Managers have several different methods from which to choose when evaluating long-term investments. Which method disregards the time value of money as a factor?

Which of the following activities would be included in the cash flows from the financing section of the statement of cash flows?

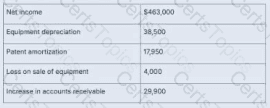

The accounting department for Aramai Inc. is preparing the cash flow statement for the current year. Using the select financial statement data below, what is Aramai’s net income when converted to cash provided by operating activities, using the indirect method?

Given:

Net Income = $463,000

Equipment Depreciation = +$38,500

Patent Amortization = +$17,950

Loss on Sale of Equipment = +$4,000

Increase in Accounts Receivable = −$29,900

Apply adjustments to net income:

Cash from Operating Activities =

= $463,000

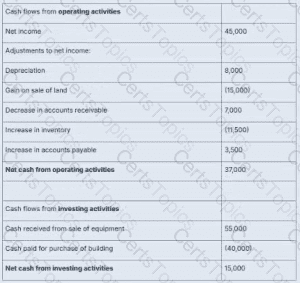

Use the statement of cash flows to calculate the free cash flow.

Which of the following employees of ABC Corporation is most likely to receive the report regarding the internal audit committee's control findings?

Wycliff Corp. had an immaterial credit balance of $1,250 in the manufacturing overhead account after $21,750 was applied to the WIP inventory account. To close the manufacturing overhead account at the end of the period, assuming no further transactions took place, what should Wycliff do?

Which of the following would be a measure of managerial accounting?

Bethel Bakery manufactures frosted sugar cookies. They maintain separate work-in-process accounts for their blending, cutting, baking, decorating, and packaging departments. Which costing method is Bethel Bakery most likely using?

Cash collections and payments for purchases would be included in which of the following budgets as part of the overall master budget?

SJ Candles subscribes to a management theory known as management by exception. Which of the following best describes a situation where management by exception would be applied?

SJ Candles should expect the absorption costing and variable costing methods to result in the same 4th quarter operating profit when which of the following is true?

Diamonds and More produced a new line of necklaces that sell for $350 each. Management requires a profit equal to 40 percent of the selling price. What is the target cost of this product?

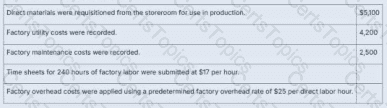

What is the balance in the manufacturing overhead account after these transactions were recorded, assuming the beginning balance was zero?

Now calculate the balance:

Manufacturing Overhead Balance = Actual Overhead – Applied Overhead

= $6,700 – $6,000 = $700 underapplied

Underapplied overhead → debit balance in Manufacturing Overhead account

Strang Tax provides tax consulting services to its clients whom they charge on an hourly basis. They would like to use differential analysis to determine whether profits would change if they dropped certain clients. Which of the following items should be excluded from this analysis?

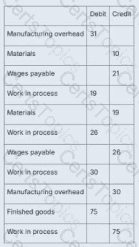

Wycliff Corporation manufactured Job #3 during the month of May. On May 29, 100% of the product was finished and sold on account for $150. These journal entries were recorded during production:

On May 31, Wycliff determined that the amount remaining in the manufacturing overhead account was immaterial and closed it out. What was the amount of gross profit before closing the manufacturing account, and what effect did closing the manufacturing account have on gross profit?