Explain THREE benefits that organizations gain from using budgetary planning and control systems.

Select ALL the true statements.

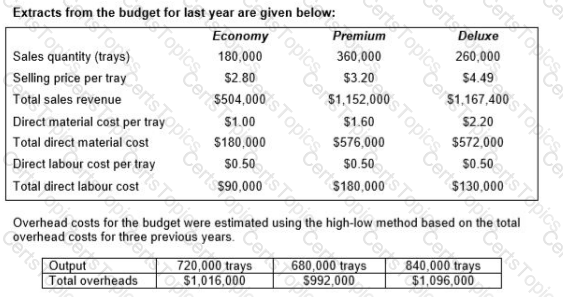

A company produces trays of pre-prepared meals that are sold to restaurants and food retailers. Three varieties of meals are sold: economy, premium and deluxe.

Discuss the benefits of flexible budgeting for planning and control purposes.

Select all the true statements.

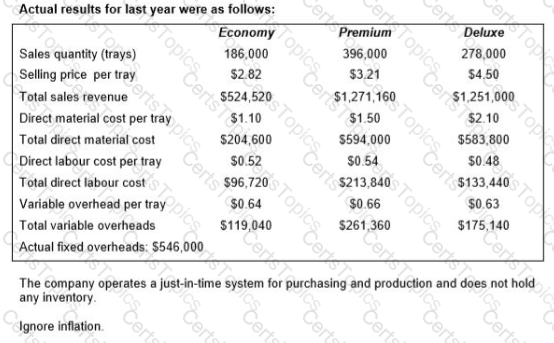

Demand for two products, A and B is 1,000 units and 2,000 units respectively. Each unit of Product A requires 8 kg of material and each unit of Product B requires 5 kg of material. The maximum availability of material is 17,200 kg. Contribution per unit of A is $10 and per unit of B is $9.

Place the production volumes of Product A and Product B, that will maximize contribution, in the table.

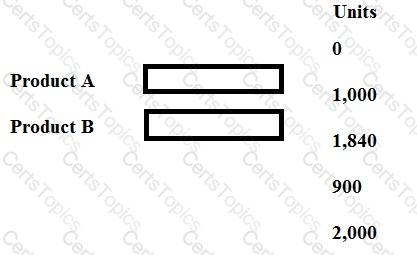

XY can choose from four mutually exclusive projects. The projects will each last for one year and their net cash inflows will be determined by market conditions. The forecast net cash inflows for each of the possible outcomes are shown below.

If the company applies the maximin criterion the project chosen would be:

A company has identified the trend in its sales figures through the regression equation Y = 65.9 + 3.86X, where Y is the sales revenue in thousands of dollars and X is the month number. The average seasonal variation for October is 87%

Calculate the forecast sales revenue for October of Year 6.

Give your answer to the nearest $000.

A master budget comprises which of the following?

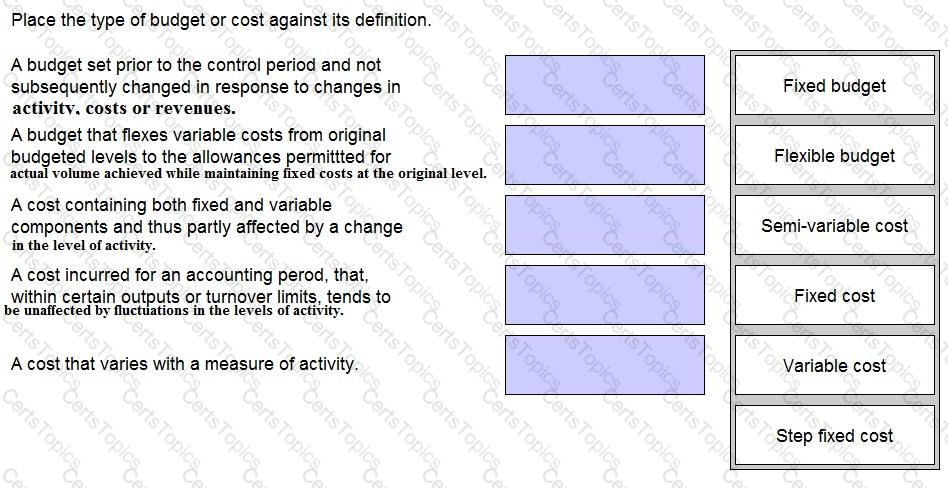

Place the type of budget or cost against its definition.

