With respect to the Income Tax structure in Singapore, the employment income is taxed at __________ or resident rate, whichever gives rise to a higher amount.

In case of Discretionary Discounted Gift Trust, the settlor has the right to receive annual capital payments upto ________ of the original capital. The trust is suitable for individuals who have a liability to ______________ and are happy to make substantial gifts.

A Hindu coparcenary consists of a common male ancestor and his linear descendants in the male line within _______ degrees. ___________ is the state in which HUF is not recognized.

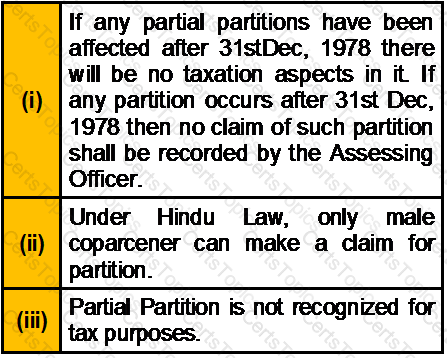

Which of the following statement(s) about HUF Partition is/are correct?