Fernanda, an advisor, is setting up her process for completing client suitability assessments. What must Fernanda do with respect to investment suitability?a

When reviewing a company's balance sheets, what ratio best determines whether their borrowing is excessive?

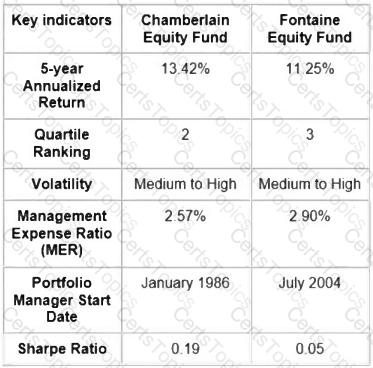

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Which of the following transactions takes place in the secondary market?