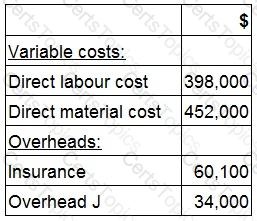

A company's product range includes Product N. The costs relating to Product N are shown below:

The direct labour costs relate to specialists employed to work wholly and exclusively with Product N.

If the company stopped making Product N, the insurance overhead cost would cease, but overhead cost J would be unaffected. Both overheads are absorbed in direct proportion to material costs.

Which of the following costs should be used in the decision whether to stop making Product N?

A company makes two products, product X with a contribution per unit of $10 and product Y with a contribution per unit of $4.

These products are sold in the mix 3:2 by volume and fixed costs are $38,000 per period.

The breakeven point for product Y, based on the expected sales mix is:

Which of the following managers is most likely to be responsible for an favourable labour efficiency variance?

A flexible budget is a budget that is:

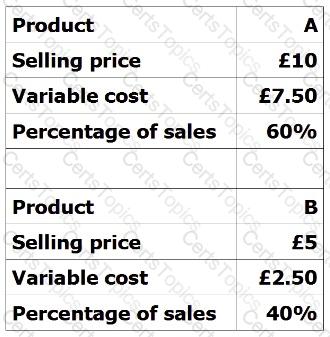

Find the weighted average contribution per unit using the following information:

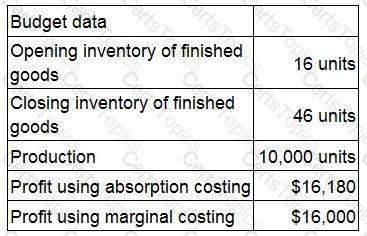

A company manufactures a single product. The following budgeted data applies to month 6:

What was the budgeted fixed production overhead for month 6?

Give your answer to the nearest whole $ (in '000s).

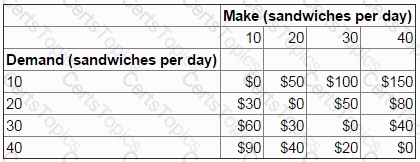

The manager of a recently opened cafe is deciding how many sandwiches to make each day.

The sandwiches are made in the morning before the cafe opens.

If demand exceeds the number of sandwiches made in the morning no extra sandwiches can be made during the day. Any unsold sandwiches are thrown away at the end of each day.

Daily demand is uncertain but is predicted to be 10, 20, 30 or 40 sandwiches.

The following regret matrix has been prepared:

If the minimax regret criterion is used to make the decision, the manager will choose to make:

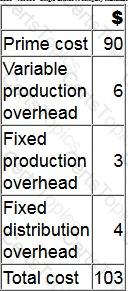

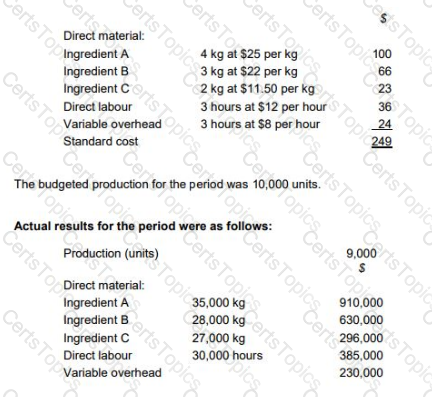

A company manufactures a single product. The cost card for a unit of this product is as follows:

During month 6, finished goods inventory increased by 350 units.

By how much would the profit differ in month 6 if finished goods inventory was valued at standard marginal cost rather than standard absorption cost?

A company develops computer software programs to meet each client's specific requirements. The management accountant is considering introducing a standard costing system.

Which THREE of the following are reasons that support the case for the company's introduction of a standard costing system?

