For claiming exemption u/s 54G, the assessed shall acquire the new asset within:

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

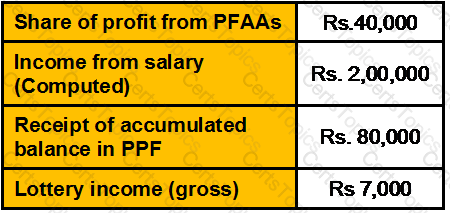

Choose the amount of final tax liability of Mr. Raj for the assessment year 2007-08:

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding Rs. 10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

__________ is a arrangement wherein lessee and lessor agree to a payment schedule where for a set period of time, there is no payment and penalty.