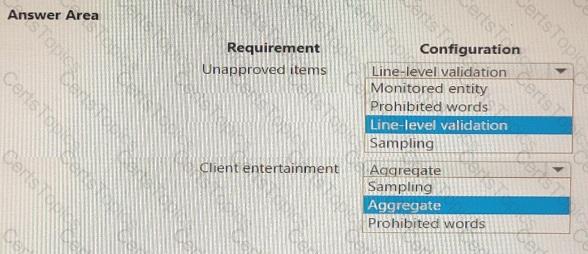

You need to prevent prohibited expenses from posting.

Which configurations should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

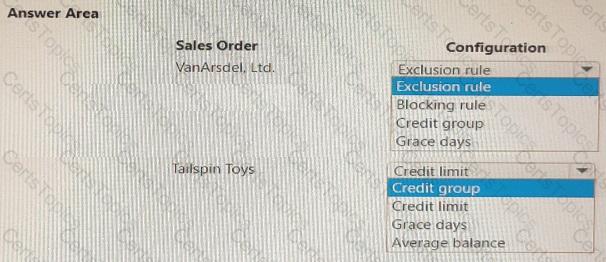

You need to identify why the sales orders where sent to customers.

Which configuration allowed the sales orders to be sent? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct select is worth one point.

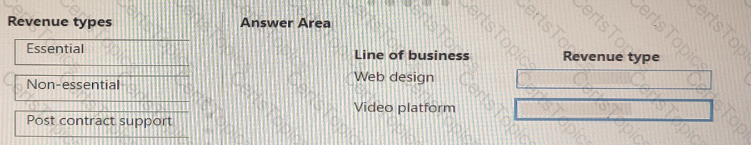

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

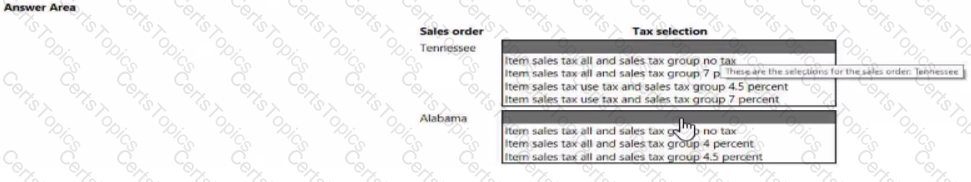

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.