U+ Bank follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card, Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

GlobalRetail operates in a fast-changing digital marketplace where customer preferences and competitor offers change weekly. Their marketing team struggles with lengthy approval processes that prevent quick responses to market trends, often causing them to miss critical engagement opportunities.

What does agility represent in the context of customer engagement projects?

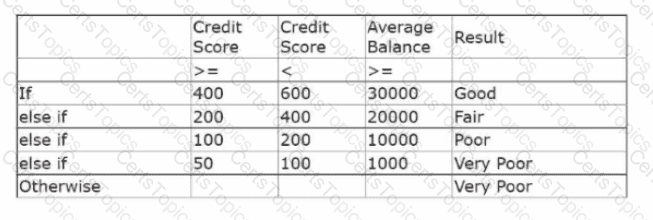

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning architect, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

U+ Bank implemented a customer journey for its customers. The journey consists of three stages. The first stage raises awareness about available products, the second stage presents available offers, and in the last stage, customers can talk to an advisor to get a personalized quote. The bank wants to actively increase offers promotion over time.

What action does the bank need to take to achieve this business requirement?

MyCo, a telecom company, wants to Include offer-related images in the emails that they send to their qualified customers. As a decisioning architect, what best practice do you follow to include images in emails?

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

In a decision strategy, to use a customer property in an expression, you

MyCo, a telecom company, uses Pega Customer Decision Hub™ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a deaccessioning architect, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?

U+- Bank uses Next-Best-Action Designer to configure engagement policies for different customer segments. A business user wants to create reusable policy conditions that can apply across multiple actions and campaigns. The user must understand when the save-to-library feature is available.

When is the save-to-library option unavailable for engagement policy conditions?

A customer qualifies for Standard card (priority 60), Rewards card {priority 40), and Premium card {priority 30). Standard card volume is exhausted. Rewards card has remaining volume, and Premium card has remaining volume. The system uses "Return any action that does not exceed constraint" mode.

Which actions does the customer receive in this scenario?

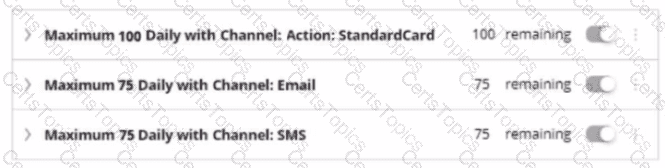

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the country. They want to advertise this offer on their website by using a banner, targeting the customers who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

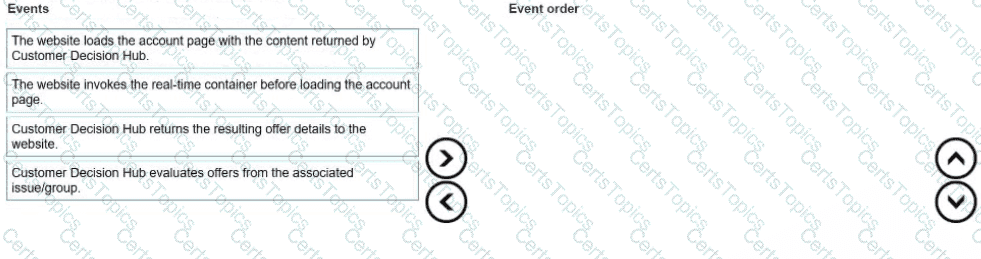

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

Place the events in the sequential order.

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days.

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days. Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

A financial services organization introduces a new policy that limits each customer to two promotional emails per month. To meet compliance requirements, the implementation team must configure this limit in the Next-Best-Action Designer.

Which configuration steps achieve the desired email frequency limit?

As a decisioning architect, how can you optimize the strategies that are based on Insights that you gain from the AI Insight feature in the Customer Profile Viewer?

U+ Bank is promoting a new premium credit card with an 18% APR to its existing customers. To protect customer value, the bank wants to avoid offering this card to customers who already hold a credit card with a lower Interest rate (12% APR or below).

Which engagement policy condition type should you use to exclude customers with lower-interest cards from receiving the premium offer?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

U+ Bank implemented multiple customer journeys for Its customers. The goal of the bank Is to present the most relevant action for the customer to increase the chance of a positive outcome. U+ Bank is sure that customers see the next best action, regardless of the current journey that they are in.

Which statement is true about customer journeys in Pega Customer Decision Hub?

MegaRetail Solutions has successfully created and approved their brand voice in Pega 1:1 Operations Manager. They have also established global directives for style, grammar, language, and compliance. Now they want to ensure that their Pega GenAI system uses this brand voice to generate marketing treatments that also maintain consistency with their established guidelines.

How will MegaRetail Solutions' approved brand voice be applied in their content generation process?

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on Its website to promote new offers to each customer.

Place the events in the sequential order.