A snowboard manufacturer is considering investing in technology that will give a good indication of how heavy snowfall will be in the future. The predictions tend to be reasonably accurate.

The current budgeted profit for the year is £2,560,000 but if they invest in this technology and it works, the expected profit will be £2,640,000. The manufacturer is willing to invest a maximum of £40,000 into the venture.

What is the expected profit if the investment is NOT made?

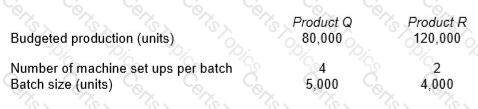

QR uses an activity based budgeting (ABB) system to budget product costs. It manufactures two products, product Q and product R. The budget details for these two products for the forthcoming period are as follows:

The total budgeted cost of setting up the machines is $74,400.

Select TWO potential benefits of using an activity based budgeting system.

Which THREE of the following statements relating to fixed overhead variances are correct?

What type of budget is prepared on an annual basis taking current year operating results and adjusting them for expected growth and inflation?

MDS is facing a temporary shortage of Material H which is used to produce all three of its products.

In order to maximise its profitability, which product should be manufactured first?

XY, a not-for-profit charity organization which is funded by public donations, is concerned that it is not making the best use of its available funds. It has carried out a review of its budgeting system and is considering replacing the current system with a zero-based budgeting system.

Select ALL the potential advantages AND disadvantages for the charity of a zero-based budgeting system.

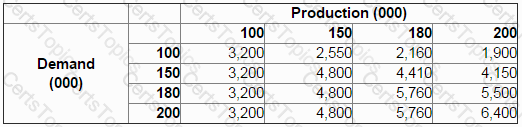

A company is launching a new product.

The company accountant has constructed a payoff table to show the estimated profit at different levels of production and demand.

How many units should the company produce if the minimax regret criterion is applied?

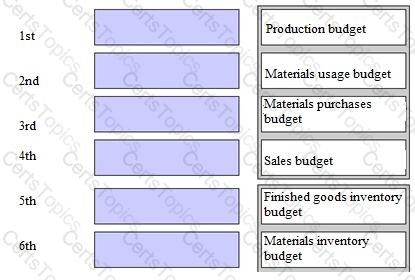

For a company that does not have any production resource limitations, what would be the correct sequence for budget preparation?

EF manufactures and sells three products, X, Y and Z. The following production overhead costs are budgeted for next year:

Required:

Calculate the total budgeted production overhead cost for each product using activity based budgeting.

A company uses a standard costing system.

The company’s sales budget for the latest period includes 1,500 units of a product with a selling price of $400 per unit.

The product has a budgeted contribution to sales ratio of 30%.

Actual sales for the period were 1,630 units at a selling price of $390 per unit.

The actual contribution to sales ratio was 28%.

The sales volume contribution variance for the product for the latest period is:

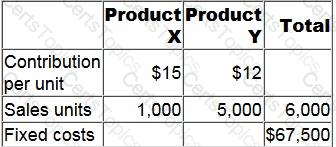

A company sells two products, X and Y, which are always sold in the same ratio.

No inventories are held.

The following budgeted data relate to month 10:

What is the budgeted margin of safety in month 10?

Explain the advantages of management participation in budget setting and the potential problems that may arise in the use of the resulting budget as a control mechanism.

Select all the correct answers.

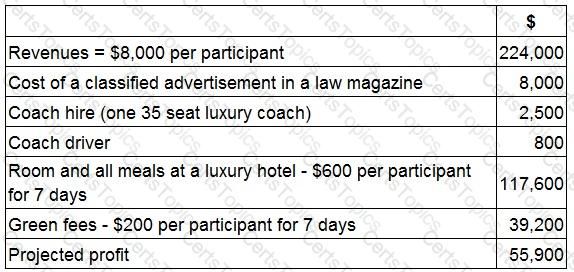

JKI is planning a golfing holiday for a group of wealthy lawyers.

The lawyers will fly to the local airport at their own expense. JKI will then pay for transport, accommodation and the use of the golf course (green fees).

