An organization is comprised of two divisions. One of the divisions manufactures a product that it sells both to an imperfect external market and to the other division.

The organization wishes to establish the most suitable basis for the transfer price for this product and is considering either a negotiated transfer price or a market-based transfer price.

Which of the following statements is correct?

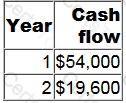

A project requires an initial investment of $50,000. It will generate positive cash flows for two years as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

Company TTM has the opportunity to invest $60,000 in a project. The project is anticipated to produce annual returns of $12,500 each year for 8 years. The cost of capital is 12%.

What is the net present value of the project? Give your answer to the nearest whole number.

A company operates a divisional structure. The manager of division D receives a bonus based on the division's annual return on capital employed (ROCE).

A minimum ROCE of 20% must be achieved to receive any bonus and thereafter the bonus increases in line with increases in ROCE.

This year division D achieved a ROCE of 24% and the divisional manager received a large bonus.

The manager is considering an investment in a new machine for next year. The incremental ROCE earned by the machine is expected to be 19% although the ROCE for the division as a whole with the machine is expected to be 22%. Without the machine, ROCE is likely to be stable at 24%.

The cost of capital for the company as a whole is 18% per year.

Which of the following statements is correct?