What does a dotted line from a "Group By" component to a "Filter" component mean?

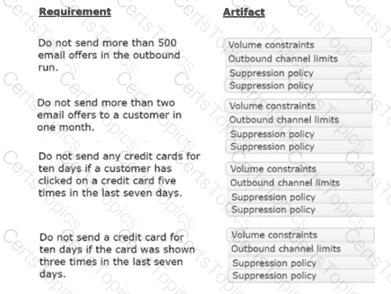

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

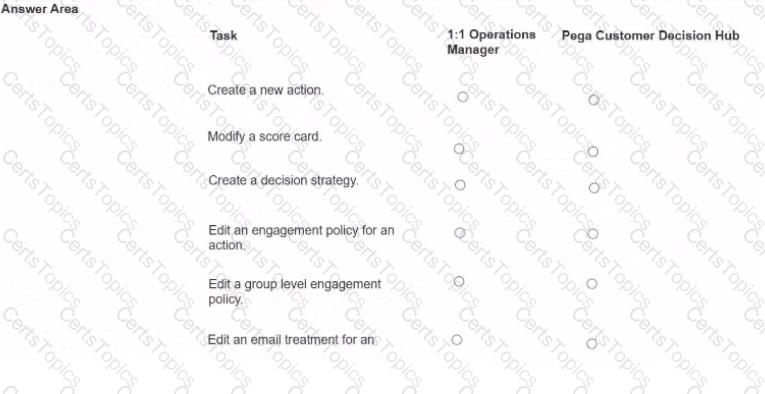

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 Operations Manager portal.

For each task, select the correct portal in which you perform the build tasks based on best practices.

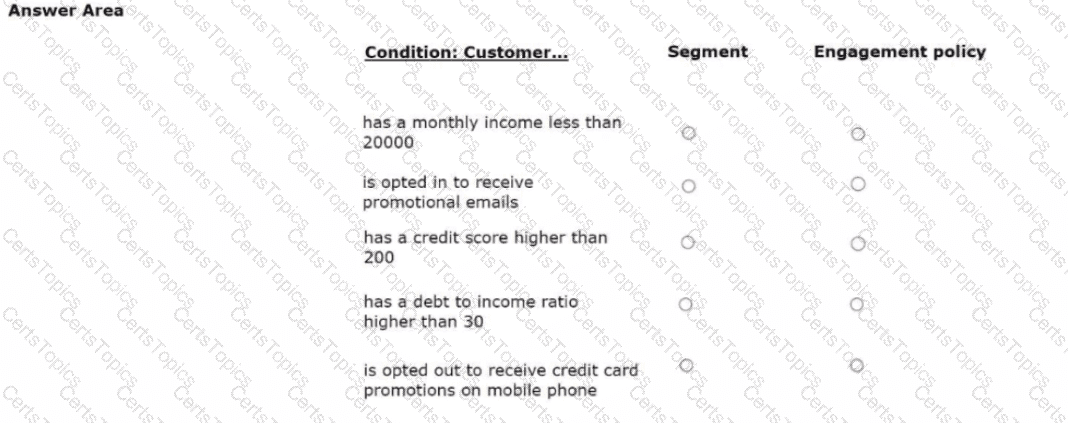

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wants to identify the starting population by defining a few high-level criteria in a segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice.

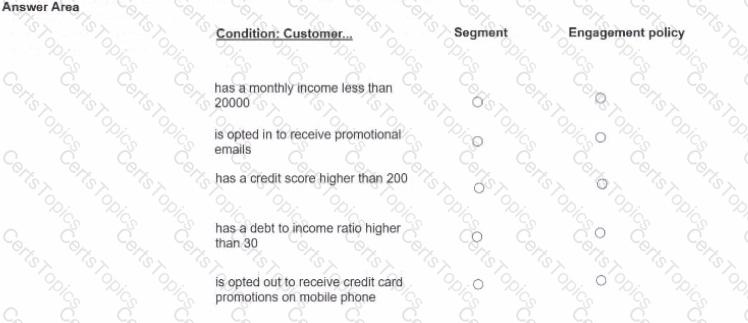

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wantsto identify the starting population by defining a few high-level criteria ina segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice

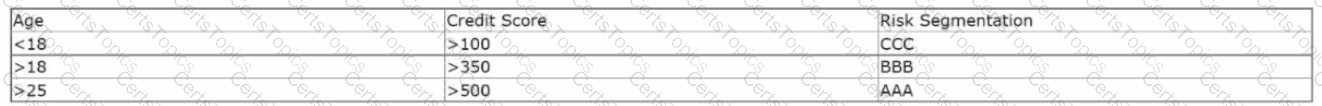

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning architect, how do you implement the business requirement?

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

Which of the following reasons explains why a customer might receive an action that they already accepted?