CIMA Related Exams

P1 Exam

A company develops computer software programs to meet each client's specific requirements. The management accountant is considering introducing a standard costing system.

Which THREE of the following are reasons that support the case for the company's introduction of a standard costing system?

In a manufacturing company, breakeven occurs at which TWO of the following?

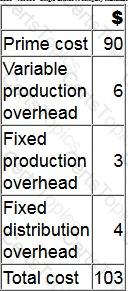

A company manufactures a single product. The cost card for a unit of this product is as follows:

During month 6, finished goods inventory increased by 350 units.

By how much would the profit differ in month 6 if finished goods inventory was valued at standard marginal cost rather than standard absorption cost?