to credit risk measurement, which of the following expressions describes the expected 'default point' value of assets at which the firm may be expected to default?

Which of the following credit risk models relies upon the analysis of credit rating migrations to assess credit risk?

Which of the following is closest to the description of a 'risk functional'?

Which of the following methods cannot be used to calculate Liquidity at Risk?

Which of the following statements is true?

I. It is sufficient to ensure that a parent entity has sufficient excess liquidity to cover a liquidity shortfall for a subsidiary.

II. If a parent entity has a shortfall of liquidity, it can always rely upon any excess liquidity that its foreign subsidiaries might have.

III. Wholesale funding sources for a bank refer to stable sources of funding provided by the central bank.

IV. Funding diversification refers to diversification of both funding sources and funding tenors.

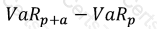

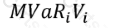

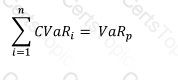

Which of the formulae below describes incremental VaR where a new position 'm' is added to the portfolio? (where p is the portfolio, and V_i is the value of the i-th asset in the portfolio. All other notation and symbols have their usual meaning.)

A)

B)

C)

D)

Which of the following attributes of an investment are affected by changes in leverage:

Which of the following statements are true in relation to Historical Simulation VaR?

I. Historical Simulation VaR assumes returns are normally distributed but have fat tails

II. It uses full revaluation, as opposed to delta or delta-gamma approximations

III. A correlation matrix is constructed using historical scenarios

IV. It particularly suits new products that may not have a long time series of historical data available

The VaR of a portfolio at the 99% confidence level is $250,000 when mean return is assumed to be zero. If the assumption of zero returns is changed to an assumption of returns of $10,000, what is the revised VaR?