JKI's costings are as follows, based on 28 participants:

JKI received 46 applications from potential participants.

What would the profit be if JKI accepted all of these bookings?

Give your answer to the nearest whole number.

Your company want to know how many units they'd have to sell this season to break even. However, you have some reservations over whether or not breakeven analysis is suitable for the company.

Which of these assumptions over product range limit the accuracy of break even analysis? Select ALL that apply.

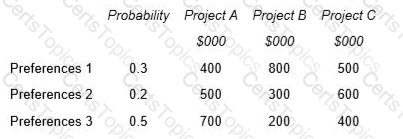

A company has to choose between three mutually exclusive projects. Market research has shown that customers could react to the projects in three different ways depending on their preferences. There is a 30% chance that customers will exhibit preferences 1, a 20% chance they will exhibit preferences 2 and a 50% chance they will exhibit preferences 3. The company uses expected value to make this type of decision.

The net present value of each of the possible outcomes is as follows:

A market research company believes it can provide perfect information about the preferences of customers in this market.

What is the maximum amount that should be paid for the information from the market research company?

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material price planning variance for ingredient B?

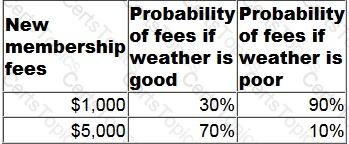

A tennis club is considering running an open day to encourage new members and thus increase membership fees. The cost of the open day will be $1,000. Attendance is dependent on the weather. There is a 60% chance of good weather and a 40% chance of poor weather on the open day.

The expected new membership fees are:

What is the expected value of running the open day?

Give your answer as a whole number.

A company is basing its budget on predicted sales of one of its products. They have tasked you with forecasting the sales in year 2. The company has found that a fairly accurate prediction can be found when the trend

is calculated like so:

a = 10,000

b = 2,000

The sales of year 1 were affected by seasonal variation and were as follows:

Q1:12,500

Q2:14,200

Q3:15,400

Q4:19,650

You use a multiplicative model and round percentages to the nearest whole percent.

Select ALL the correct quarterly forecasts of year 2 from the list.

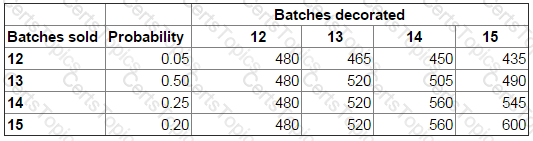

A bakery manager is deciding how many batches of birthday cakes to decorate each day.

Demand for the birthday cakes varies from 12 to 15 batches per day. Each batch decorated and sold earns a contribution of $40 but each batch unsold leads to loss of contribution of $15.

The payoff table below shows the total $ contribution from each of the possibilities:

Based on expected values, the number of batches of birthday cakes the bakery manager should decorate each day is:

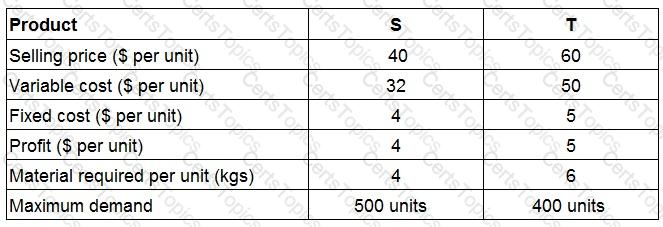

Two products being produced by a company require the same material which is limited to 2,600 kgs.

What is the optimal production plan?

In a manufacturing company, breakeven occurs at which TWO of the following?

Which THREE of the following are purposes of all budgets?

You are a management accounting working for a car manufacturer. The company is publicly listed and has been around for many years.

The company produces 2 products. Car 1 and Car 2. Car 1 sells for £20,000 and Car 2 for £27,000.

Car 1 can be upgraded post production to the 1ZC model for £5,000 and Car 2 to the 2ZC model for £3,500.

Post production upgrade the 1ZC sells for £25,500 and the 2ZCfor £30,000.

The company sources all of its supplies for the same supplier and has access to a large workforce. As a result there are no bottlenecks or limiting factors to production.

Based on the information above the company should...