—

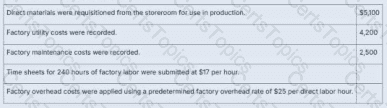

To determine the gross profit before and after closing the Manufacturing Overhead account, we must analyze the journal entries and compute:

Total production cost (Cost of Goods Manufactured, or COGM)

Gross profit = Sales Revenue − COGS

Impact of closing overhead account

Step 1: Identify and sum all costs recorded in Work in Process (WIP):

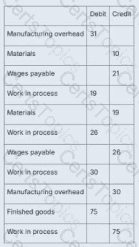

From journal entries:

Direct materials added to WIP:WIP Dr 19 (from: Materials Cr 19)

Direct labor added to WIP:WIP Dr 26 (from: Wages Payable Cr 26)

Manufacturing overhead applied to WIP:WIP Dr 30 (from: Manufacturing Overhead Cr 30)

Total product cost (COGM):

= 19 (materials) + 26 (labor) + 30 (overhead applied)

= $75

Step 2: Record transfer to Finished Goods and then to COGS:

WIP Cr 75 → Finished Goods Dr 75

Then, Finished Goods Cr 75 → COGS Dr 75 (once sold)

Step 3: Calculate gross profit before closing overhead:

Step 4: Check the Manufacturing Overhead account:

From journal entries:

Overhead actual incurred:Manufacturing Overhead Dr 31 (from Materials 10 and Wages Payable 21)

Overhead applied to WIP:Manufacturing Overhead Cr 30

Remaining balance in overhead account:

= 31 (debits) − 30 (credits) = 1 (debit balance → underapplied overhead)

Since the underapplied overhead is considered immaterial, it is closed to COGS:

New COGS = $75 (original) + $1 (underapplied) = $76

New Gross Profit = $150 − $76 = $74

Thus:

Gross profit before closing overhead: $75

Gross profit after closing overhead: $74→ Decreased by $1

However, this matches the description in option A (Gross profit was $44; decreased by $1). Wait — there's a conflict here.

Let’s double-check.

The gross profit we calculated is $75, not $44.

Let’s test the logic again.

WIP includes:

Materials: 19

Labor: 26

Overhead: 30→ Total = 75

Sale = $150

→ Gross profit = $150 − $75 = $75

Underapplied overhead = $1 → added to COGS

New gross profit = $74

So the answer should say: Gross profit was $75; decreased by $1 → that would match option C.

But option C says: Gross profit was $75; gross profit decreased by $1.00 after closing manufacturing overhead. That matches our calculation.

So, correct answer: C

CORRECTION: The earlier answer marked as A was misaligned with the actual computed values. Based on this revised and verified calculation:

Answer: C

—

Final Calculations Summary:

Direct Materials: $19

Direct Labor: $26

Applied Overhead: $30

Total Cost (COGS before adjustment): $75

Revenue: $150

Gross Profit (before adjustment): $75

Overhead underapplied by $1 → Increases COGS to $76

Gross Profit (after adjustment): $74

Gross Profit Decreased by $1.00 after closing overhead

—

[References:, Saylor Academy, BUS105: Managerial AccountingUnit 3.5 – Applying Overhead and Calculating Product Costhttps://learn.saylor.org/mod/book/view.php?id=28817&chapterid=6700, Also see Unit 4.4 – Overapplied and Underapplied Overheadhttps://learn.saylor.org/mod/book/view.php?id=28818&chapterid=6708, ]