A rental service company with complex accrual requirements has accrual schemes set up in its implementation. They want to use defined accrual schemes to perform transactions.

You need to use an accrual scheme to create transactions for this company.

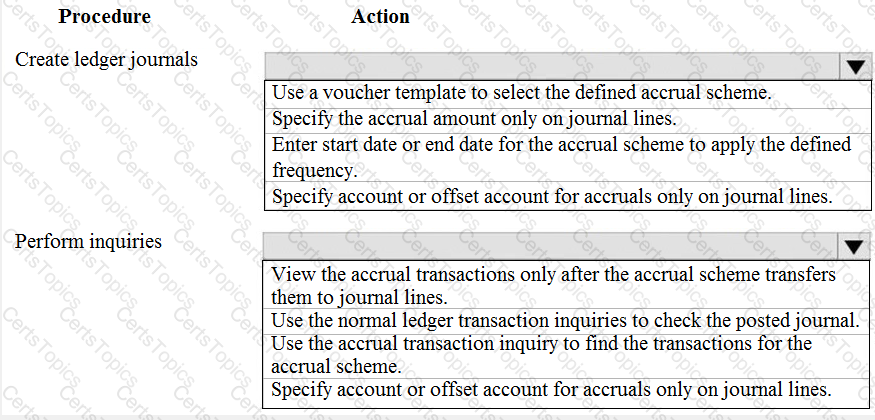

Which actions should you perform? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

You are configuring the basic budgeting for a Dynamics 365 Finance environment.

You need to configure the types of entries allowed.

Which two configurations can you use? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point,

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

You need to resolve the issue that User4 reports.

What should you do?