What is the full form of CLT?

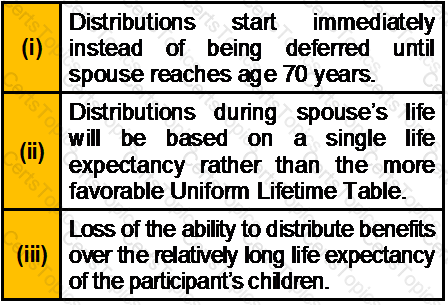

You are a Trust and Estate Planner. Mr. Keith is your client. He is 45 years old. He asks you that in case he wants to leave assets for the life benefit of his spouse, but ultimately have the funds pass to his children by a prior marriage he should create ______________________. He further asks you to explain disadvantages of such arrangement. You tell him that the disadvantages of the arrangement are ____________ of the given options.

Where a transfer of value is from a UK-domiciled spouse to a non-UK domiciled spouse, then the exempt transfer is limited to ____________

Mrs. Brown is a widow with four children. Her husband left his estate completely to her on his death. When Mrs. Brown dies, her estate on death includes:-

The funeral expenses of Mrs. Brown amount upto £1,900. Find out the amount of estate that would be distributable to each beneficiary.